Question: need help with Adjustments 1 and 2 601 Computerized Accounting 600 Chapter 11 P11.1.7 Adjusting Entries 1. Export to Excel or print the Trial Balance

need help with Adjustments 1 and 2

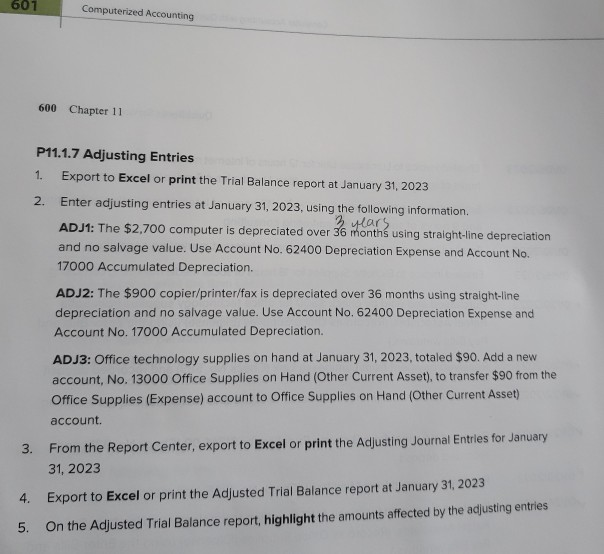

601 Computerized Accounting 600 Chapter 11 P11.1.7 Adjusting Entries 1. Export to Excel or print the Trial Balance report at January 31, 2023 2. Enter adjusting entries at January 31, 2023, using the following information. 3 ulars ADJ1: The $2,700 computer is depreciated over 36 months using straight-line depreciation and no salvage value. Use Account No. 62400 Depreciation Expense and Account No. 17000 Accumulated Depreciation. ADJ2: The $900 copier/printer/fax is depreciated over 36 months using straight-line depreciation and no salvage value. Use Account No. 62400 Depreciation Expense and Account No. 17000 Accumulated Depreciation. ADJ3: Office technology supplies on hand at January 31, 2023, totaled $90. Add a new account, No. 13000 Office Supplies on Hand (Other Current Asset), to transfer $90 from the Office Supplies (Expense) account to Office Supplies on Hand (Other Current Asset) account. From the Report Center, export to Excel or print the Adjusting Journal Entries for January 31, 2023 Export to Excel or print the Adjusted Trial Balance report at January 31, 2023 3. 4. 5. On the Adjusted Trial Balance report, highlight the amounts affected by the adjusting entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts