Question: need help with 3b to include interest, long forward, short swaps, and the exchange rate all factored in Exercise 3. For this exercise, suppose that:

need help with 3b to include interest, long forward, short swaps, and the exchange rate all factored in

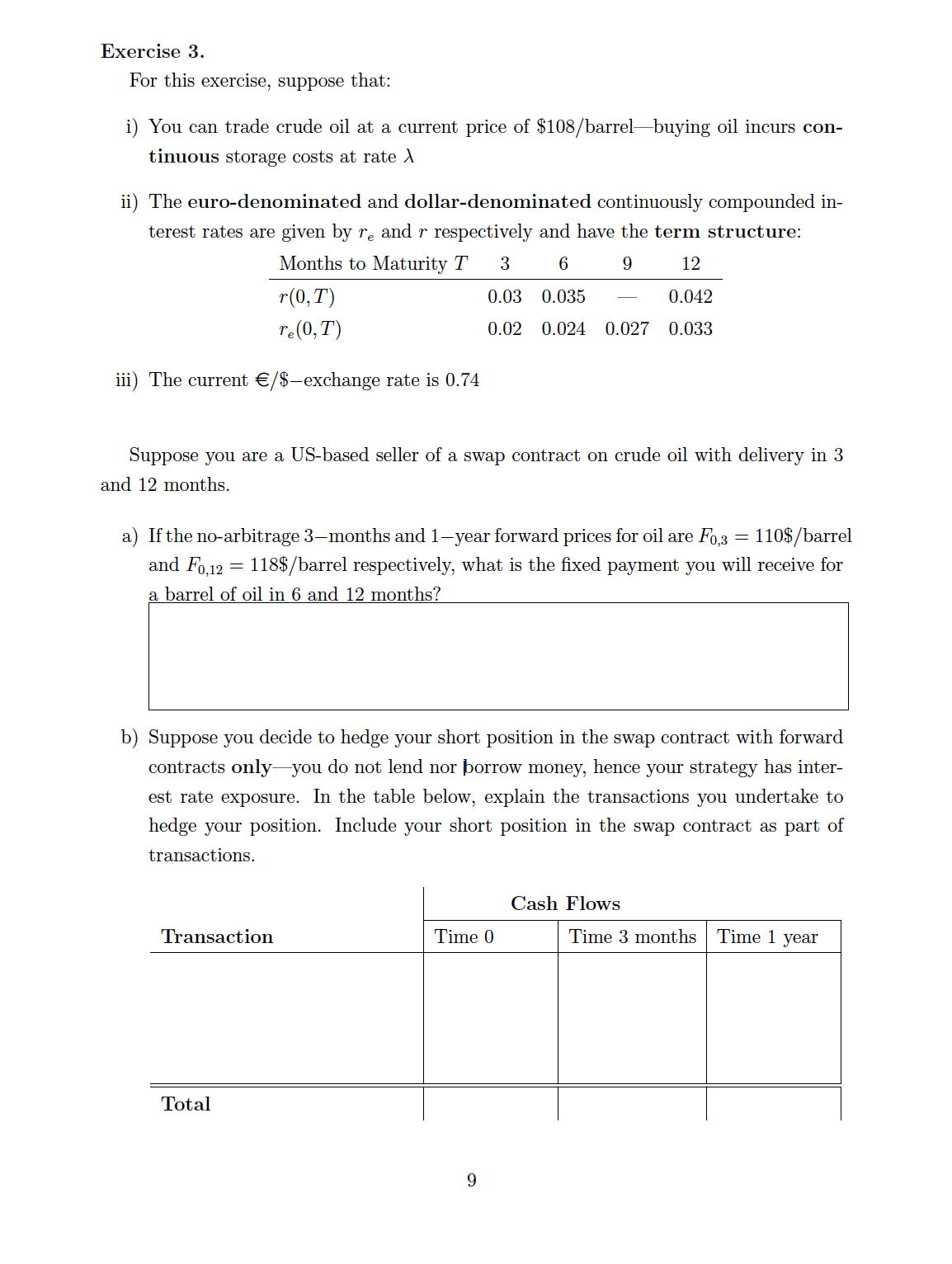

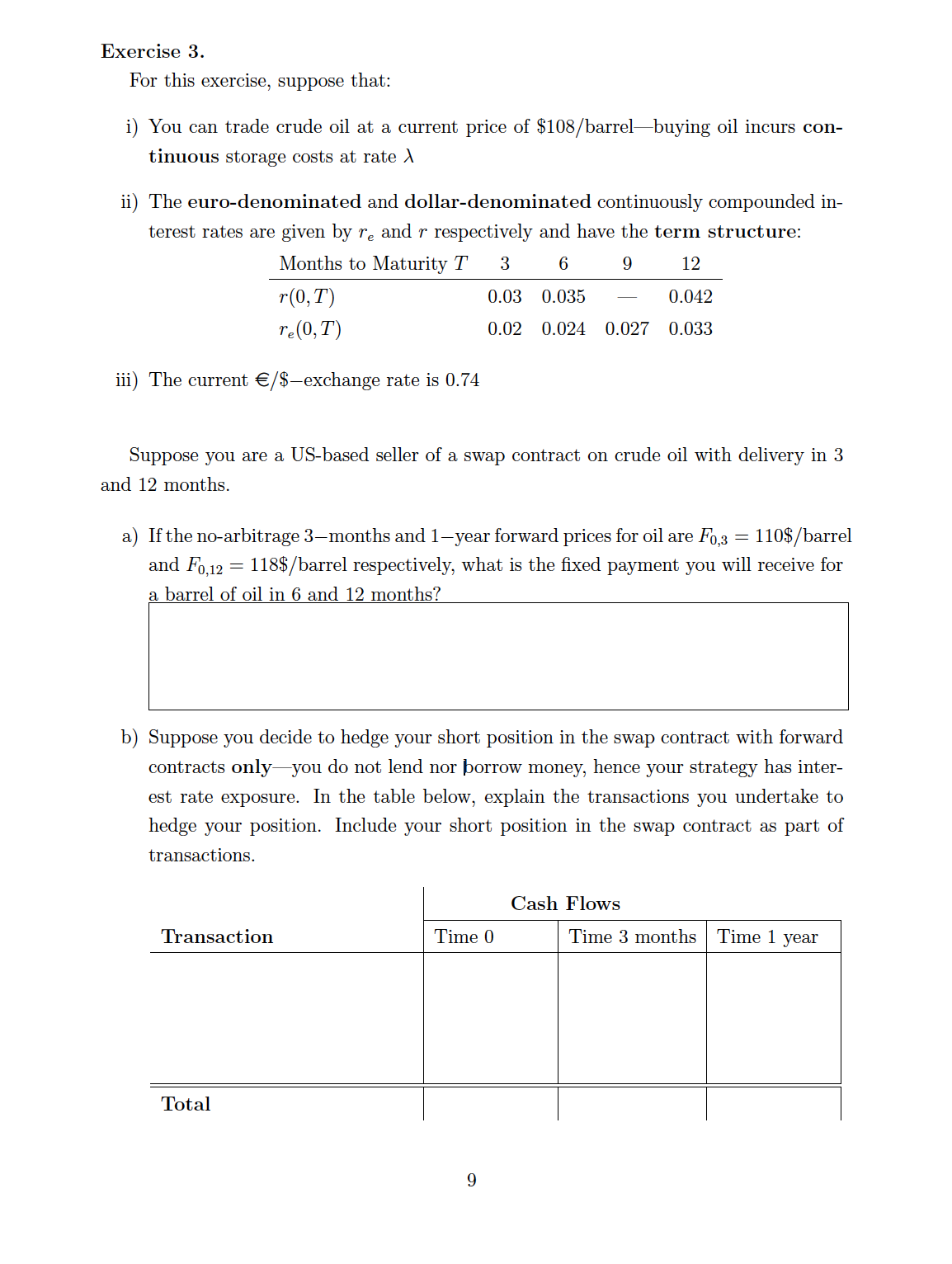

Exercise 3. For this exercise, suppose that: i) You can trade crude oil at a current price of $108/barrelbuying oil incurs con- tinuous storage costs at rate A ii) The euro-denominated and dollar-denominated continuously compounded in- terest rates are given by re and a" respectively and have the term structure: Months to Maturity T 3 6 9 12 1'10, T) 0.03 0.035 0.042 1",, (0, T) 0.02 0.024 0.027 0033 iii) The current /$exchange rate is 0.74 Suppose you are a USbased seller of a swap contract on crude oil with delivery in 3 and 12 months. a) If the noarbitrage 3months and 1year forward prices for oil are F03, : 110$ / barrel and F0," : 118$ / barrel respectively, what is the xed payment you will receive for a barrel of oil in 6 and 12 months? b) Suppose you decide to hedge your short position in the swap contract with forward contracts onlyyou do not lend nor borrow money, hence your strategy has inter- est rate exposure. In the table below, explain the transactions you undertake to hedge your position. Include your short position in the swap contract as part of transactions. Cash Flows Transaction Time 0 Time 3 months Time 1 year Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts