Question: need help with all 1. risk can be diversified away, 2. risk cannot be eliminated by diversification. 3. Investing in multiple stocks instead of just

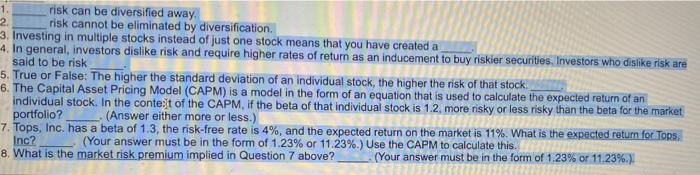

1. risk can be diversified away, 2. risk cannot be eliminated by diversification. 3. Investing in multiple stocks instead of just one stock means that you have created a 4. In general, investors dislike risk and require higher rates of return as an inducement to buy riskier securities, Investors who dislike risk are said to be risk 5. True or False: The higher the standard deviation of an individual stock, the higher the risk of that stock. 6. The Capital Asset Pricing Model (CAPM) is a model in the form of an equation that is used to calculate the expected return of an Individual stock. In the contest of the CAPM. if the beta of that individual stock is 1.2 more risky or less risky than the beta for the market portfolio? (Answer either more or less.) 7. Tops, Inc. has a beta of 1.3, the risk-free rate is 4%, and the expected return on the market is 11%. What is the expected return for Tops Inc? (Your answer must be in the form of 1.23% or 11.23%.) Use the CAPM to calculate this. 8. What is the market risk premium implied in Question 7 above? (Your answer must be in the form of 1.23% or 11.23%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts