Question: need help with both question 1 question 2 Suppose a five-year, $1,000 bond with annual coupons has a price of $897.49 and a yield to

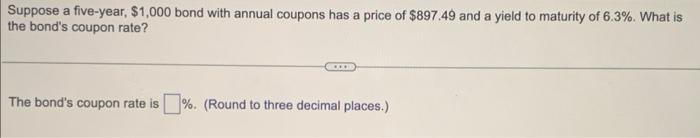

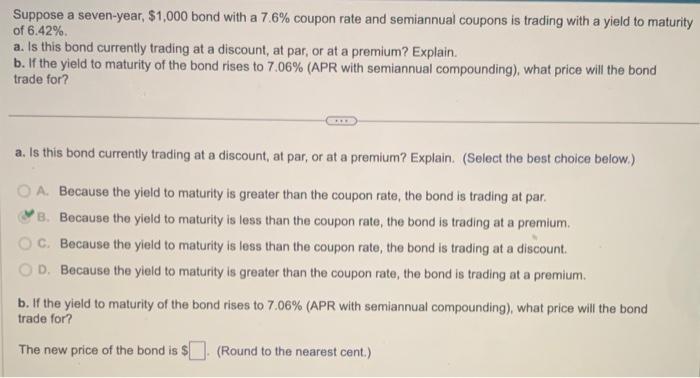

Suppose a five-year, $1,000 bond with annual coupons has a price of $897.49 and a yield to maturity of 6.3%. What is the bond's coupon rate? The bond's coupon rate is \%. (Round to three decimal places.) Suppose a seven-year, $1,000 bond with a 7.6% coupon rate and semiannual coupons is trading with a yield to maturity of 6.42% a. Is this bond currently trading at a discount, at par, or at a premium? Explain. b. If the yield to maturity of the bond rises to 7.06% (APR with semiannual compounding), what price will the bond trade for? a. Is this bond currently trading at a discount, at par, or at a premium? Explain. (Select the best choice below.) A. Because the yield to maturity is greater than the coupon rate, the bond is trading at par. B. Because the yield to maturity is less than the coupon rate, the bond is trading at a premium. C. Because the yield to maturity is less than the coupon rate, the bond is trading at a discount. D. Because the yield to maturity is greater than the coupon rate, the bond is trading at a premium. b. If the yield to maturity of the bond rises to 7.06\% (APR with semiannual compounding), what price will the bond trade for? The new price of the bond is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts