Question: need help with bottom part need with this chart (orange is where numbers need to be ) the rest has the info need help woth

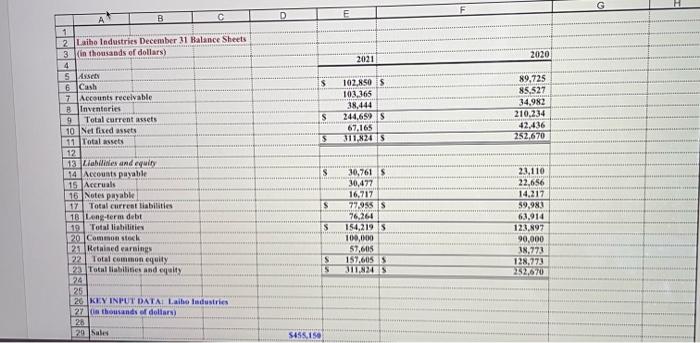

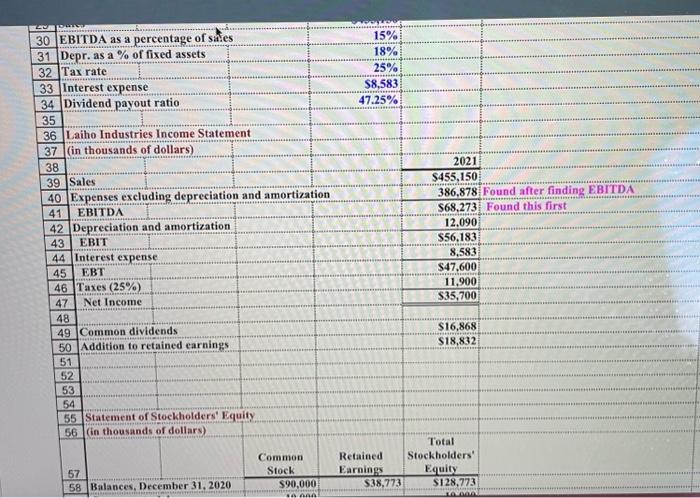

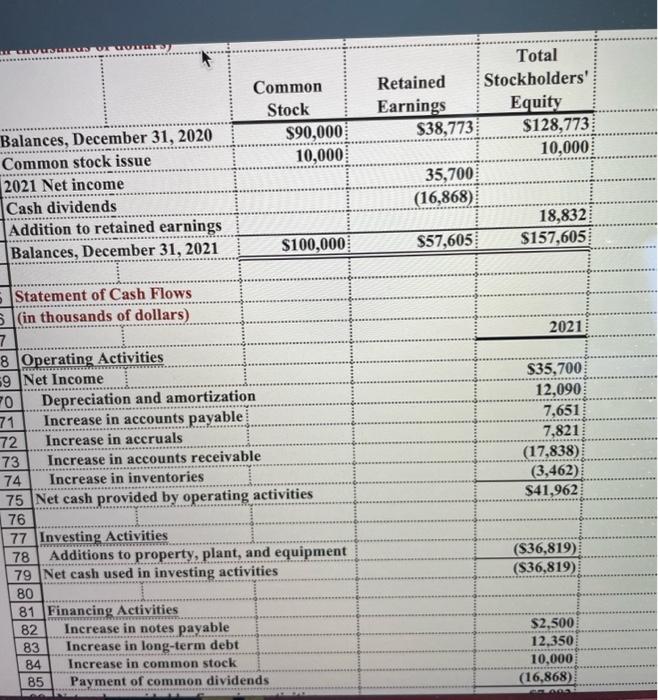

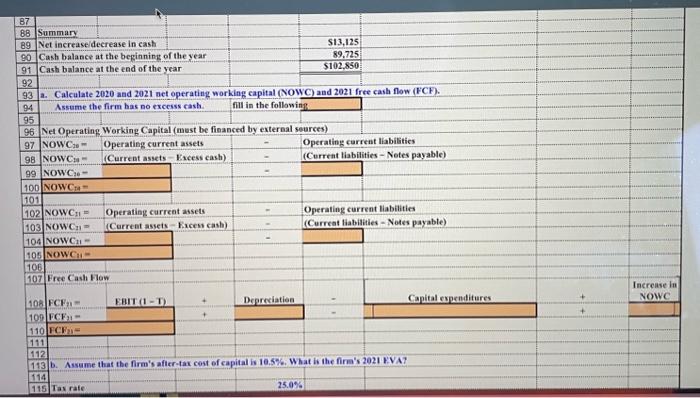

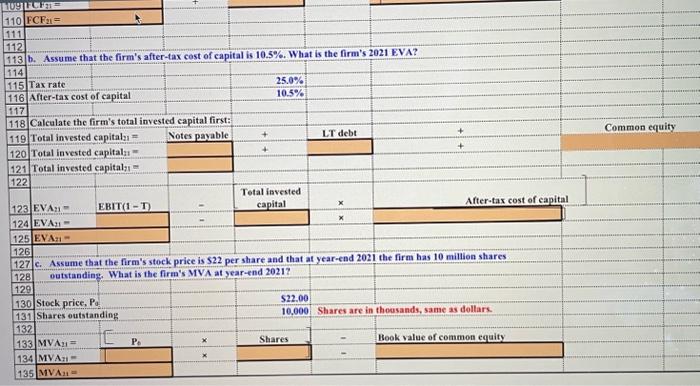

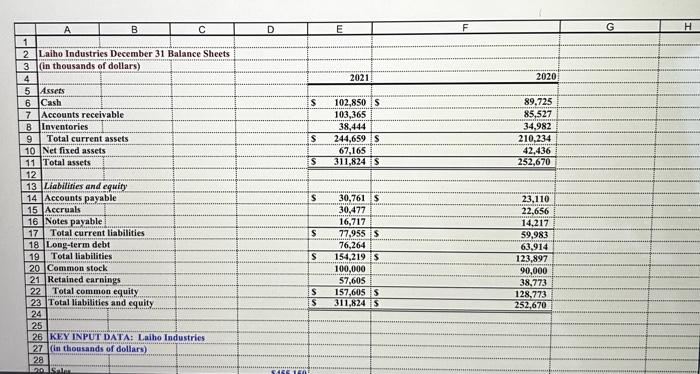

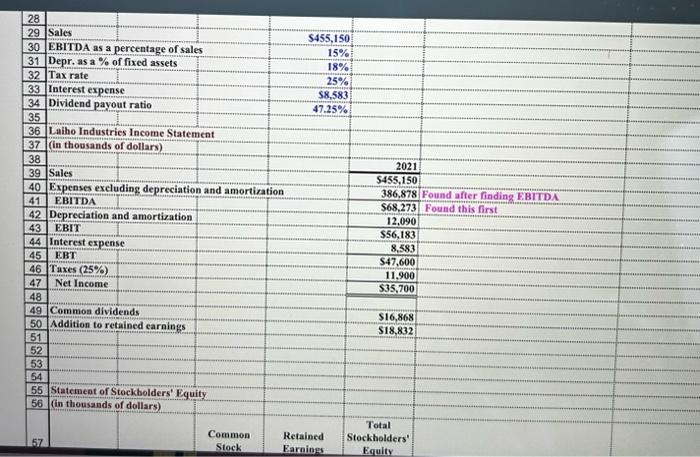

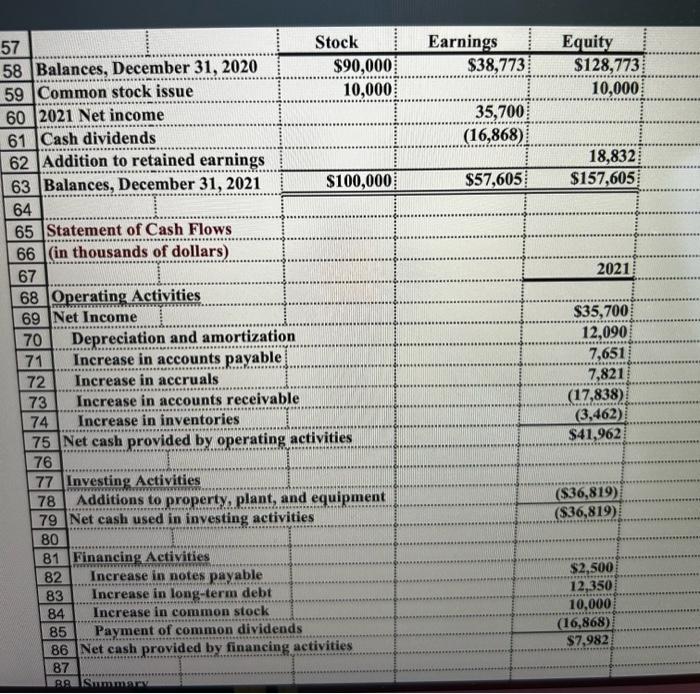

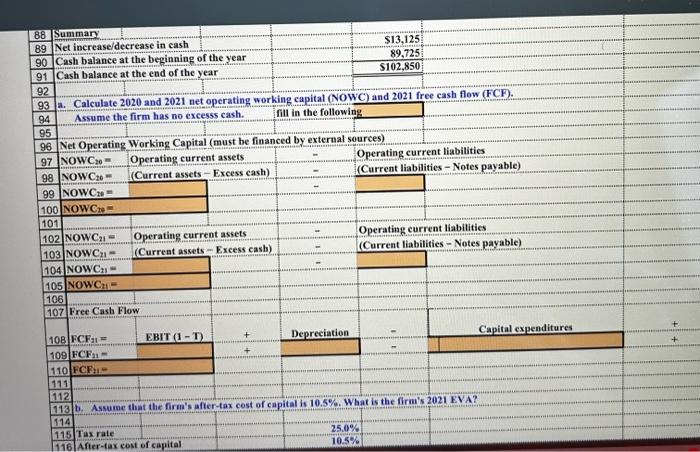

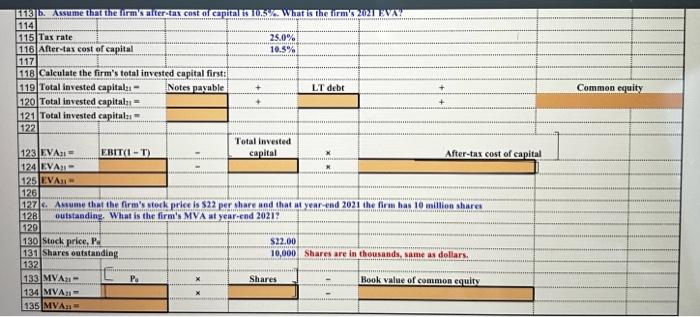

Common Retained Stockholders' Stock Earnings Equity Balances, December 31, 2020 Common stock issue 2021 Net income Cash dividends Addition to retained earnings Balances, December 31, 2021 $100,000 $57,605 Statement of Cash Flows (in thousands of dollars) 2021 8 Operating Activities 9 Net Income 0 Depreciation and amortization Increase in accounts payable 72 Increase in accruals 73 Increase in accounts receivable Increase in inventories 7675 Net cash provided by operating activities 77 Investing Activities 78 Additions to property, plant, and equipment 79 Net cash used in investing activities 80 81 Financing Activities 84 Increase in common stock 85 Payment of common dividends \begin{tabular}{|} $35,700 \\ 12,090 \\ 7,651 \\ 7,821 \\ (17,838) \\ (3,462) \\ $41,962 \\ \hline($36,819) \\ ($36,819) \\ \hline$2,500 \\ \hline 12,350 \\ \hline 10,000 \\ \hline(16,868) \end{tabular} \begin{tabular}{|l|l|r|r|} \hline 87 & \multicolumn{1}{|c|}{} & & \\ \hline 88 & Summary & & \\ \hline 89 & Net increaseldecrease in cast & & $13,125 \\ \hline 90 & Cash balance at the beginning of the year & & 89,725 \\ \hline 91 & Cash balance at the end of the year & & 5102,830 \\ \hline 92 & & & \\ \hline \end{tabular} 93 a. Calculate 2020 and 2021 net eperating working capital (NOWC) and 2021 free cash flow (FCF). \begin{tabular}{|l|l|l|} \hline 94 & Assume the firm has no excess cash. fill in the following \\ \hline 95 & & \\ \hline \end{tabular} 96 Net Operating Working Capital (mest be financed by external seurces) \begin{tabular}{|l|l|l|l|l|} \hline 97 & NOWC C30= & Operating current assets & - & Operating carrent liabilities \\ \hline 98 & NOWCia = & (Current assets - Eacess cash) & - & \\ \hline 99 & NOWCie - & & \\ \hline 100 & NOWCerrent liabilities - Notes payable) \\ \hline 101 & & & & \\ \hline \end{tabular} 102 NOWC 31= Operating curreat assets Operating current liabilities 103 NOWC NO11= (Cerrent assets - Races cash) (Curreat liabilities - Notes payable) \begin{tabular}{|l|l|} \hline 104 & NowC \\ \hline 105 & NowC \\ \hline 106 & \\ \hline 107 & Free Cash How \\ \hline \end{tabular} 113 b. Assume that the firm's afier-tax cost of eapital is 10.5\%. What is the firm's 2021 RV.A? \begin{tabular}{|l|l|l|} \hline 114 & Tas rate \\ \hline \end{tabular} 25.0% c. Assume that the firm's stock price is 522 per share and that at year-end 2021 the firm bas 10 million shares outstanding. What is the firm's MVA at year-end 2021 ? \begin{tabular}{|l|l|} \hline 128 & outstanding \\ \hline 129 & \\ \hline 130 & Stock price, Po \\ \hline 131 & Shares eutstan \\ \hline 137 & \end{tabular} 522.00 \begin{tabular}{|l|l|l|l} 131 & Shares outstanding \\ \hline 13? & & \end{tabular} 10.000 Shares are in thousands, same as dollars. 132 133 MVA21 = 134 MVA: = 135MVA31=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts