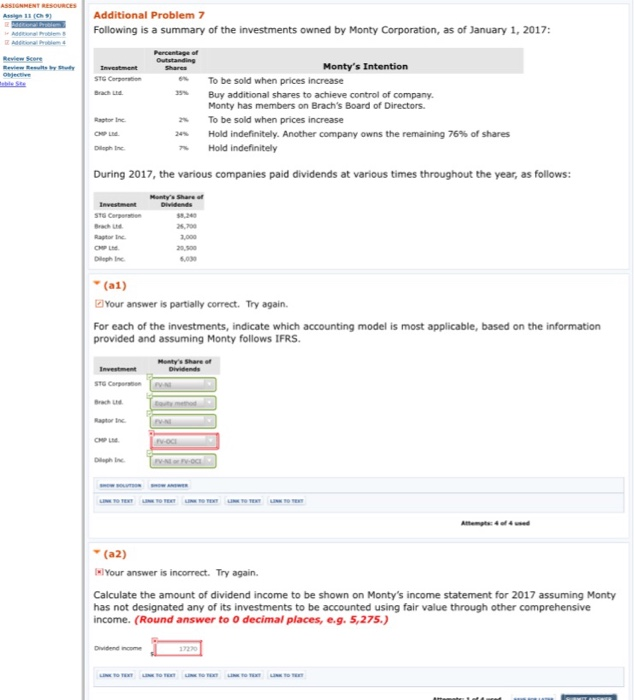

Question: Need help with answer for the last box in red please. Additional Problem 7 Following is a summary of the investments owned by Monty Corporation,

Additional Problem 7 Following is a summary of the investments owned by Monty Corporation, as of January 1, 2017: Percentage of Monty's Intention STG Cerpotion To be sold when prices increase Buy additional shares to achieve control of company. Monty has members on Brach's Board of Directors Tobe sold when prices increase Hold indefinitely. Another company owns the remaining 76% of shares Hold indefinitely Brach Ltd 2% 24% 7% During 2017, the various companies paid dividends at various times throughout the year, as follows Investment TG Cerpe ,240 ,000 ,030 (a1) Your answer is partially correct. Try again. For each of the investments, indicate which accounting model is most applicable, based on the information provided and assuming Monty follows IFRS. STG Carpn Brach Ltd (a2) Your answer is incorrect. Try again. Calculate the amount of dividend income to be shown on Monty's income statement for 2017 assuming Monty has not designated any of its investments to be accounted using fair value through other comprehensive income. (Round answer to 0 decimal places, e.g. S,275.) Dividend nome

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts