Question: need help with 4&5 Question 4 (1 point) One-year T-bills yield 1.25%. Based on futures rates, the market expects that one year from now, new

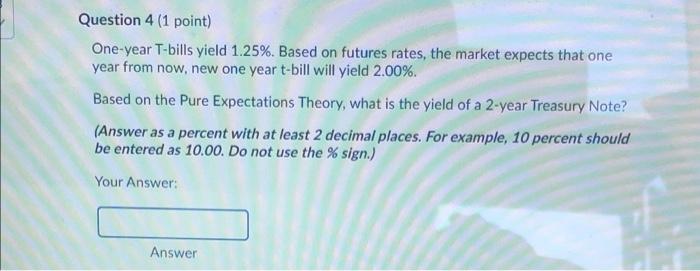

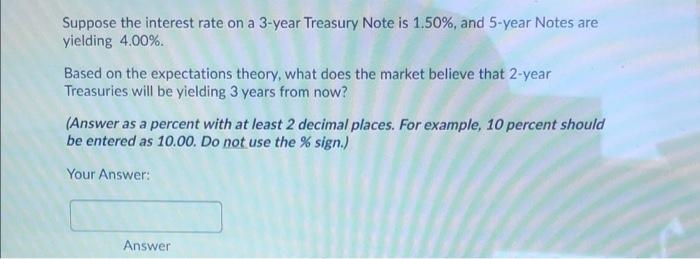

Question 4 (1 point) One-year T-bills yield 1.25%. Based on futures rates, the market expects that one year from now, new one year t-bill will yield 2.00%. Based on the Pure Expectations Theory, what is the yield of a 2-year Treasury Note? (Answer as a percent with at least 2 decimal places. For example, 10 percent should be entered as 10.00. Do not use the % sign.) Your Answer: Answer Suppose the interest rate on a 3-year Treasury Note is 1.50%, and 5-year Notes are yielding 4.00%. Based on the expectations theory, what does the market believe that 2-year Treasuries will be yielding 3 years from now? (Answer as a percent with at least 2 decimal places. For example, 10 percent should be entered as 10.00. Do not use the % sign.) Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts