Question: need help with all questions. data tavle for a Data table T.P. Jarmon's total asset tumover is 1.47 . (Round to two decimai places.) T.

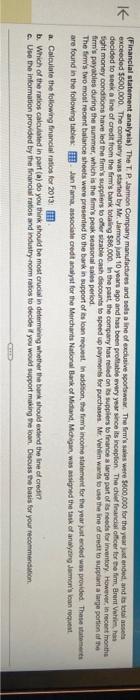

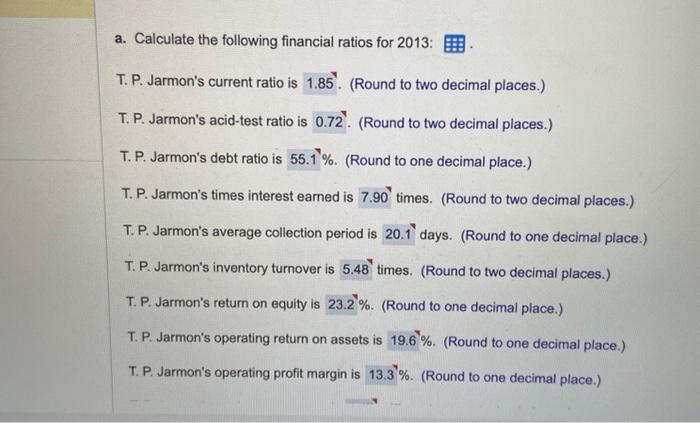

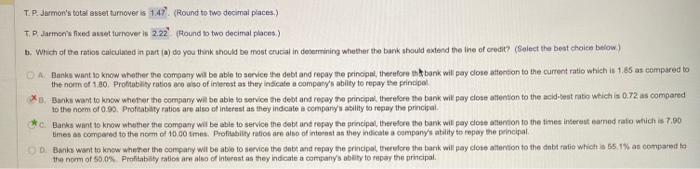

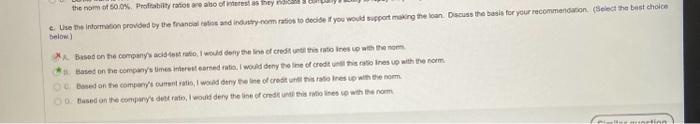

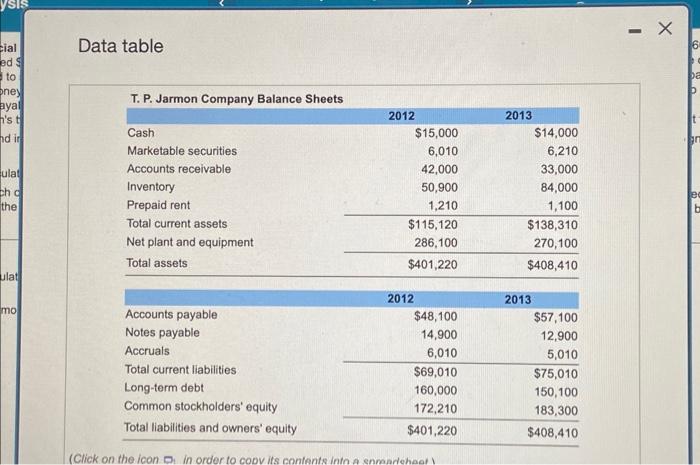

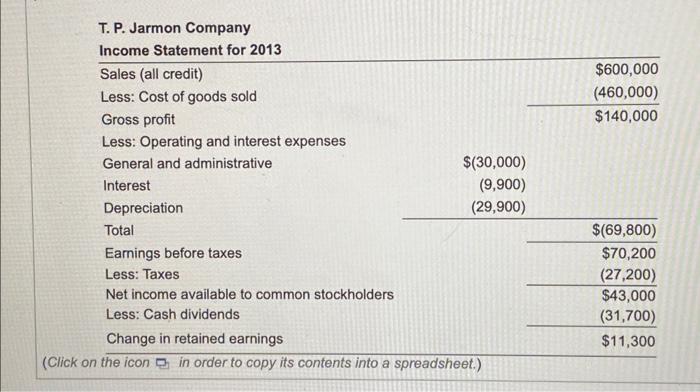

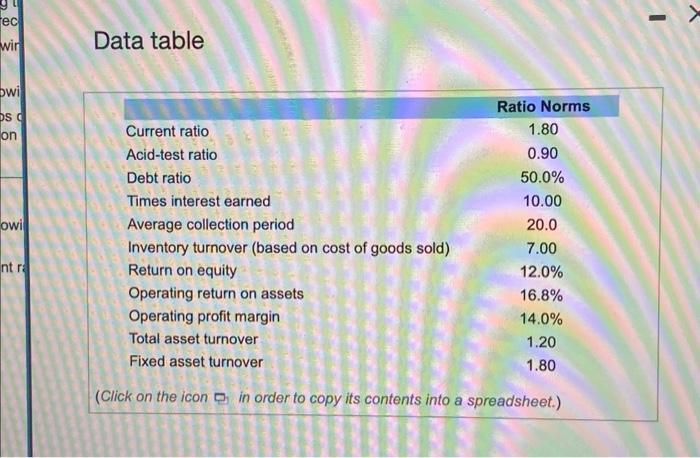

Data table T.P. Jarmon's total asset tumover is 1.47 . (Round to two decimai places.) T. P. Jarmsenis fixed atset furnover is 2.22. (Rlound to two decimal places.) b. Which of the ratios calculased in part (a) do you think should be moot crveal in deberninimg whether the bank should extend the ine of credit? (Salect the best choice below) to the noem of 0.95 . Proteabity ratios are also of interest as they indeate a companys asility to repay the princigai. Data table (G un une icon in oraer to copy its contents into a spreadsheet.) below) T. P. Jarmon Company Income Statement for 2013 \begin{tabular}{ll} \hline Sales (all credit) & $600,000 \\ Less: Cost of goods sold & (460,000) \\ Gross profit & $140,000 \end{tabular} Less: Operating and interest expenses General and administrative $(30,000) Interest (9,900) Depreciation (29,900) Total Earnings before taxes Less: Taxes Net income available to common stockholders Less: Cash dividends Change in retained earnings $(69,800)$70,200(27,200)$43,000(31,700)$11,300 (Click on the icon in order to copy its contents into a spreadsheet.) a. Calculate the following financial ratios for 2013 : T. P. Jarmon's current ratio is 1.85. (Round to two decimal places.) T. P. Jarmon's acid-test ratio is 0.72 . (Round to two decimal places.) T. P. Jarmon's debt ratio is 55.1%. (Round to one decimal place.) T. P. Jarmon's times interest earned is 7.90 times. (Round to two decimal places.) T. P. Jarmon's average collection period is days. (Round to one decimal place.) T. P. Jarmon's inventory turnover is times. (Round to two decimal places.) T. P. Jarmon's return on equity is 23.2%. (Round to one decimal place.) T. P. Jarmon's operating return on assets is 19.6%. (Round to one decimal place.) T. P. Jarmon's operating profit margin is 13.3%. (Round to one decimal place.) firm's payables during the summer, which is the firm's peak seasonal sales period. a. Calculate the following financial ratios for 2013 : b. Which of the ratios cakulated in part (a) do you think should be most crucial in detemining whether the berk should extend the line of credin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts