Question: need help with b and c Hamilton General Hospital needs a new MRI machine due to increasing volume of outpatient MRI orders and the state

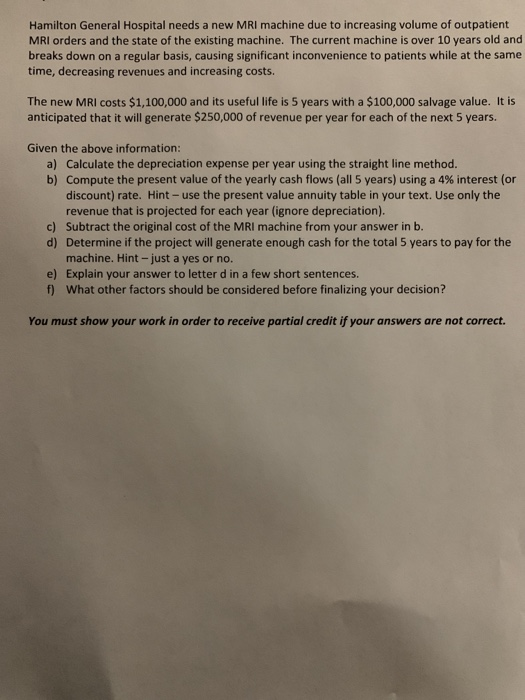

Hamilton General Hospital needs a new MRI machine due to increasing volume of outpatient MRI orders and the state of the existing machine. The current machine is over 10 years old and breaks down on a regular basis, causing significant inconvenience to patients while at the same time, decreasing revenues and increasing costs The new MRI costs $1,100,000 and its useful life is 5 years with a $100,000 salvage value. It is anticipated that it will generate $250,000 of revenue per year for each of the next 5 years. Given the above information: a) Calculate the depreciation expense per year using the straight line method. b) Compute the present value of the yearly cash flows (all 5 years) using a 4% interest (or discount) rate. Hint-use the present value annuity table in your text. Use only the revenue that is projected for each year (ignore depreciation). c) Subtract the original cost of the MRI machine from your answer in b. d) Determine if the project will generate enough cash for the total 5 years to pay for the machine. Hint-just a yes or no. Explain your answer to letter d in a few short sentences. What other factors should be considered before finalizing your decision? e) f) You must show your work in order to receive partial credit if your answers are not correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts