Question: need help with 9 and 10 Question 9 (2 points) In a refunding operation, a company calls low yield bonds using high yield bonds effectively

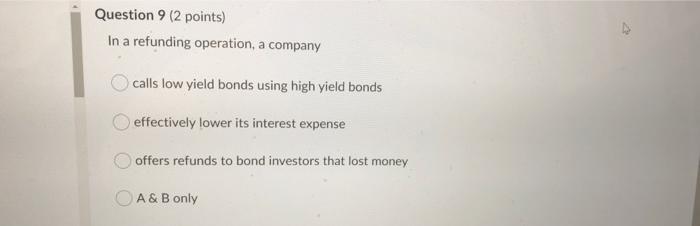

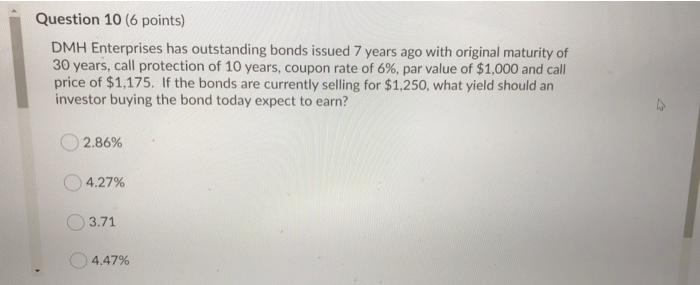

Question 9 (2 points) In a refunding operation, a company calls low yield bonds using high yield bonds effectively lower its interest expense offers refunds to bond investors that lost money A & B only Question 10 (6 points) DMH Enterprises has outstanding bonds issued 7 years ago with original maturity of 30 years, call protection of 10 years, coupon rate of 6%, par value of $1,000 and call price of $1,175. If the bonds are currently selling for $1,250, what yield should an investor buying the bond today expect to earn? 2.86% 4.27% 3.71 4.47%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts