Question: Need help with all 8 please BASIC (Questions 1-17) 1. Caleulating Liquidity Ratios ILO2] SDJ, Inc., has net working capital of S1,920, current liabilities of

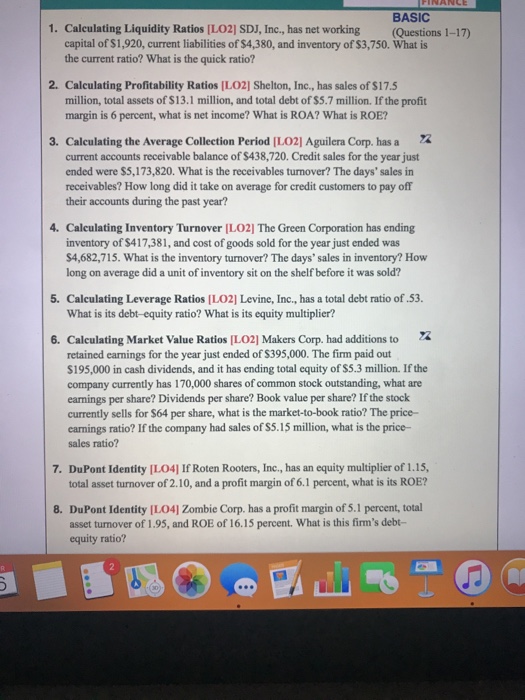

BASIC (Questions 1-17) 1. Caleulating Liquidity Ratios ILO2] SDJ, Inc., has net working capital of S1,920, current liabilities of $4,380, and inventory of $3,750. What is the current ratio? What is the quick ratio? 2. Calculating Profitability Ratios [LO2] Shelton, Inc.,. has sales of $17.5 million, total assets of $13.1 million, and total debt of $5.7 million. If the profit margin is 6 percent, what is net income? What is ROA? What is ROE? 3. Calculating the Average Collection Period [LO2] Aguilera Corp. has a current accounts receivable balance of $438,720. Credit sales for the year just ended were $5,173,820. What is the receivables turnover? The days' sales in receivables? How long did it take on average for credit customers to pay off their accounts during the past year? 4. Calculating Inventory Turnover LO21 The Green Corporation has ending inventory of $417,381, and cost of goods sold for the year just ended was S4,682,715. What is the inventory turnover? The days' sales in inventory? How long on average did a unit of inventory sit on the shelf before it was sold? 5. Calculating Leverage Ratios ILO2] Levine, Inc., has a total debt ratio of.53. What is its debt-equity ratio? What is its equity multiplier? 6. Calculating Market Value Ratios ILO2] Makers Corp. had additions to retained earnings for the year just ended of S395,000. The firm paid out $195,000 in cash dividends, and it has ending total equity of $5.3 million. If the company currently has 170,000 shares of common stock outstanding, what are earnings per share? Dividends per share? Book value per share? If the stock currently sells for $64 per share, what is the market-to-book ratio? The price- carnings ratio? If the company had sales of S5.15 million, what is the price- sales ratio? DuPont Identity [LO4] If Roten Rooters, Inc., has an equity multiplier of 1.15, total asset turnover of 2.10, and a profit margin of 6.1 percent, what is its ROE? 7. DuPont Identity [L041 Zombie Corp. has a profit margin of 5.1 percent, total asset tunover of 1.95, and ROE of 16.15 percent. What is this firm's debt- equity ratio? 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts