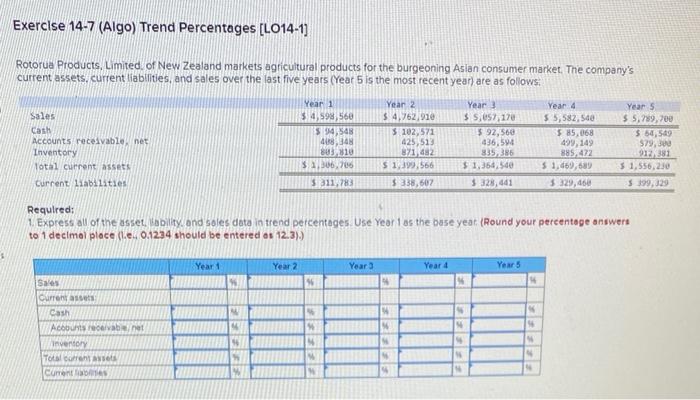

Question: Need help with all questions please. All information is provided Exerclse 14-7 (Algo) Trend Percentages [LO14-1] Rotorua Products, Limited, of New Zealand markets agricultural products

![14-7 (Algo) Trend Percentages [LO14-1] Rotorua Products, Limited, of New Zealand markets](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67184c4847303_63967184c476b6c5.jpg)

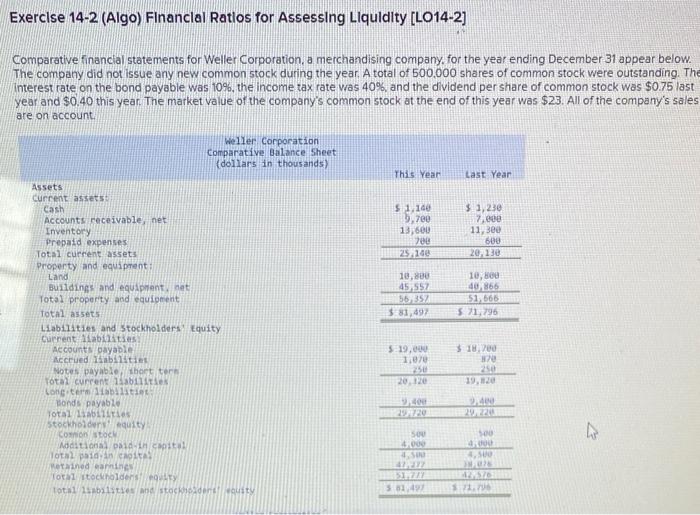

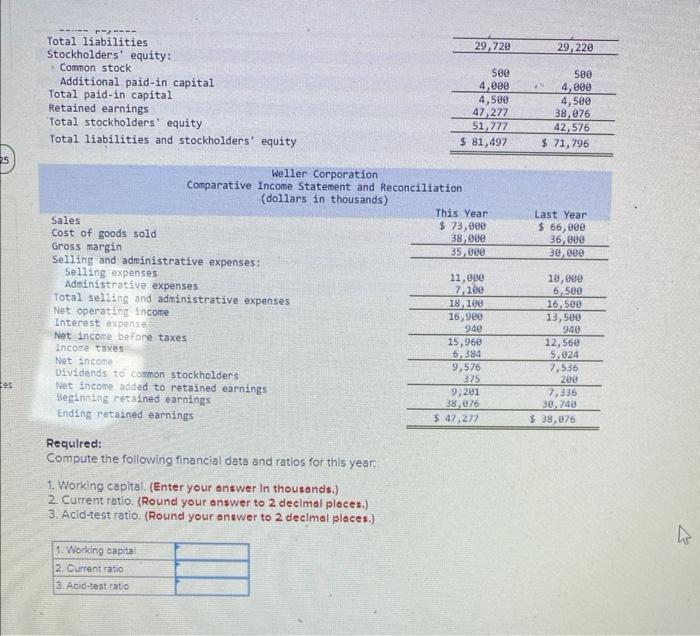

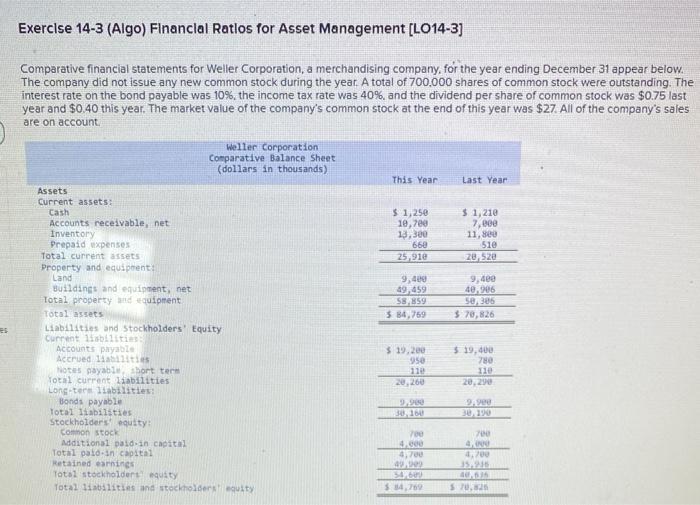

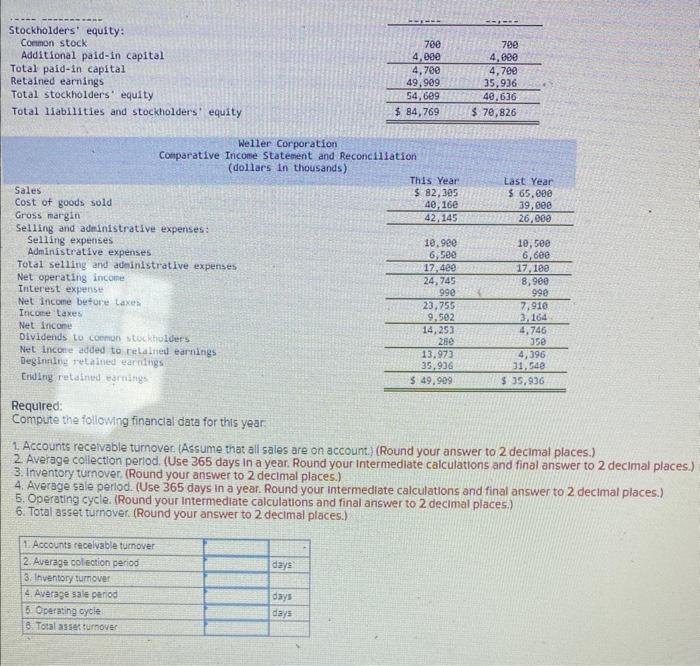

Exerclse 14-7 (Algo) Trend Percentages [LO14-1] Rotorua Products, Limited, of New Zealand markets agricultural products for the burgeoning Asian consumer market. The company's current assets. current liablifies, and sales over the last five years (Yeat 5 is the most recent year) are as follows: Requlred; 1. Express all of the asset. Wibility and soles deta in irend percentages. Use Year i as the base yeat. (Round your percentage answert to 1 decimal place (Le. 0.1234 should be entered as 12.3). ) Exerclse 14-1 (Algo) Common-Slze Income Statement [LO14-1] A comparative income statement is given below for McKenzie Sales, Limited, of Toronto: Members of the company's board of directors are surpised to see that net income increased by only $134.900 when sales increased by $1,764.400 Required: 1. Express each year's income statement in common-size percentages. (Round your percentage answers to 1 decimal ploce (l.e.. 0.1234 should be entered of 12.3). ) Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 500.000 shares of common stock were outstanding. The interest rate on the bond payable was 10%, the income tax rate vas 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company's common stock at the end of this year was $23. All of the company's sales are on account: Reculred: Compute the following financial data and ratios for this year. 1. Working capital, (Enter your answer in thousands.) 2. Current ratio. (Round your answer to 2 decimal places.) 3. Acid-test ratio. (Round your answer to 2 declmal places.) Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total of 700,000 shares of common stock were outstanding. The interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of common stock was $0.75 last year and $0.40 this year. The market value of the company's common stock at the end of this year was $27. All of the company's sales are on account. Required: Compute the following financlal data for this year: 1. Accounts receivable turnover (Assume that all sales are on account) (Round your answer to 2 decimal places.) 2. Average collection period. (Use 365 days in a year. Round your intermedlate calculations and final answer to 2 decimal places.) 3. Inventory turnover, (Round your answer to 2 decimal places.) 4. Average sale perlod. (Use 365 days in a year. Round your intermediate calculations and final answer to 2 decimal places.) 5. Operating cycle. (Round your intermediate calculations and final answer to 2 decimal places.) 6. Total asset turnover. (Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts