Question: need help with #8 Chapter 14: Security Structures and Determining Enterprise Values 53 8. LEnterprise Valuation Cash Flows] Find the enterprise valuation cash flow expected

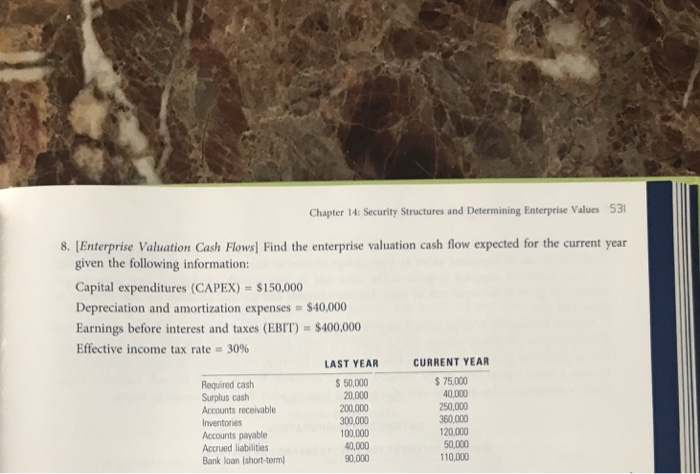

Chapter 14: Security Structures and Determining Enterprise Values 53 8. LEnterprise Valuation Cash Flows] Find the enterprise valuation cash flow expected for the current year given the following information: Capital expenditures (CAPEX) -$150,000 Depreciation and amortization expenses $40,000 Earnings before interest and taxes (EBIT) $400,000 Effective income tax rate 30% CURRENT YEAR LAST YEAR $ 75,000 0,000 250,000 360,000 120,000 50,000 110,000 50,000 20,000 200,000 300,000 100,000 40,000 90,000 Required cash Surplus cash Accounts receivable Inventories Accounts payable Accrued liabilities Bank loan (short-term)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts