Question: need help with an budget file. Excel budget Additional information for the Production Budget: 1 Beginning Finished Goods Inventory in units for Q1 2022 is

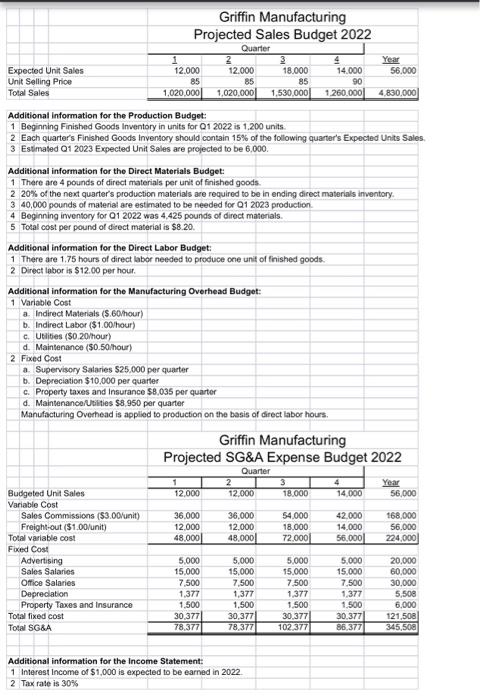

Additional information for the Production Budget: 1 Beginning Finished Goods Inventory in units for Q1 2022 is 1.200 units. 2 Each quarter's Finished Goods Inventory should contain 15% of the following quarter's Expected Units Soles. 3 Estimated Q1 2023 Expected Unit Sales are projected to be 6,000. Additional information for the Direct Materials Budget: 1 There are 4 pounds of direct materials per unit of finished goods. 2.20% of the next quarter's production materials are required to be in ending direct materials inventory. 340,000 pounds of material are estimated to be needed for 012023 production. 4 Beginning inventory for 012022 was 4,425 pounds of direct materials. 5 Total cost per pound of direct material is $8.20. Additional information for the Direct Labor Budget: 1 There are 1.75 hours of direct labor needed to produce one unit of fished goods. 2 Direct labor is $12.00 per hour. Additional information for the Manufacturing Overhead Budget: 1 Variable Cost a. Indirect Materials (\$.60.hour) b. Indirect Labor (\$1.00hour) c. Utiites (\$0.20hour) d. Maintenance (\$0.50.hour) 2 Foxed Cost a. Supervisory Salaries $25,000 per quarter b. Depreciation $10.000 per quarfer c. Property taves and Insurance $8,035 per quarter d. MaintenancerUbities $8.950 per quarter Manufacturing Overhead is applied to production on the basis of direct labor hours. Griffin Manufacturing Projected SG\&A Expense Budget 2022 Budgeted Unit Sales Variable Cost Sales Commissions (\$3.00/unit) Freight-out (\$1.00/unit) Total variable cost Foced Cost Advertising Sales Salaries Oftice Salaries Depreclation Property Taxes Total fixed cost Total SGBA Additional information for the Income Statement: 1 Interest lncome of $1,000 is expected to be earned in 2022. 2 Tax rate is 30% Additional information for the Production Budget: 1 Beginning Finished Goods Inventory in units for Q1 2022 is 1.200 units. 2 Each quarter's Finished Goods Inventory should contain 15% of the following quarter's Expected Units Soles. 3 Estimated Q1 2023 Expected Unit Sales are projected to be 6,000. Additional information for the Direct Materials Budget: 1 There are 4 pounds of direct materials per unit of finished goods. 2.20% of the next quarter's production materials are required to be in ending direct materials inventory. 340,000 pounds of material are estimated to be needed for 012023 production. 4 Beginning inventory for 012022 was 4,425 pounds of direct materials. 5 Total cost per pound of direct material is $8.20. Additional information for the Direct Labor Budget: 1 There are 1.75 hours of direct labor needed to produce one unit of fished goods. 2 Direct labor is $12.00 per hour. Additional information for the Manufacturing Overhead Budget: 1 Variable Cost a. Indirect Materials (\$.60.hour) b. Indirect Labor (\$1.00hour) c. Utiites (\$0.20hour) d. Maintenance (\$0.50.hour) 2 Foxed Cost a. Supervisory Salaries $25,000 per quarter b. Depreciation $10.000 per quarfer c. Property taves and Insurance $8,035 per quarter d. MaintenancerUbities $8.950 per quarter Manufacturing Overhead is applied to production on the basis of direct labor hours. Griffin Manufacturing Projected SG\&A Expense Budget 2022 Budgeted Unit Sales Variable Cost Sales Commissions (\$3.00/unit) Freight-out (\$1.00/unit) Total variable cost Foced Cost Advertising Sales Salaries Oftice Salaries Depreclation Property Taxes Total fixed cost Total SGBA Additional information for the Income Statement: 1 Interest lncome of $1,000 is expected to be earned in 2022. 2 Tax rate is 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts