Question: need help with 4 and 6 Question 4 (1 point) Project A costs $67,775, its expected net cash inflows are $10,000 per year for 10

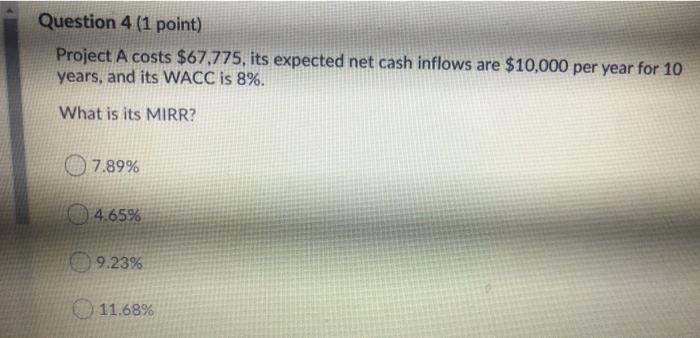

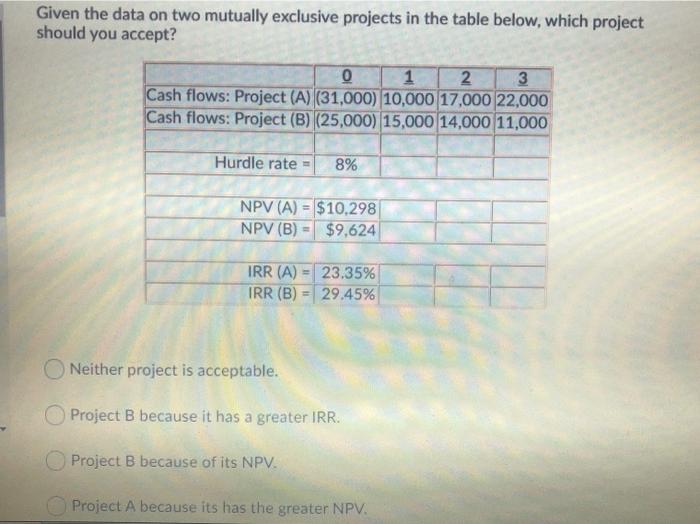

Question 4 (1 point) Project A costs $67,775, its expected net cash inflows are $10,000 per year for 10 years, and its WACC is 8%. What is its MIRR? 7.89% 4.65% 9.23% % 11.68% % Given the data on two mutually exclusive projects in the table below, which project should you accept? 0 1 2 3 Cash flows: Project (A) (31,000) 10,000 17,000 22,000 Cash flows: Project (B) (25,000) 15,000 14,000 11,000 Hurdle rate = 8% NPV (A) = $10,298 NPV (B) = $9,624 IRR (A) = 23.35% IRR (B) = 29.45% ONeither project is acceptable. Project B because it has a greater IRR. Project B because of its NPV. Project A because its has the greater NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts