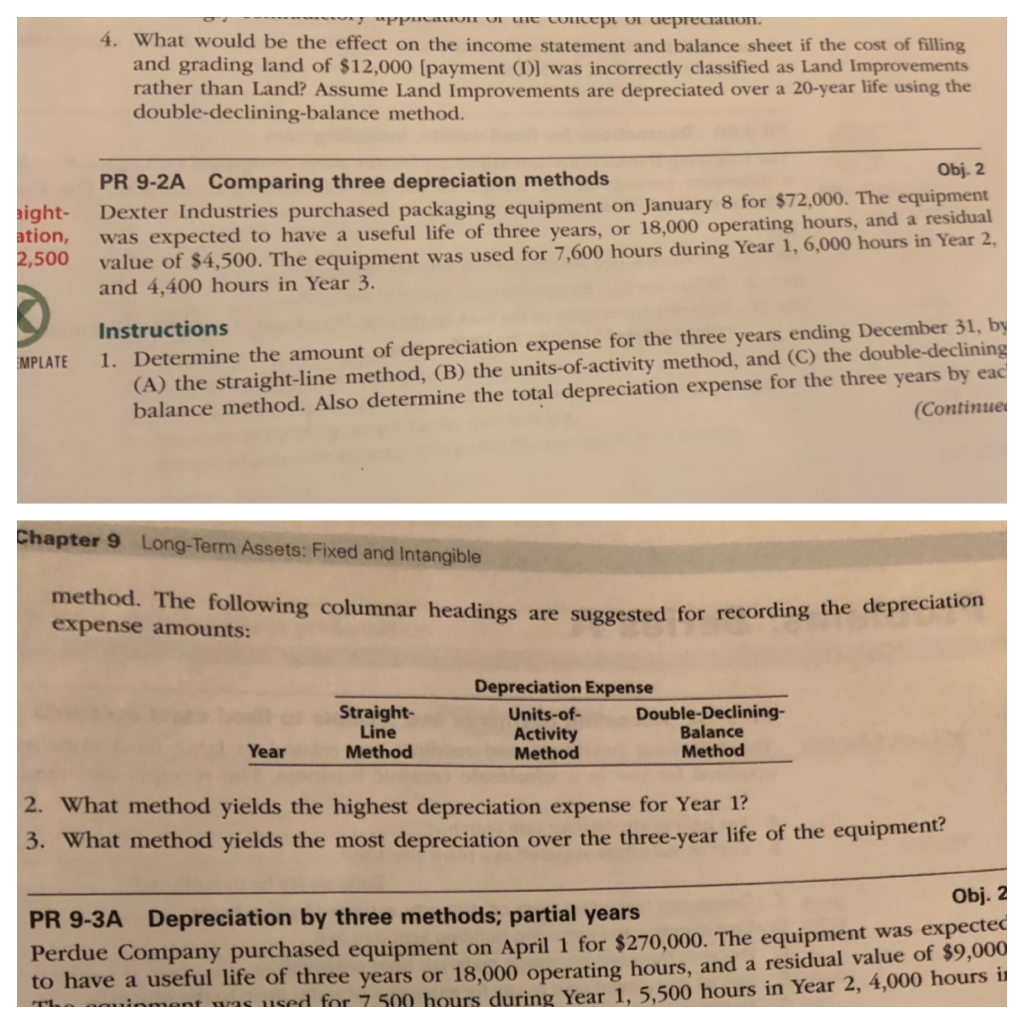

Question: Need help with 9-2 Comparing three depreciation methods reciation En Units-Dobe-Declining Straight Line Activit Balance Year Totals Calculations: Straight-line method: Cost Years - Yearly Depreciation

Need help with 9-2 Comparing three depreciation methods

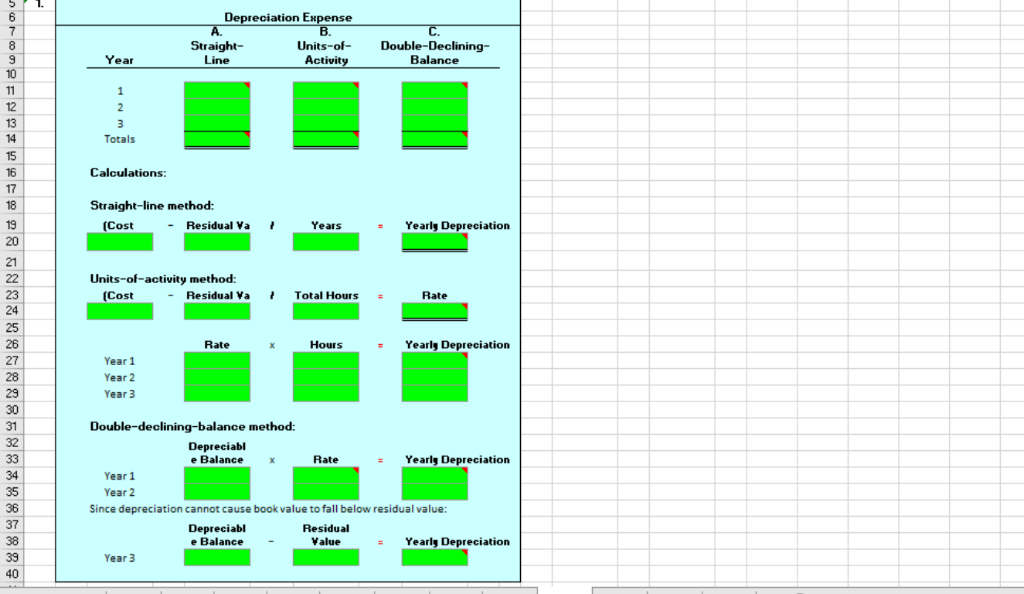

reciation En Units-Dobe-Declining Straight Line Activit Balance Year Totals Calculations: Straight-line method: Cost Years - Yearly Depreciation -Residual Va 21 Units-of-activity method: -Residual VaTotal Hours - 25 Rate Hours - Yearly Depreciation 27 Year 1 Year 2 Year 3 30 31 32 Double-declining-balance method: Depreciabl e Balance x Rate s Yearly Depreciation 34 35 Year 1 Year 2 Since depreciation cannot cause book value to fall below residual value: Depreciabl e Balance - Residual Value s Yearly Depreciation Year 3 40

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock