Question: need help with a Finance problem the question is located at the bottom of the picture. Use the information above it to solve. . .

need help with a Finance problem the question is located at the bottom of the picture. Use the information above it to solve.

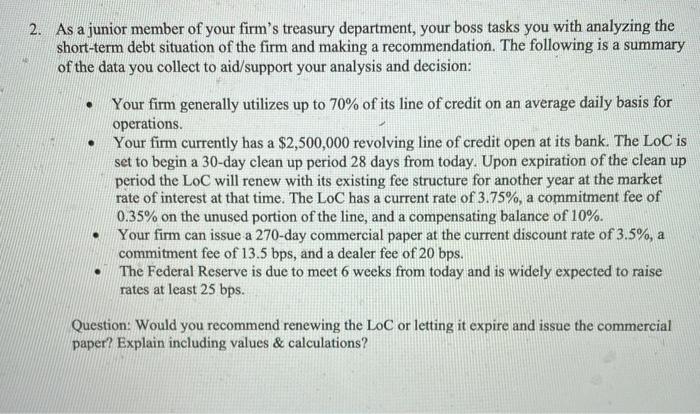

. . 2. As a junior member of your firm's treasury department, your boss tasks you with analyzing the short-term debt situation of the firm and making a recommendation. The following is a summary of the data you collect to aid/support your analysis and decision: Your firm generally utilizes up to 70% of its line of credit on an average daily basis for operations. Your firm currently has a $2,500,000 revolving line of credit open at its bank. The LoC is set to begin a 30-day clean up period 28 days from today. Upon expiration of the clean up period the LoC will renew with its existing fee structure for another year at the market rate of interest at that time. The LoC has a current rate of 3.75%, a commitment fee of 0.35% on the unused portion of the line, and a compensating balance of 10%. Your firm can issue a 270-day commercial paper at the current discount rate of 3.5%, a commitment fee of 13.5 bps, and a dealer fee of 20 bps. The Federal Reserve is due to meet 6 weeks from today and is widely expected to raise rates at least 25 bps. . . Question: Would you recommend renewing the LoC or letting it expire and issue the commercial paper? Explain including values & calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts