Question: Need help with 7-9 Need help with 7-9 It is the beginning of January. Actual sales for the previous quarter (Q4) and estimated sales for

Need help with 7-9

Need help with 7-9

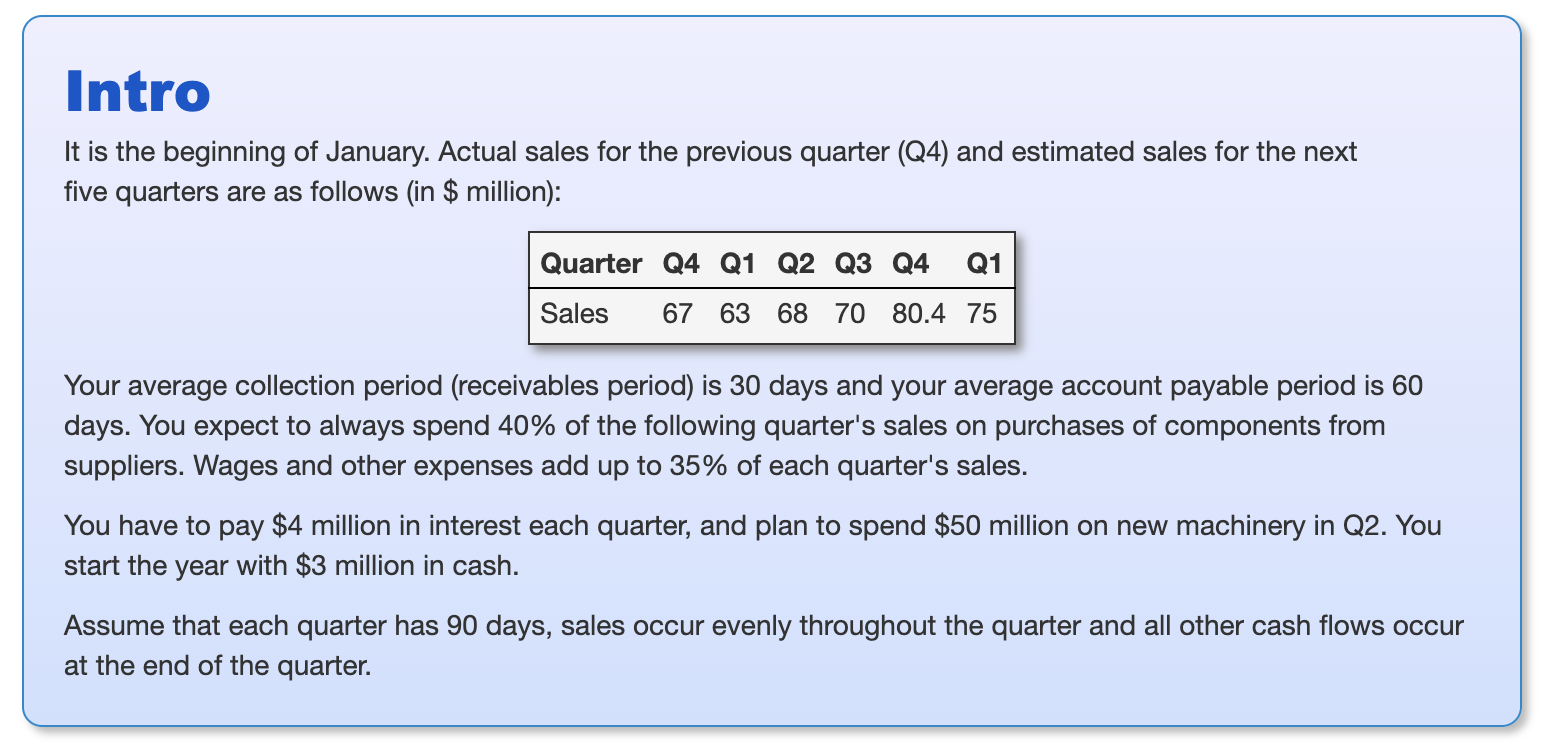

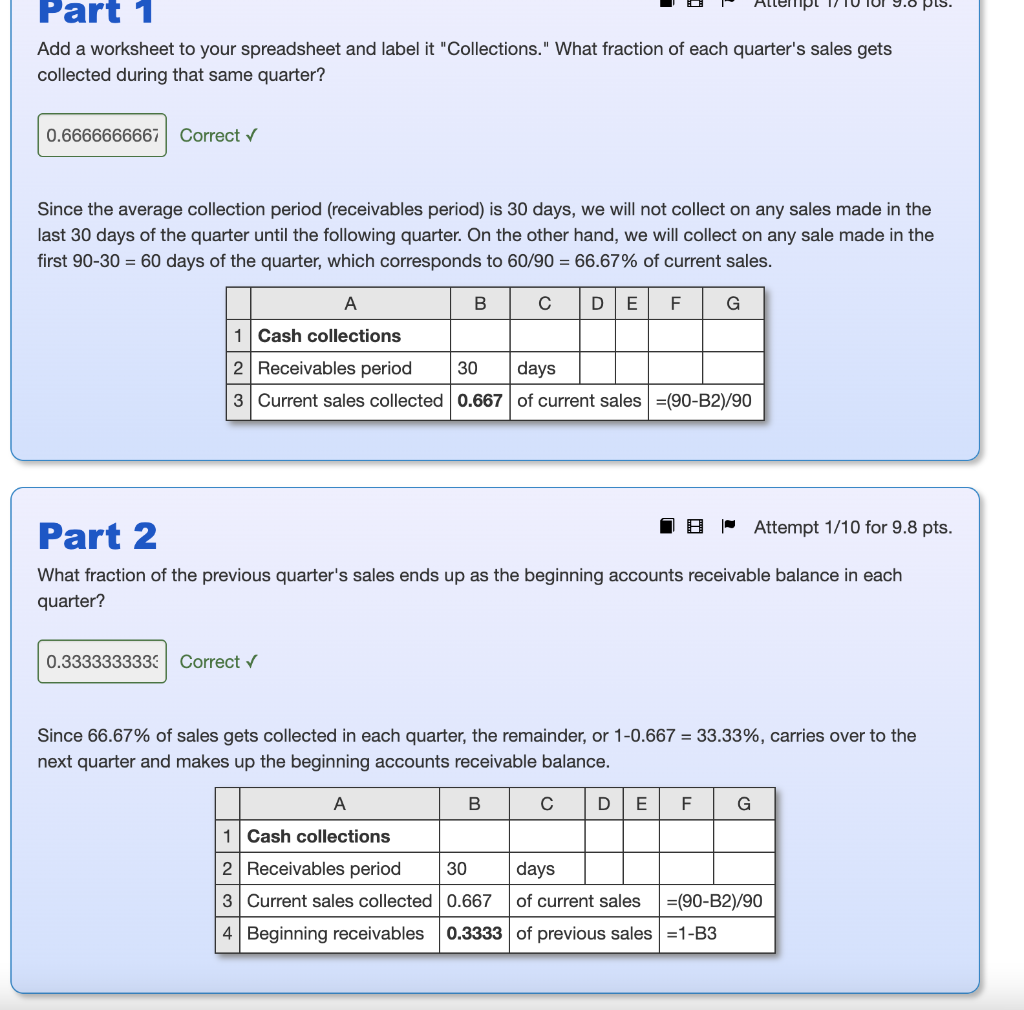

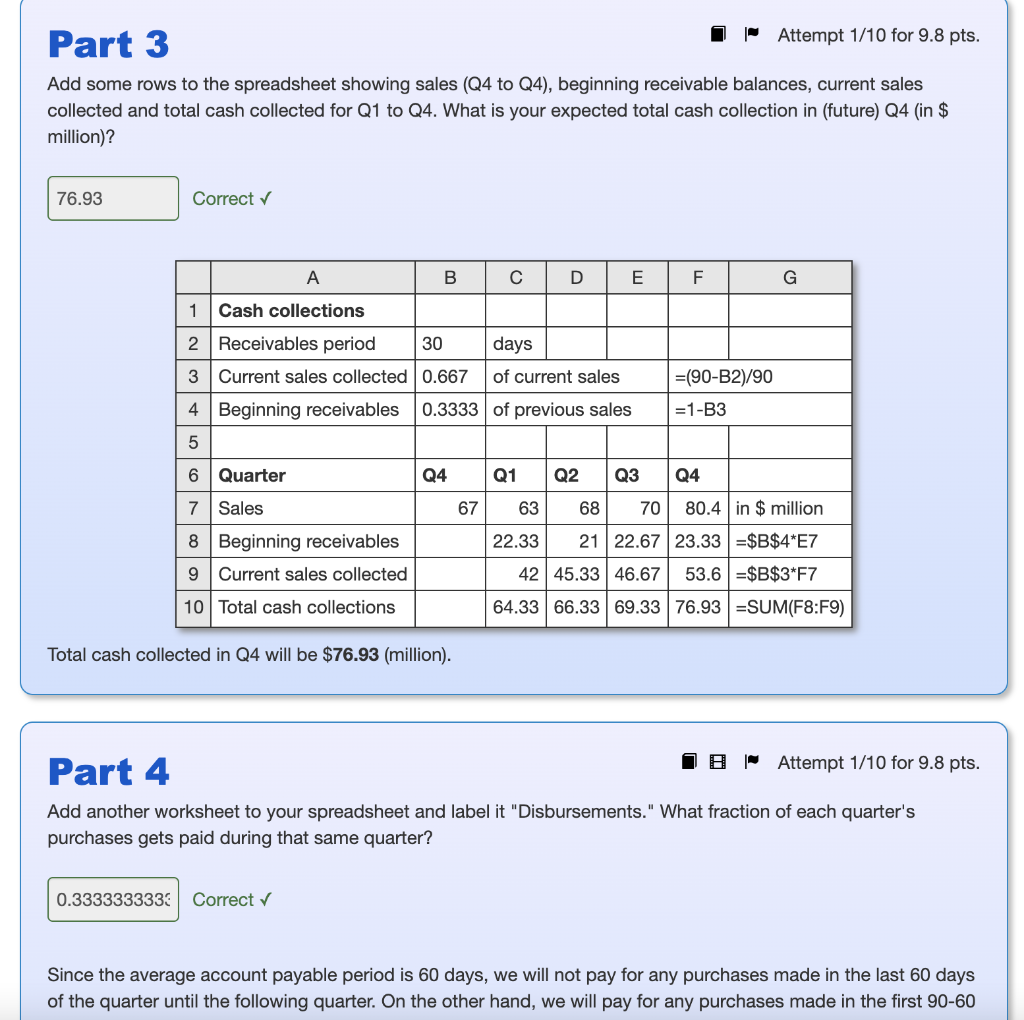

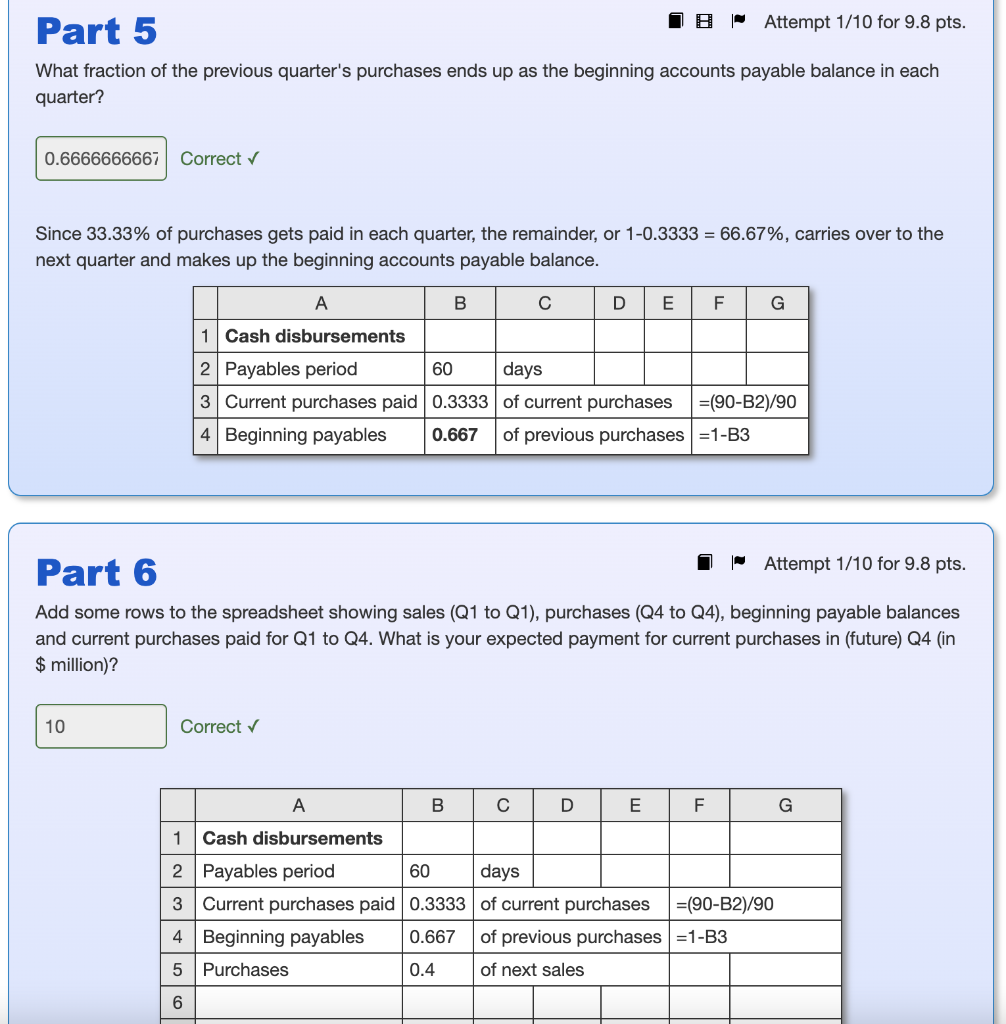

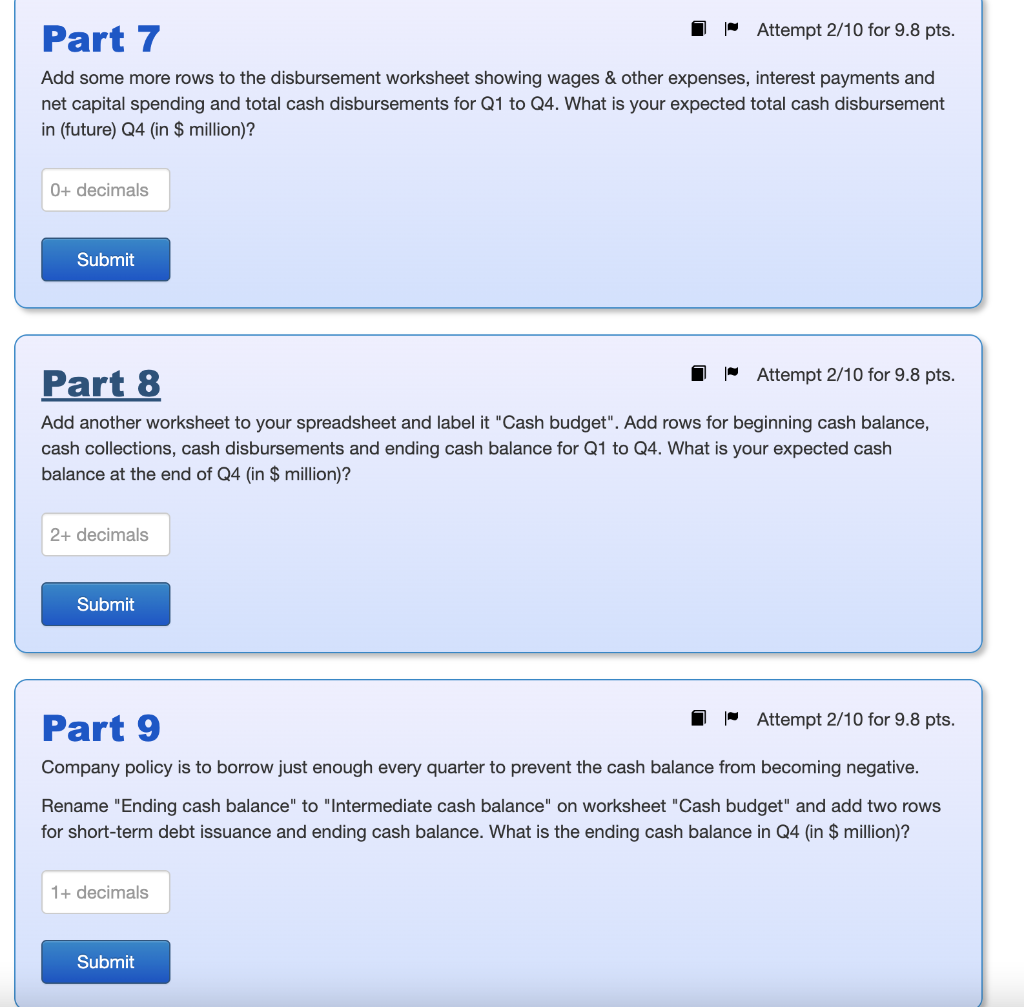

It is the beginning of January. Actual sales for the previous quarter (Q4) and estimated sales for the next five quarters are as follows (in $ million): Your average collection period (receivables period) is 30 days and your average account payable period is 60 days. You expect to always spend 40% of the following quarter's sales on purchases of components from suppliers. Wages and other expenses add up to 35% of each quarter's sales. You have to pay $4 million in interest each quarter, and plan to spend $50 million on new machinery in Q2. You start the year with $3 million in cash. Assume that each quarter has 90 days, sales occur evenly throughout the quarter and all other cash flows occur at the end of the quarter. Add a worksheet to your spreadsheet and label it "Collections." What fraction of each quarter's sales gets collected during that same quarter? Correct Since the average collection period (receivables period) is 30 days, we will not collect on any sales made in the last 30 days of the quarter until the following quarter. On the other hand, we will collect on any sale made in the first 9030=60 days of the quarter, which corresponds to 60/90=66.67% of current sales. What fraction of the previous quarter's sales ends up as the beginning accounts receivable balance in each quarter? Correct Since 66.67% of sales gets collected in each quarter, the remainder, or 10.667=33.33%, carries over to the next quarter and makes up the beginning accounts receivable balance. Add some rows to the spreadsheet showing sales (Q4 to Q4), beginning receivable balances, current sales collected and total cash collected for Q1 to Q4. What is your expected total cash collection in (future) Q4 (in $ million)? Correct Total cash collected in Q4 will be $76.93 (million). Part 4 A Attempt 1/10 for 9.8 pts. Add another worksheet to your spreadsheet and label it "Disbursements." What fraction of each quarter's purchases gets paid during that same quarter? Correct Since the average account payable period is 60 days, we will not pay for any purchases made in the last 60 days of the quarter until the following quarter. On the other hand, we will pay for any purchases made in the first 9060 What fraction of the previous quarter's purchases ends up as the beginning accounts payable balance in each quarter? Correct Since 33.33% of purchases gets paid in each quarter, the remainder, or 10.3333=66.67%, carries over to the next quarter and makes up the beginning accounts payable balance. Part 6 Attempt 1/10 for 9.8 pts. Add some rows to the spreadsheet showing sales (Q1 to Q1), purchases (Q4 to Q4), beginning payable balances and current purchases paid for Q1 to Q4. What is your expected payment for current purchases in (future) Q4 (in $ million)? Add some more rows to the disbursement worksheet showing wages \& other expenses, interest payments and net capital spending and total cash disbursements for Q1 to Q4. What is your expected total cash disbursement in (future) Q4 (in $ million)? Attempt 2/10 for 9.8 pts. Add another worksheet to your spreadsheet and label it "Cash budget". Add rows for beginning cash balance, cash collections, cash disbursements and ending cash balance for Q1 to Q4. What is your expected cash balance at the end of Q4 (in $ million)? Part 9 Attempt 2/10 for 9.8 pts. Company policy is to borrow just enough every quarter to prevent the cash balance from becoming negative. Rename "Ending cash balance" to "Intermediate cash balance" on worksheet "Cash budget" and add two rows for short-term debt issuance and ending cash balance. What is the ending cash balance in Q4 (in $ million)? It is the beginning of January. Actual sales for the previous quarter (Q4) and estimated sales for the next five quarters are as follows (in $ million): Your average collection period (receivables period) is 30 days and your average account payable period is 60 days. You expect to always spend 40% of the following quarter's sales on purchases of components from suppliers. Wages and other expenses add up to 35% of each quarter's sales. You have to pay $4 million in interest each quarter, and plan to spend $50 million on new machinery in Q2. You start the year with $3 million in cash. Assume that each quarter has 90 days, sales occur evenly throughout the quarter and all other cash flows occur at the end of the quarter. Add a worksheet to your spreadsheet and label it "Collections." What fraction of each quarter's sales gets collected during that same quarter? Correct Since the average collection period (receivables period) is 30 days, we will not collect on any sales made in the last 30 days of the quarter until the following quarter. On the other hand, we will collect on any sale made in the first 9030=60 days of the quarter, which corresponds to 60/90=66.67% of current sales. What fraction of the previous quarter's sales ends up as the beginning accounts receivable balance in each quarter? Correct Since 66.67% of sales gets collected in each quarter, the remainder, or 10.667=33.33%, carries over to the next quarter and makes up the beginning accounts receivable balance. Add some rows to the spreadsheet showing sales (Q4 to Q4), beginning receivable balances, current sales collected and total cash collected for Q1 to Q4. What is your expected total cash collection in (future) Q4 (in $ million)? Correct Total cash collected in Q4 will be $76.93 (million). Part 4 A Attempt 1/10 for 9.8 pts. Add another worksheet to your spreadsheet and label it "Disbursements." What fraction of each quarter's purchases gets paid during that same quarter? Correct Since the average account payable period is 60 days, we will not pay for any purchases made in the last 60 days of the quarter until the following quarter. On the other hand, we will pay for any purchases made in the first 9060 What fraction of the previous quarter's purchases ends up as the beginning accounts payable balance in each quarter? Correct Since 33.33% of purchases gets paid in each quarter, the remainder, or 10.3333=66.67%, carries over to the next quarter and makes up the beginning accounts payable balance. Part 6 Attempt 1/10 for 9.8 pts. Add some rows to the spreadsheet showing sales (Q1 to Q1), purchases (Q4 to Q4), beginning payable balances and current purchases paid for Q1 to Q4. What is your expected payment for current purchases in (future) Q4 (in $ million)? Add some more rows to the disbursement worksheet showing wages \& other expenses, interest payments and net capital spending and total cash disbursements for Q1 to Q4. What is your expected total cash disbursement in (future) Q4 (in $ million)? Attempt 2/10 for 9.8 pts. Add another worksheet to your spreadsheet and label it "Cash budget". Add rows for beginning cash balance, cash collections, cash disbursements and ending cash balance for Q1 to Q4. What is your expected cash balance at the end of Q4 (in $ million)? Part 9 Attempt 2/10 for 9.8 pts. Company policy is to borrow just enough every quarter to prevent the cash balance from becoming negative. Rename "Ending cash balance" to "Intermediate cash balance" on worksheet "Cash budget" and add two rows for short-term debt issuance and ending cash balance. What is the ending cash balance in Q4 (in $ million)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts