Question: Need help with B please Depreciation by Two Methods A Caterpillar tractor acquired on January 12 at a cost of $63,000 has an estimated useful

Need help with B please

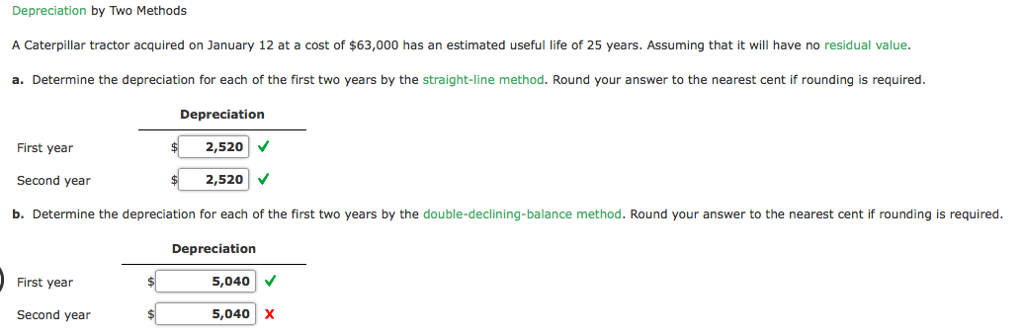

Depreciation by Two Methods A Caterpillar tractor acquired on January 12 at a cost of $63,000 has an estimated useful life of 25 years. Assuming that it will have no residual value. a. Determine the depreciation for each of the first two years by the straight-line method. Round your answer to the nearest cent if rounding is required. Depreciation 2,520V First yea Second year b. Determine the depreciation for each of the first two years by the double-declining-balance method. Round your answer to the nearest cent if rounding is required. 2,520 Depreciation First year 5,040V Second year 5,0401 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts