Question: need help with answer? please use second problem with answer as reference Robert and John are married and have 4 dependent children and earn a

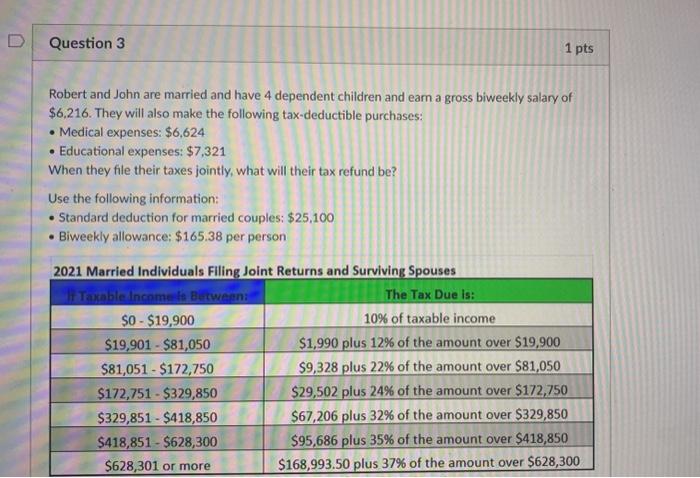

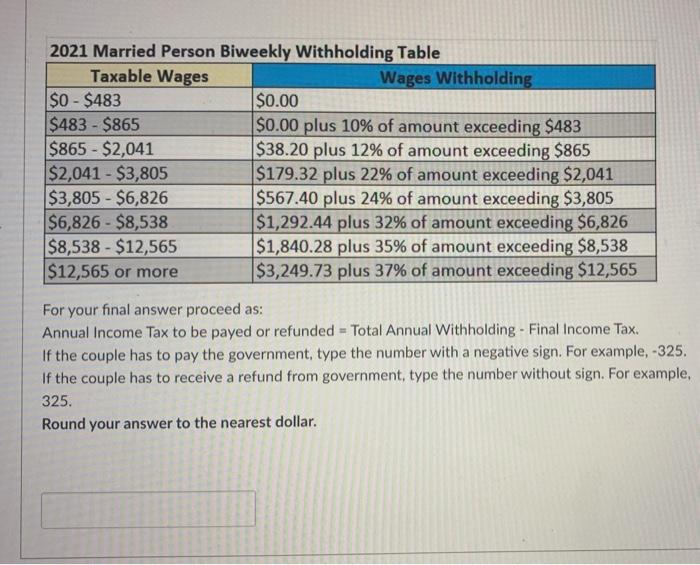

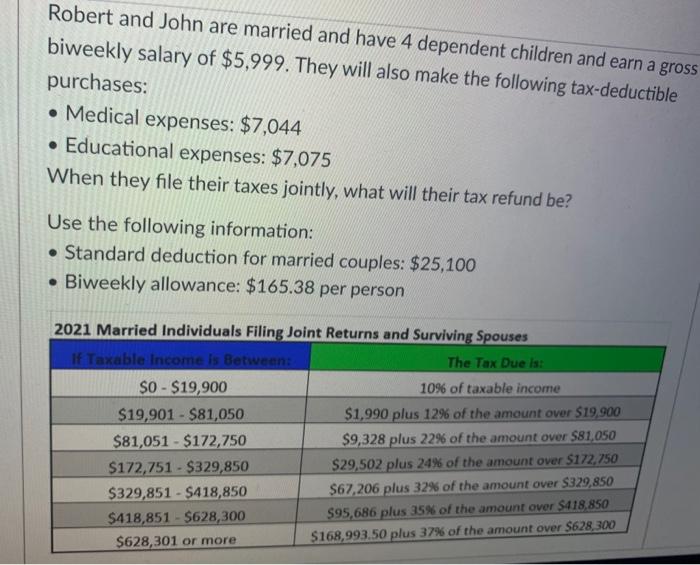

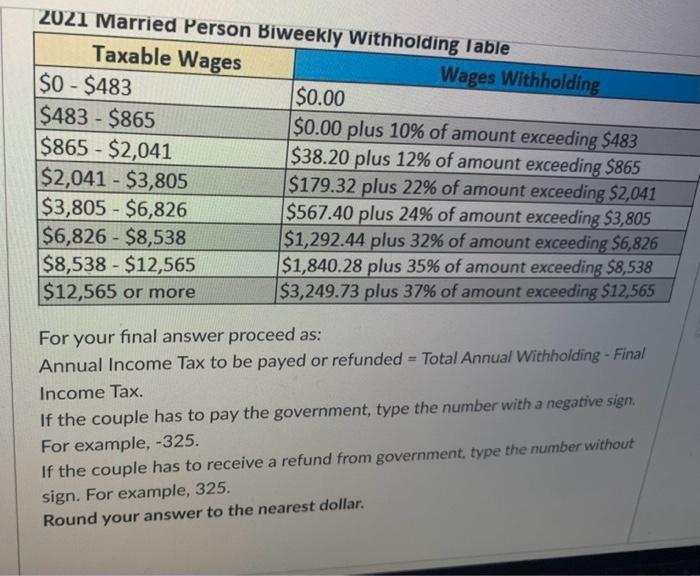

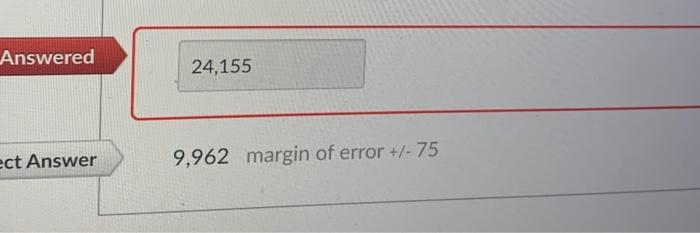

Robert and John are married and have 4 dependent children and earn a gross biweekly salary of $6,216. They will also make the following tax-deductible purchases: - Medical expenses: $6,624 - Educational expenses: $7,321 When they file their taxes jointly, what will their tax refund be? Use the following information: - Standard deduction for married couples: $25,100 - Biweekly allowance: $165.38 per person For your final answer proceed as: Annual Income Tax to be payed or refunded = Total Annual Withholding - Final Income Tax. If the couple has to pay the government, type the number with a negative sign. For example, 325. If the couple has to receive a refund from government, type the number without sign. For example, 325. Round your answer to the nearest dollar. Robert and John are married and have 4 dependent children and earn a gross biweekly salary of $5,999. They will also make the following tax-deductible purchases: - Medical expenses: $7,044 - Educational expenses: $7,075 When they file their taxes jointly, what will their tax refund be? Use the following information: - Standard deduction for married couples: $25,100 - Biweekly allowance: $165.38 per person 2021 Marrian For your final answer proceed as: Annual Income Tax to be payed or refunded = Total Annual Withholding - Final Income Tax. If the couple has to pay the government, type the number with a negative sign. For example, 325. If the couple has to receive a refund from government, type the number without sign. For example, 325. Round your answer to the nearest dollar. Answered 24,155 9,962 margin of error +1.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts