Question: need help with (a) only Below are the financial statement and tax bases for Delta Bhd (DB) as at 31 December 2021: Tax Base Land

need help with (a) only

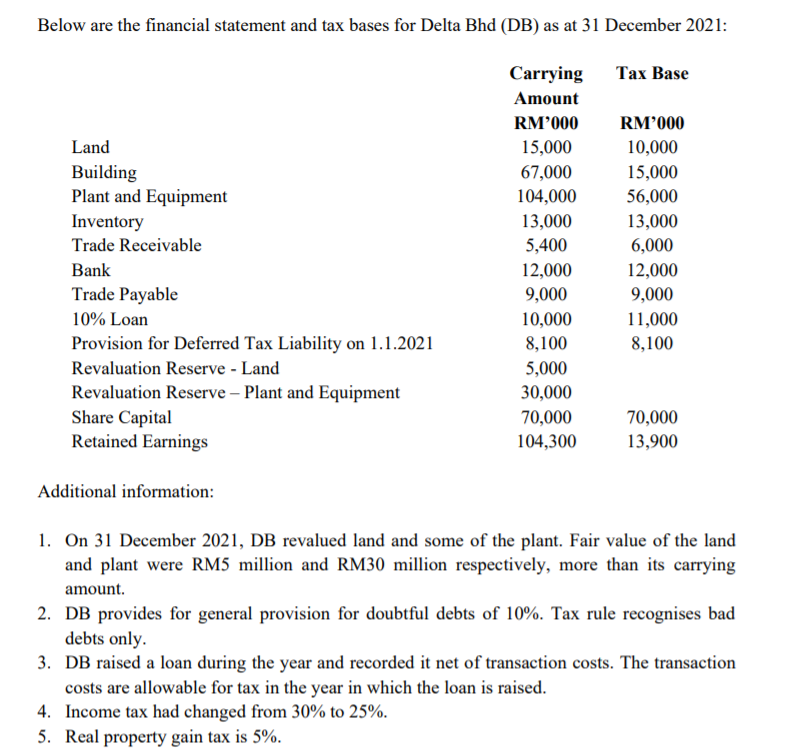

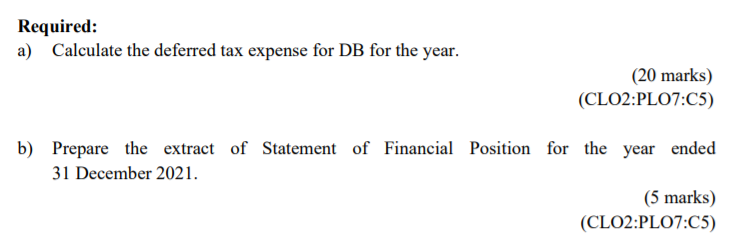

Below are the financial statement and tax bases for Delta Bhd (DB) as at 31 December 2021: Tax Base Land Building Plant and Equipment Inventory Trade Receivable Bank Trade Payable 10% Loan Provision for Deferred Tax Liability on 1.1.2021 Revaluation Reserve - Land Revaluation Reserve - Plant and Equipment Share Capital Retained Earnings Carrying Amount RM'000 15,000 67,000 104,000 13,000 5,400 12,000 9,000 10,000 8,100 5,000 30,000 70,000 104,300 RM'000 10,000 15,000 56,000 13,000 6,000 12,000 9,000 11,000 8,100 70,000 13,900 Additional information: 1. On 31 December 2021, DB revalued land and some of the plant. Fair value of the land and plant were RM5 million and RM30 million respectively, more than its carrying amount. 2. DB provides for general provision for doubtful debts of 10%. Tax rule recognises bad debts only. 3. DB raised a loan during the year and recorded it net of transaction costs. The transaction costs are allowable for tax in the year in which the loan is raised. 4. Income tax had changed from 30% to 25%. 5. Real property gain tax is 5%. Required: a) Calculate the deferred tax expense for DB for the year. (20 marks) (CLO2:PL07:05) b) Prepare the extract of Statement of Financial Position for the year ended 31 December 2021. (5 marks) (CLO2.PL07:C5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts