Question: need help with all, thank you! dropdowns are included below 3. The lessee's lease analysis Consider the case of Scorecard Corporation: Scorecard Corporation is considering

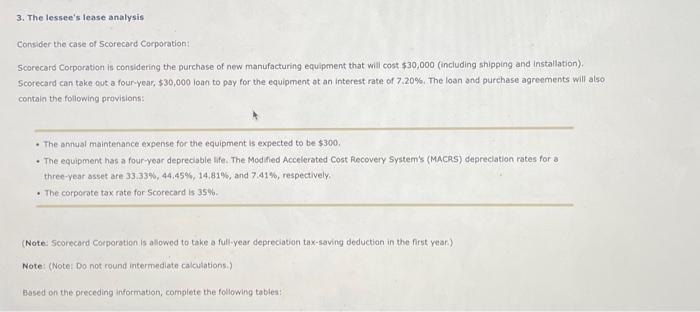

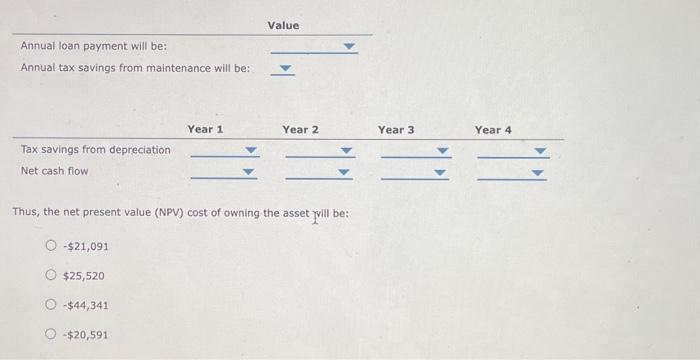

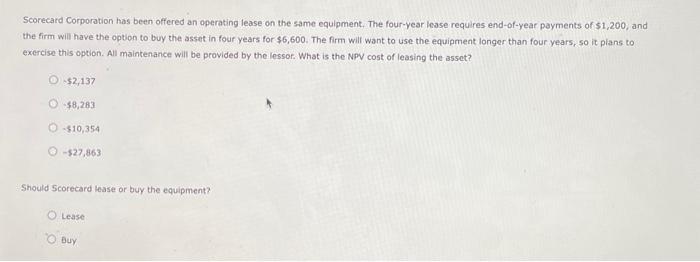

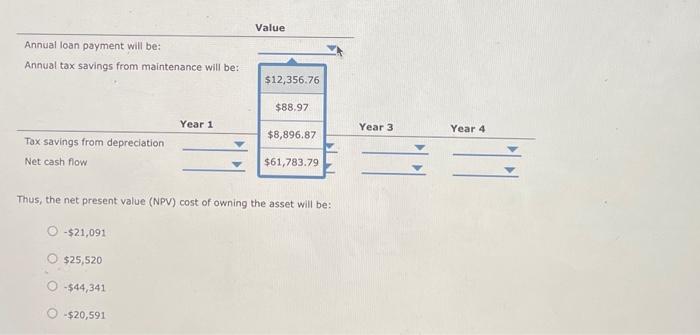

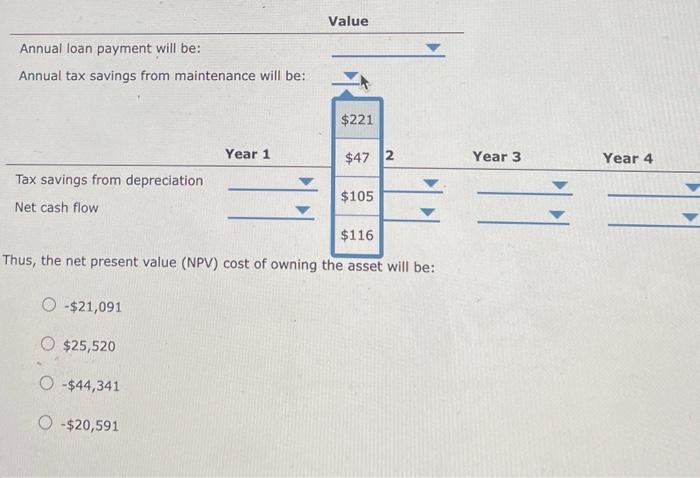

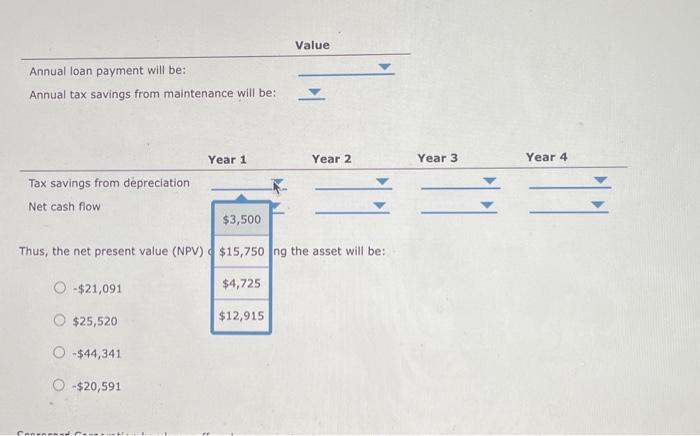

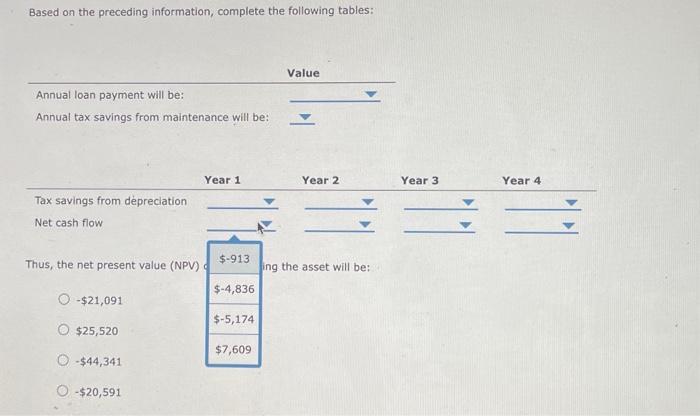

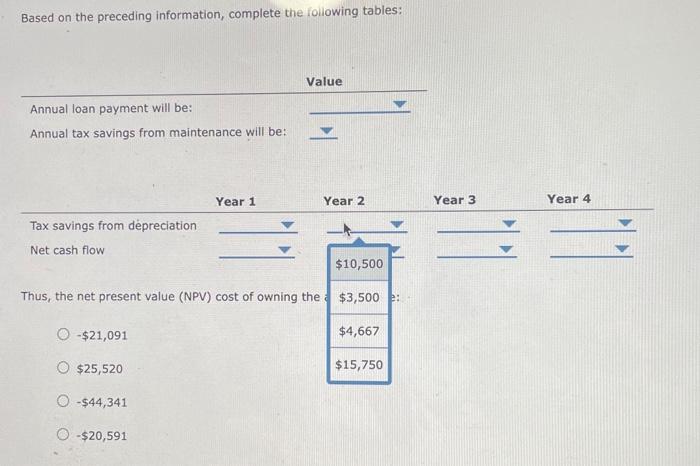

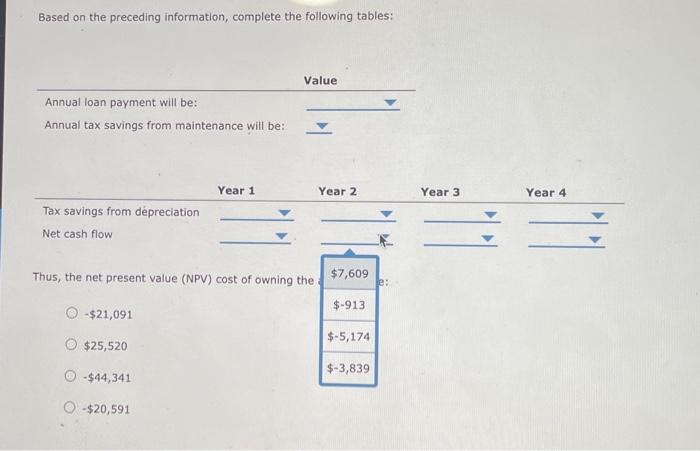

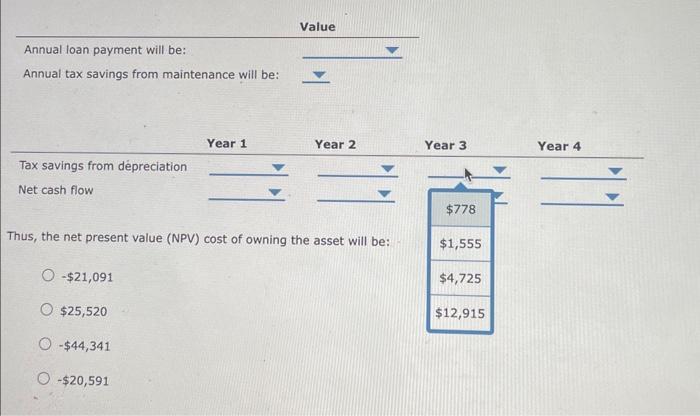

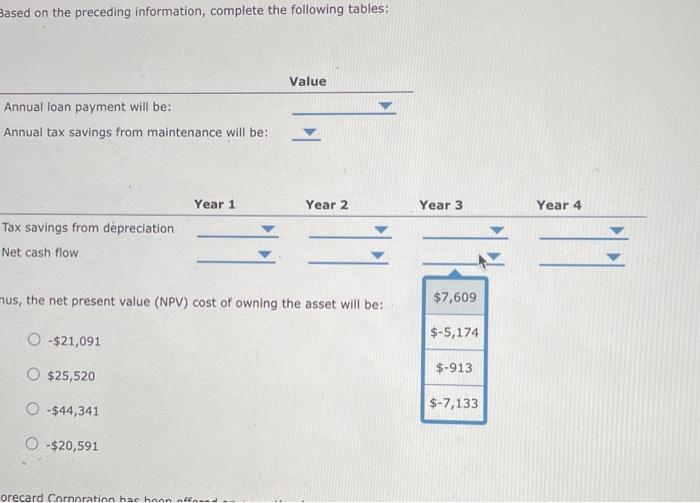

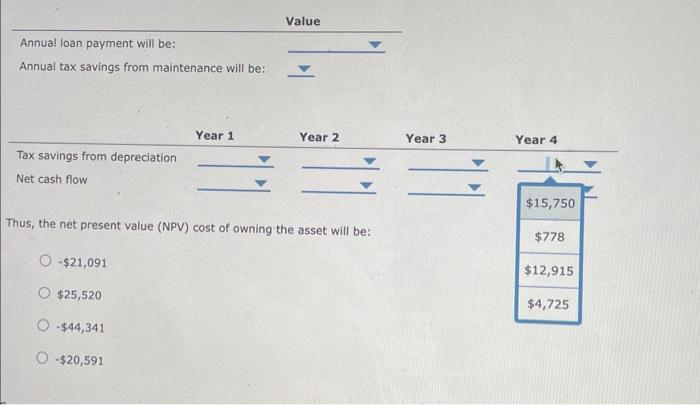

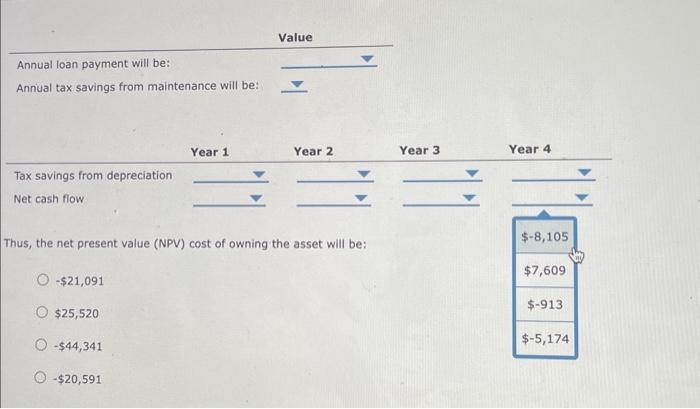

3. The lessee's lease analysis Consider the case of Scorecard Corporation: Scorecard Corporation is considering the purchase of new manufacturing equipment that will cost $30,000 (including shipping and installation). Scorecard can take out a fouryear, $30,000 loan to pay for the equipment at an interest rate of 7.20%6. The loan and purchase agreements will also contain the following provisions: * The annust maintenance expense for the equipment is expected to be $304. - The equipment has a four-year depreclable life. The Mod hied Accelerated Cost Recovery System's (MAcRS) depreclation rates for a three-year asset are 33.33%,44,45%,14,81%, and 7.41%, respectively, - The corporate tax rate for 5 corecard is 35%. (Note: Scorecard corporation is allowed to take a full-year depreciation tax-saving deduction in the first year.) Note: (Note: Do not round intermediate calculations.) Bised on the oreceding informiation, complete the following tables: Thus, the net present value (NPV) cost of owning the asset will be; $21,091$25,520$44,341$20,591 Scorecard Corporation has been offered an operating lease on the same equipment. The four-year lease requiles end-of-year payments of $1,200, and the firm will have the option to buy the asset in four years for $6,600. The firm will want to use the equipment longer than four years, so it plans to exercise this option. All maintenance will be provided by the lessor. What is the NpV cost of leasing the asset? 52,137$8,283510,354527,863 Should Scorecard lease or buy the equipment? Lease y Thus, the net present value (NPV) cost of owning the asset will be: $21,091 $25,520 $44,341 $20,591 Annual loan payment will be: Inus, the net present value (NPV) cost of owning the asset will be: $21,091$25,520$44,341$20,591 $21,091$25,520$44,341$20,591 Based on the preceding information, complete the following tables: Thus, the net present value (NPV) ing the asset will be: $21,091$25,520$44,341$20,591 Based on the preceding information, complete the following tables: Based on the preceding information, complete the following tables: Thus, the net present value (NPV) cost of owning the asset will be: $21,091 $25,520 $44,341 $20,591 3ased on the preceding information, complete the following tables: hus, the net present value (NPV) cost of owning the asset will be: $21,091$25,520$44,341$20,591 Thus, the net present value (NPV) cost of owning the asset will be: $21,091 $25,520 $44,341 $20,591 Thus, the net present value (NPV) cost of owning the asset will be: $21,091$25,520$44,341$20,591

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts