Question: need help with % change Question 2 The following financial information is for Ivanhoe Company. IVANHOE COMPANY Balance Sheets December 31 Assets 2017 2016 Cash

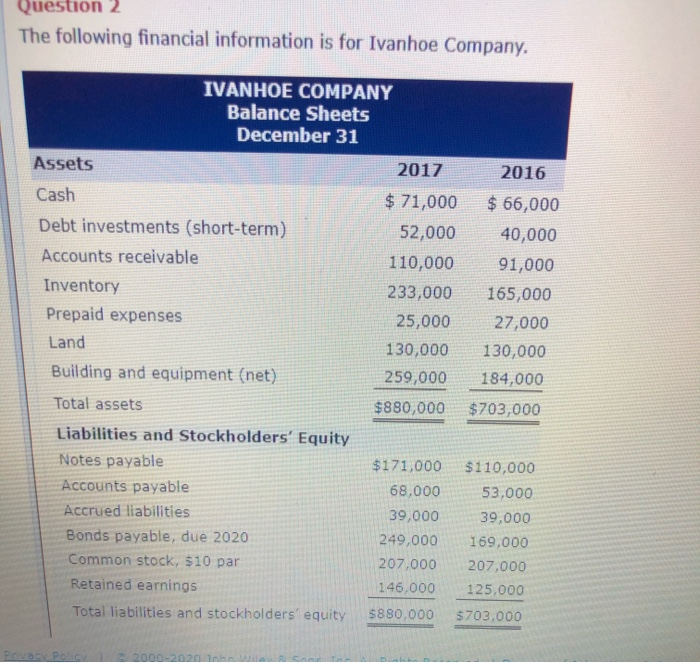

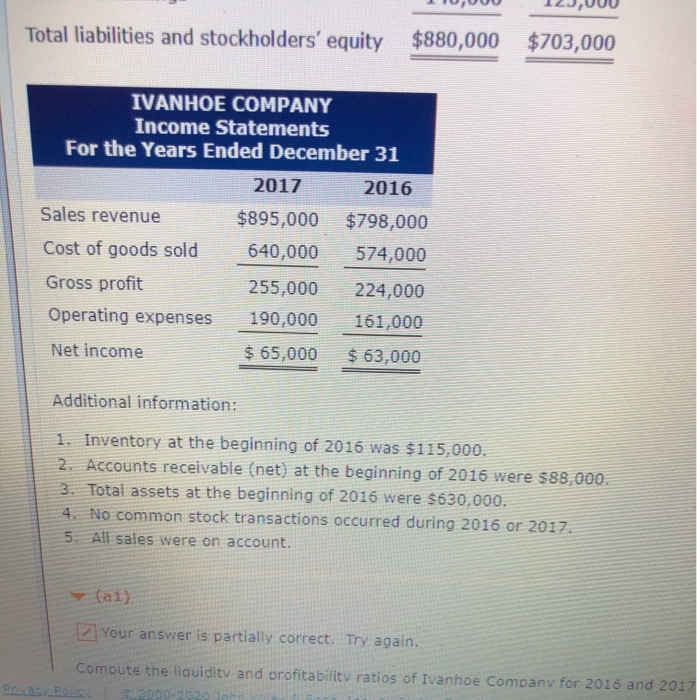

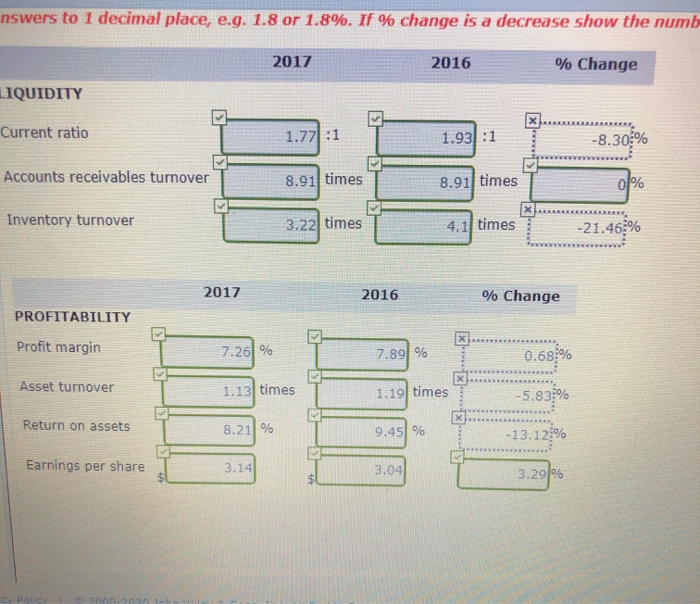

Question 2 The following financial information is for Ivanhoe Company. IVANHOE COMPANY Balance Sheets December 31 Assets 2017 2016 Cash $ 71,000 $ 66,000 Debt investments (short-term) 52,000 40,000 Accounts receivable 110,000 91,000 Inventory 233,000 165,000 Prepaid expenses 25,000 27,000 Land 130,000 130,000 Building and equipment (net) 259,000 184,000 Total assets $880,000 $703,000 Liabilities and Stockholders' Equity Notes payable $171,000 $110,000 Accounts payable 68,000 53,000 Accrued liabilities 39,000 39,000 Bonds payable, due 2020 249,000 169,000 Common stock, $10 par 207.000 207,000 Retained earnings 146,000 125.000 Total liabilities and stockholders' equity $880,000 $703,000 D PO 2000-2020 Inn UUUU 12J,UUU Total liabilities and stockholders' equity $880,000 $703,000 IVANHOE COMPANY Income Statements For the Years Ended December 31 2017 2016 Sales revenue $895,000 $798,000 Cost of goods sold 640,000 574,000 Gross profit 255,000 224,000 Operating expenses 190,000 161,000 Net income $ 65,000 $ 63,000 Additional information: 1. Inventory at the beginning of 2016 was $115,000. 2. Accounts receivable (net) at the beginning of 2016 were $88,000. 3. Total assets at the beginning of 2016 were $630,000. 4. No common stock transactions occurred during 2016 or 2017. 5. All sales were on account. (al) Your answer is partially correct. Try again. Compute the liquidity and profitability ratios of Ivanhoe Company for 2016 and 2017 Prva Polic 2000-2020 inh mswers to 1 decimal place, e.g. 1.8 or 1.8%. If % change is a decrease show the numb 2017 2016 % Change IQUIDITY Current ratio BE 1.771 1.93 -8.30% Accounts receivables turnover 8.91 times 8.91 times Inventory turnover 3.22 times times . -21.46% 2017 2016 % Change PROFITABILITY Profit margin 7.26% 7.89% 0.68% Asset turnover 1.13 times SS 1.19 times -5.83% Return on assets 8.21% 9.45 % -13.12% Earnings per share 3.14 3.04 3.29%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts