Question: Need help with an Accounting Class Payroll calculation and distribution; overtime and idle time A rush order was accepted by Bartley's Conversions for five van

Need help with an Accounting Class

Need help with an Accounting Class

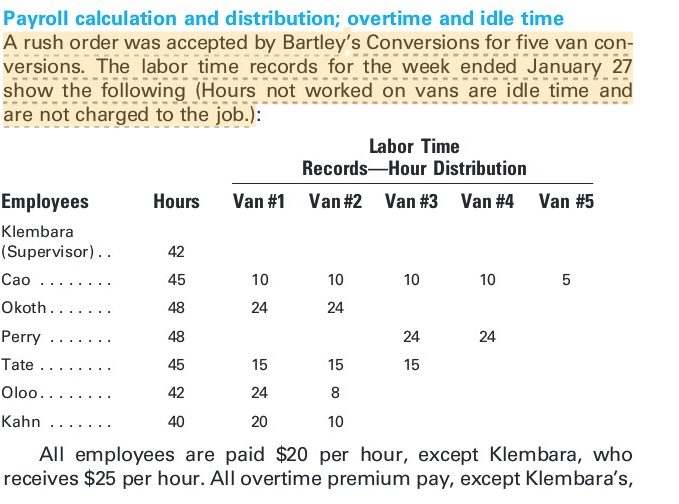

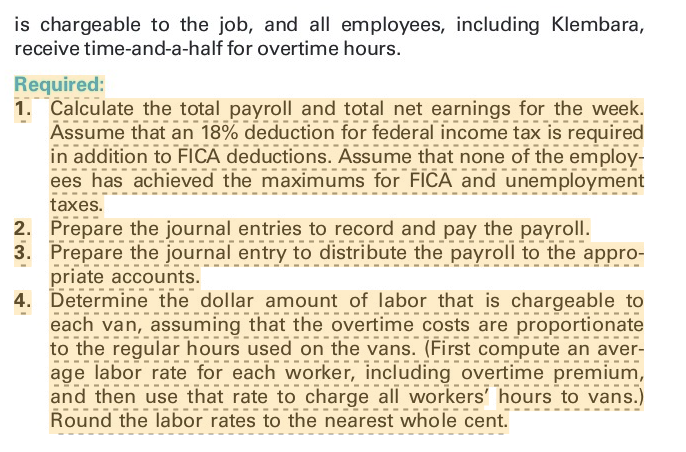

Payroll calculation and distribution; overtime and idle time A rush order was accepted by Bartley's Conversions for five van conversions. The labor time records for the week ended January 27 show the following (Hours not worked on vans are iddle time and are not charged to the job.): All employees are paid $20 per hour, except Klembara, who receives $25 per hour. All overtime premium pay, except Klembara's, is chargeable to the job, and all employees, including Klembara, receive time-and-a-half for overtime hours. Required: 1. Calculate the total payroll and total net earnings for the week. Assume that an 18% deduction for federal income tax is required in addition to FICA deductions. Assume that none of the employees has achieved the maximums for FCA and unemployment taxes. 2. Prepare the journal entries to record and pay the payroll. 3. Prepare the journal entry to distribute the payroll to the appropriate accounts. 4. Determine the dollar amount of labor that is chargeable to each van, assuming that the overtime costs are proportionate to the regular hours used on the vans. (First compute an average labor rate for each worker, including overtime premium, and then use that rate to charge all workers' hours to vans.) Round the labor rates to the nearest whole cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts