Question: Need help with balance sheet and multi-step income statement Upon incorporation, SWI was authorized to issue an unlimited number of common shares and 50,000 $2.00

Need help with balance sheet and multi-step income statement

Upon incorporation, SWI was authorized to issue an unlimited number of common shares and 50,000 $2.00 non-cumulative preferred shares. At December 31, 2022 the company had 250,000 common shares and 10,000 preferred shares issued and outstanding. The total paid in capital from common shares and preferred shares was $500,000 and $100,000, respectively. SWI declared and paid cash dividends of $90,000 during the year. No shares were issued or retired during 2022. SWI has an operating bank account held at TD Bank as well as a payroll account at Royal Bank of Canada. SWI has dealt with TD Bank since incorporation, but the payroll service agency who processes SWIs monthly payroll insisted on SWI opening an account at Royal Bank since this is their preferred financial institution. As a result, SWI makes monthly bank transfers between the operating account and the payroll account to ensure all employees get paid. Both bank accounts have overdraft protection.

Case Requirements

You are an auditor with Mandryk & Associates LLP. The main accountant employed by SWI was recently hospitalized due to COVID-19 and as such, could not prepare the financial statements for the year-ended, December 31, 2022. Instead, a junior accountant was approached to draft the financial statements which have been given to you for your review (Appendix A). Prepare a written report that addresses the following questions using the headings in bold below. The responses under each of the headings should be written in paragraph form and provide clear answers & recommendations.

Correcting the Financial Statements

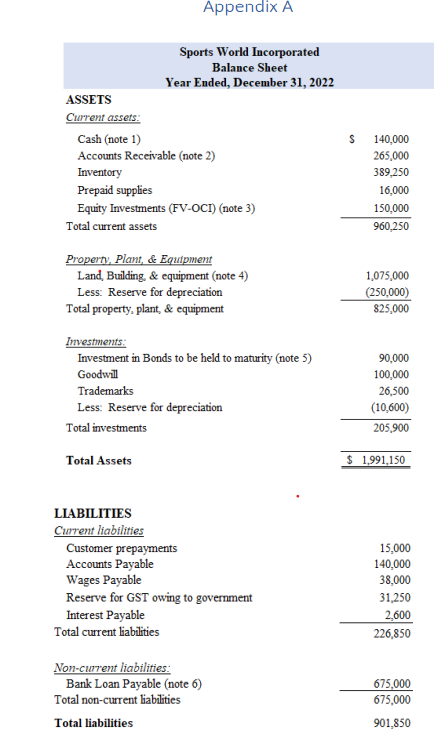

3. Prepare a corrected classified statement of financial position (balance sheet). [25 marks]

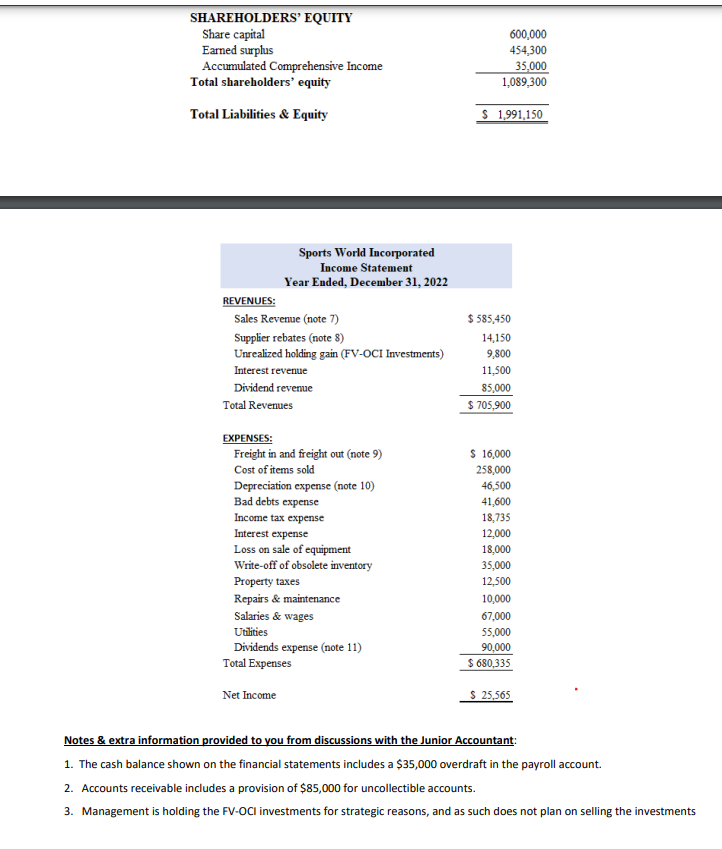

4. Prepare a corrected multi-step income statement. [30 marks]

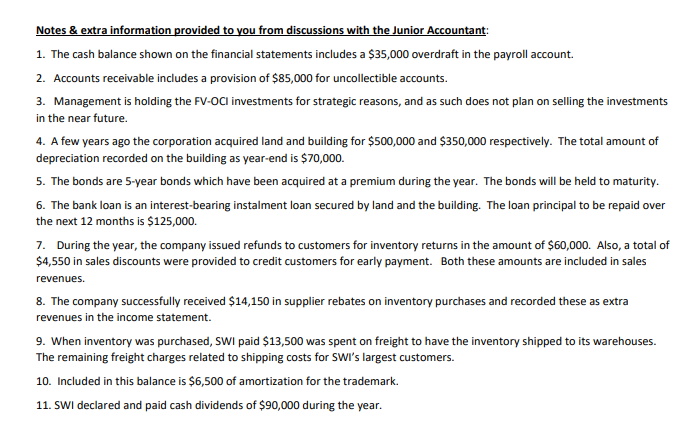

Appendix A Notes \& extra information provided to you from discussions with the Junior Accountant: 1. The cash balance shown on the financial statements includes a $35,000 overdraft in the payroll account. 2. Accounts receivable includes a provision of $85,000 for uncollectible accounts. 3. Management is holding the FV-OCl investments for strategic reasons, and as such does not plan on selling the investments Notes \& extra information provided to you from discussions with the Junior Accountant: 1. The cash balance shown on the financial statements includes a $35,000 overdraft in the payroll account. 2. Accounts receivable includes a provision of $85,000 for uncollectible accounts. 3. Management is holding the FV-OCl investments for strategic reasons, and as such does not plan on selling the investments in the near future. 4. A few years ago the corporation acquired land and building for $500,000 and $350,000 respectively. The total amount of depreciation recorded on the building as year-end is $70,000. 5. The bonds are 5-year bonds which have been acquired at a premium during the year. The bonds will be held to maturity. 6. The bank loan is an interest-bearing instalment loan secured by land and the building. The loan principal to be repaid over the next 12 months is $125,000. 7. During the year, the company issued refunds to customers for inventory returns in the amount of $60,000. Also, a total of $4,550 in sales discounts were provided to credit customers for early payment. Both these amounts are included in sales revenues. 8. The company successfully received $14,150 in supplier rebates on inventory purchases and recorded these as extra revenues in the income statement. 9. When inventory was purchased, SWI paid \$13,500 was spent on freight to have the inventory shipped to its warehouses. The remaining freight charges related to shipping costs for SWI's largest customers. 10. Included in this balance is $6,500 of amortization for the trademark. 11. SWI declared and paid cash dividends of $90,000 during the year. Appendix A Notes \& extra information provided to you from discussions with the Junior Accountant: 1. The cash balance shown on the financial statements includes a $35,000 overdraft in the payroll account. 2. Accounts receivable includes a provision of $85,000 for uncollectible accounts. 3. Management is holding the FV-OCl investments for strategic reasons, and as such does not plan on selling the investments Notes \& extra information provided to you from discussions with the Junior Accountant: 1. The cash balance shown on the financial statements includes a $35,000 overdraft in the payroll account. 2. Accounts receivable includes a provision of $85,000 for uncollectible accounts. 3. Management is holding the FV-OCl investments for strategic reasons, and as such does not plan on selling the investments in the near future. 4. A few years ago the corporation acquired land and building for $500,000 and $350,000 respectively. The total amount of depreciation recorded on the building as year-end is $70,000. 5. The bonds are 5-year bonds which have been acquired at a premium during the year. The bonds will be held to maturity. 6. The bank loan is an interest-bearing instalment loan secured by land and the building. The loan principal to be repaid over the next 12 months is $125,000. 7. During the year, the company issued refunds to customers for inventory returns in the amount of $60,000. Also, a total of $4,550 in sales discounts were provided to credit customers for early payment. Both these amounts are included in sales revenues. 8. The company successfully received $14,150 in supplier rebates on inventory purchases and recorded these as extra revenues in the income statement. 9. When inventory was purchased, SWI paid \$13,500 was spent on freight to have the inventory shipped to its warehouses. The remaining freight charges related to shipping costs for SWI's largest customers. 10. Included in this balance is $6,500 of amortization for the trademark. 11. SWI declared and paid cash dividends of $90,000 during the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts