Question: need help with 5&6 Question 5 (1 point) Project A costs $67,775, its expected net cash inflows are $10,000 per year for 10 years, and

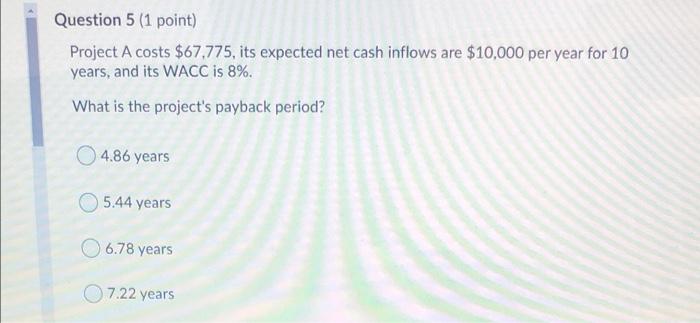

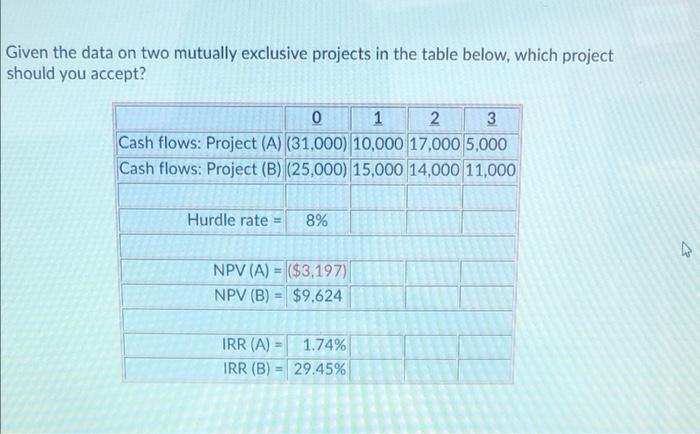

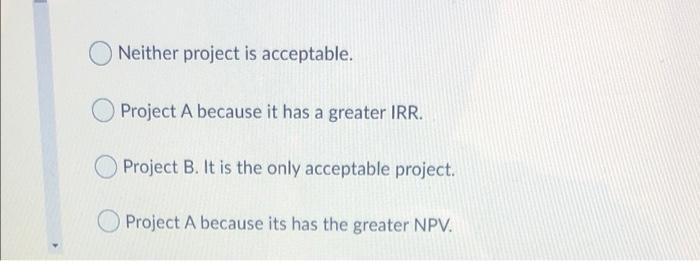

Question 5 (1 point) Project A costs $67,775, its expected net cash inflows are $10,000 per year for 10 years, and its WACC is 8%. What is the project's payback period? 4.86 years 5.44 years 6.78 years 7.22 years Given the data on two mutually exclusive projects in the table below, which project should you accept? 0 1 2 3 Cash flows: Project (A) (31,000) 10,000 17,000 5,000 Cash flows: Project (B) (25,000) 15,000 14,000 11,000 Hurdle rate = 8% NPV (A) = ($3,197) NPV (B) = $9,624 IRR (A) 1.74% IRR (B) = 29.45% Neither project is acceptable. Project A because it has a greater IRR. Project B. It is the only acceptable project. Project A because its has the greater NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts