Question: need help with all Required information The Foundational 15 (5tatic) [LO3-4, LO3-2, LO3-3, LO3-4] The following information applies to the questions displayed below.]. Bunnell Corporation

![LO3-3, LO3-4] The following information applies to the questions displayed below.]. Bunnell](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fba2a936b9e_20866fba2a8c9932.jpg)

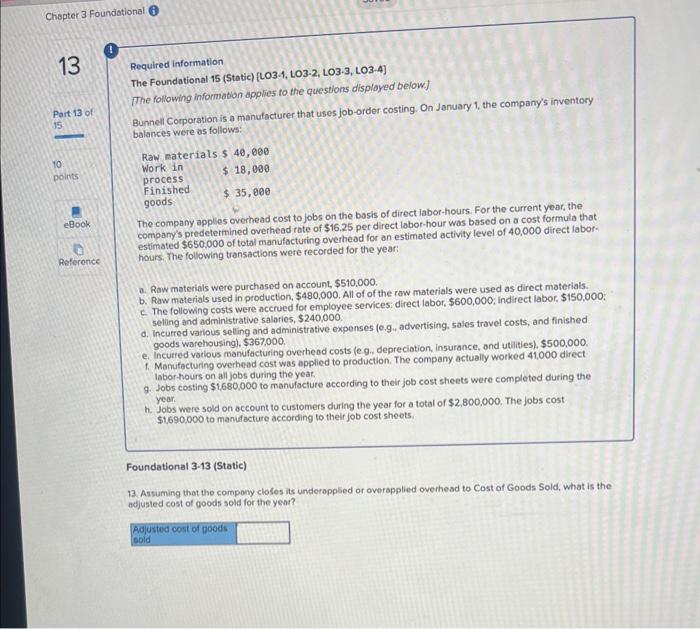

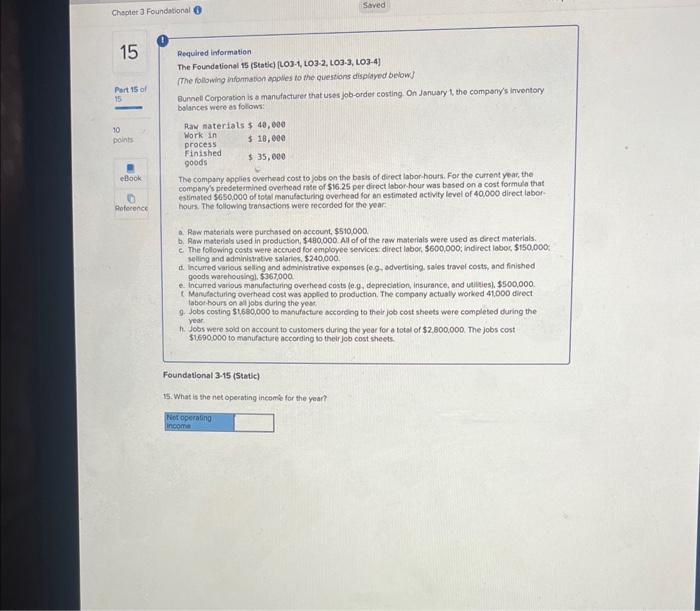

Required information The Foundational 15 (5tatic) [LO3-4, LO3-2, LO3-3, LO3-4] The following information applies to the questions displayed below.]. Bunnell Corporation is a manufocturer that uses job-order costing. On January 1, the company's inventory balances were as follows: The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of $16.25 per direct labor-hour was based on a cost formula that estimated $650,000 of total manufacturing overhead for an estimated activity level of 40,000 direct laborhours. The following transactions wete recorded for the year: a. Raw materials were purchased on account, $510,000. b. Raw materials used in production, $480,000. All of of the raw materials were used as direct materials. c. The following costs were accrued for employee services; direct labor, $600,000; indirect labor, $150,000 : selling and administrative salaries, $240,000. d. Incurred various selling and administrative expenses (e.94 advertising, sales travel costs, and finished goods warehousing), $367,000. e. Incurred vatious manufacturing overhead costs (e.9. depreciation, insurance, and utilities), $500,000. t. Manufacturing overhead cost was applied to production. The company actually worked 41,000 direct labor hours on all jobs during the year. 9. Jobs costing $1,680.000 to manufacture according to their job cost sheets were completed during the year. h. Jobs were sold on account to customers during the year for a total of $2,800,000. The jobs cost $1,690.000 to manufacture according to their job cost sheets. Foundational 3-13 (Static) 13. Assuming that the compony closes its underapplied or overapplied overhead to Cost of Goods Sold, what is the adjusted cost of goods sold for the year? Required information The Foundational 15 (5tatic) [L03-1, LO3-2, L03-3, LO3-4] (The following information applies to the questons diplayed below) Bunnell Corporation is a manufacturer that uses job-order costing. On January 1 , the company's imventory balances were as follows: The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the company's predetermined overhead rate of 516.25 pee direct labor-hour was based on a cost formula that estimated $650,000 of total manufacturing overhead for an estimoted activity level of 40,000 direct laborhours. The fodowing tensactions were fecorded for the year: a. Raw materials were purchased on account, 5510.000. b. Aow matetiais wsed in production, $400,000. All of of the raw materials were used as direct materials. c. The fobowing costs were accrued for employee services: diect labor, $600,000; indirect labor, $150.000; seling and administrative salarios, $240.000. d theurred various seling and administatere expenses (e.g. advertising, sales trayel costs, and finished goods warehousingl, $367,000. e. Incurred various mamufacturing overhead costs (e.9. depreciation, insurance, and ut alies), $500,000. t. Manstacturing overhead cost was applied to production. The company actually worked 41000 direct labor houn on all jobs during the yeat. 9. Jobs costing \$16e0,000 to manufacture according to their job cost sheets were complesed during the yeat. h. Jobs were sold on eccount to customers cuiling the year for a total of 32,800.000. The jobs cost Ste90.000 to manulacture according to their job cost theets; Foundational 3-14 (Static) 14. What is the gross margin for the' year? Required information The Foundational 15 (5tatic) [t.03-1, L03-2, L03-3, L03-4] [The following information appites to the questions displaynd below] Bumet Comorotion is a manufacturet that uses job-order costing On January t, the companys inventory bolunces were as follows: The compary applies everhead cost to jobs on the bash of divect labor hours. For the current year, the company's predetermined overicod rate of $16.25 per diroct labor-hour was based on a cost formula that estimated 5650,000 of totel monulscturiag overhead for an estimated activity level of 40,000 direct laborhours. The following transactions were recorded for the year: a. Raw materials were purchased on account, $510,000 b. Row moterials used in produetion, 5480.000. All of of the raw materials were used as deect materials. e. The following costs were accued for employee services direct labor, $600,000; indirect laboc, 5150,000 : seting and adminisvation salares, $240,000. d. Incurred various seling and odministrative expenses fog. odvertising. saies trovel costs, and finished goods warehouingi, $367,000 e. heurred various manufacturing ovethesd costs le.g. depreciation, insurance, and utiities), $500,000. t. Manufocturing overhead cost was appted to production. The compaey actualy worked 41,000 direct labod-bours on alf jobs during the yeat. 9. Jobs costing $1,680,000 to mathucture accoteing to their job cost sheets were completed during the year. 1h. Joas were sold on account to customers during the year for a total of $2.800,000. The jobs cost $1,690.000 to manufacture according to their job cost theets. Foundational 3-15 (Static) 15. What is the net operating incomief for the yean

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts