Question: Need help with balance sheet questions. Each statement is either correct or incorrect, and the answer choices below the statement support its validity. The last

Need help with balance sheet questions. Each statement is either correct or incorrect, and the answer choices below the statement support its validity. The last fill in the blank question has answer options of increase, decrease or stay the same.

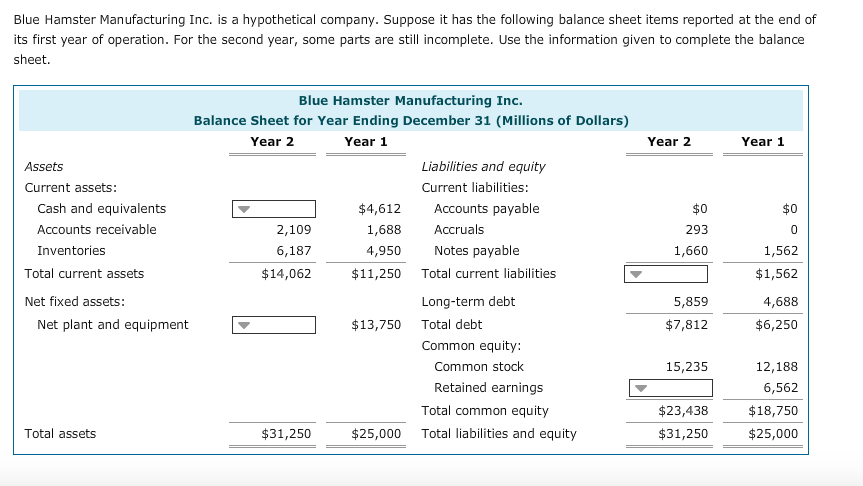

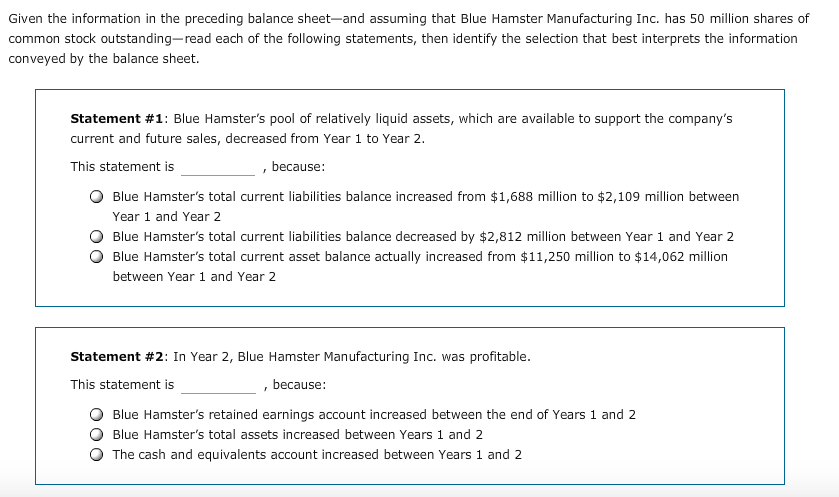

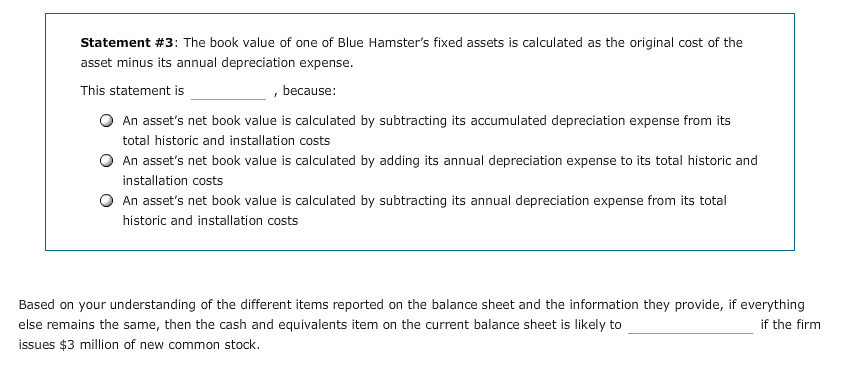

Blue Hamster Manufacturing Inc. is a hypothetical company. Suppose it has the following balance sheet items reported at the end of its first year of operation. For the second year, some parts are still incomplete. Use the information given to complete the balance sheet. Blue Hamster Manufacturing Inc. Balance Sheet for Year Ending December 31 (Millions of Dollars) Year 2 Year 1 Year 2 Year 1 Assets Current assets Liabilities and equity Current liabilities: Cash and equivalents Accounts receivable Inventories $4,612 Accunts payable $0 293 1,660 $0 2,109 6,187 $14,062 Accruals 1,688 4,950 $11,250 Notes payable 1,562 $1,562 4,688 $6,250 Total current assets Total current liabilities Net fixed assets: Long-term debt 5,859 Net plant and equipment $13,750 Total debt $7,812 Common equity: Common stock 12,188 6,562 $18,750 $25,000 15,235 Retained earnings Total common equity $23,438 $31,250 Total assets $31,250 $25,000 abilities and equity Given the information in the preceding balance sheet-and assuming that Blue Hamster Manufacturing Inc. has 50 million shares of common stock outstanding-read each of the following statements, then identify the selection that best interprets the information conveyed by the balance sheet. Statement # 1: Blue Hamster's pool of relatively liquid assets, which are available to support the company's current and future sales, decreased from Year 1 to Year 2. This statement is because Blue Hamster's total current liabilities balance increased from $1,688 million to $2,109 million between Year 1 and Year 2 O Blue Hamster's total current liabilities balance decreased by $2,812 million between Year 1 and Year 2 Blue Hamster's total current asset balance actually increased from $11,250 million to $14,062 million between Year 1 and Year 2 Statement #2: In Year 2, Blue Hamster Manufacturing Inc. was profitable. This statement is because O Blue Hamster's retained earnings account increased between the end of Years 1 and 2 Blue Hamster's total assets increased between Years 1 and 2 O The cash and equivalents account increased between Years 1 and 2 Statement #3 : The book value of one of Blue Hamster's fixed assets is calculated as the original cost of the asset minus its annual depreciation expense This statement is because: O An asset's net book value is calculated by subtracting its accumulated depreciation expense from its total historic and installation costs O An asset's net book value is calculated by adding its annual depreciation expense to its total historic and installation costs O An asset's net book value is calculated by subtracting its annual depreciation expense from its total historic and installation costs Based on your understanding of the different items reported on the balance sheet and the information they provide, if everything else remains the same, then the cash and equivalents item on the current balance sheet is likely to issues $3 million of new common stock. if the firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts