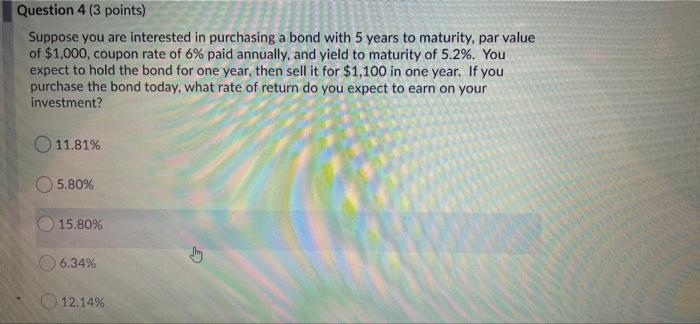

Question: need help with 4 and 5 Question 4 (3 points) Suppose you are interested in purchasing a bond with 5 years to maturity, par value

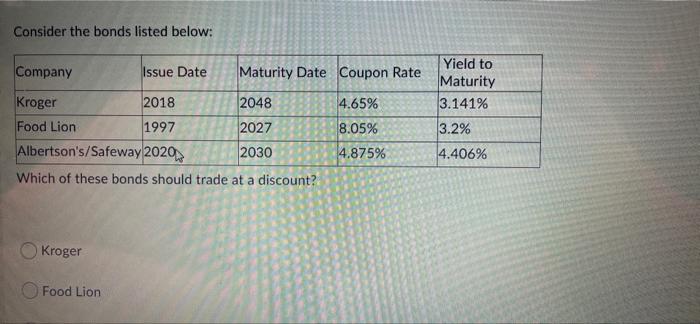

Question 4 (3 points) Suppose you are interested in purchasing a bond with 5 years to maturity, par value of $1,000, coupon rate of 6% paid annually, and yield to maturity of 5.2%. You expect to hold the bond for one year, then sell it for $1,100 in one year. If you purchase the bond today, what rate of return do you expect to earn on your investment? 11.81% 5.80% 15.80% 6.34% 12.14% Consider the bonds listed below: Company Issue Date Maturity Date Coupon Rate 4.65% Yield to Maturity 3.141% 3.2% Kroger 2018 2048 Food Lion 1997 2027 Albertson's/Safeway 2020 2030 Which of these bonds should trade at a discount? 8.05% 4.875% 4.406% Kroger Food Lion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts