Question: Need help with chapter exercise homework Pablo Management has eight employees, each of whom earns $125 per day. They are paid on Fridays for work

Need help with chapter exercise homework

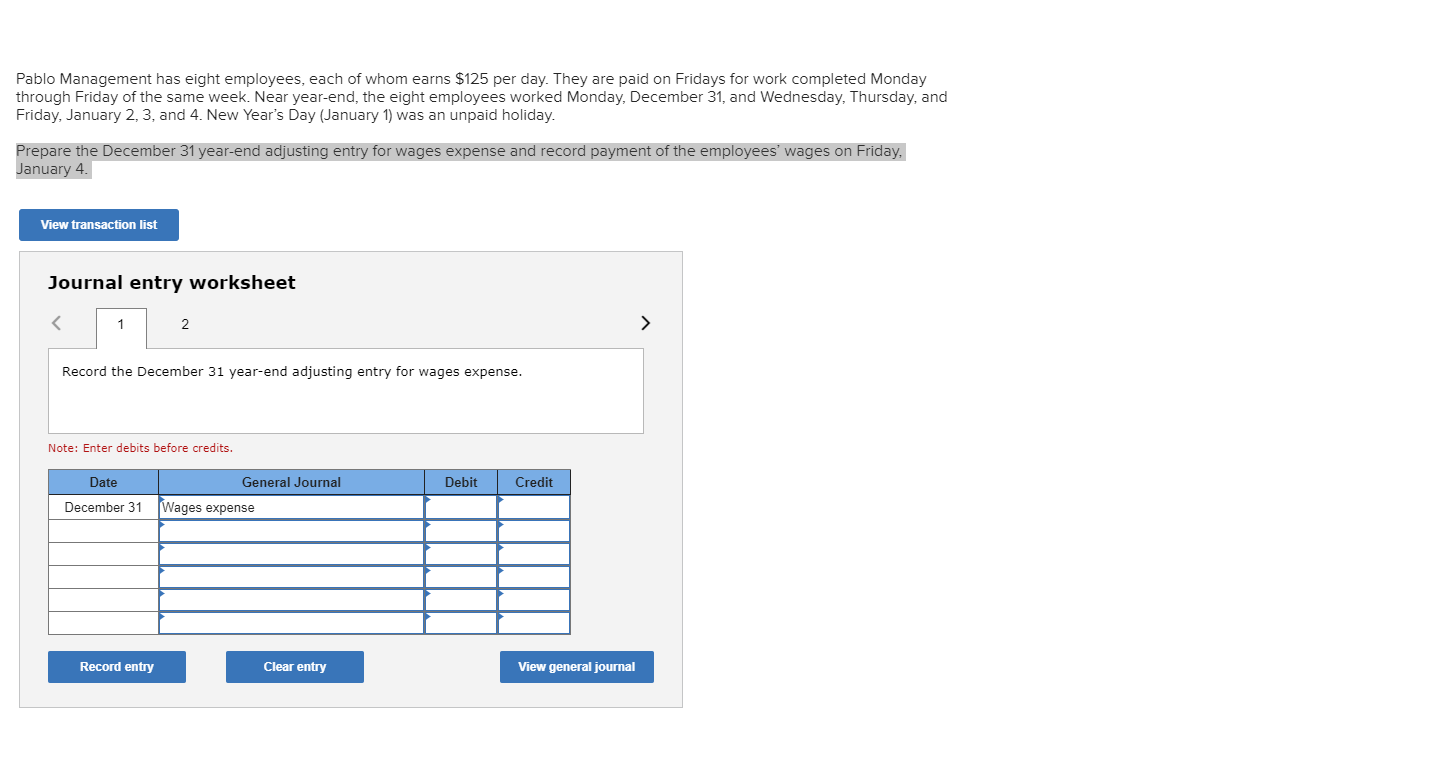

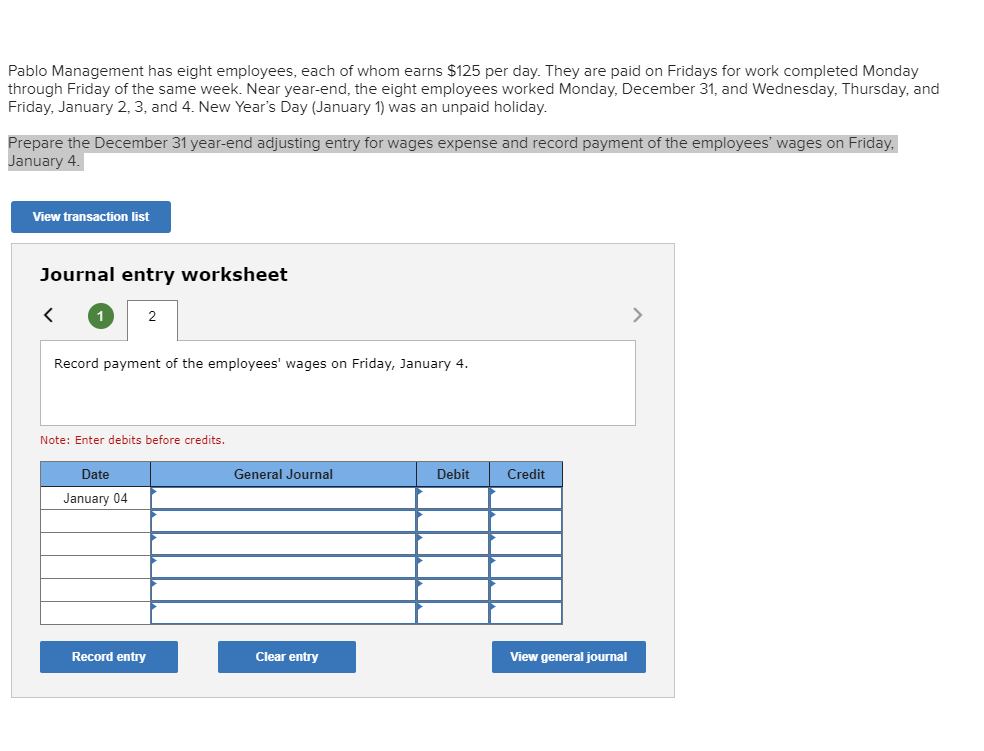

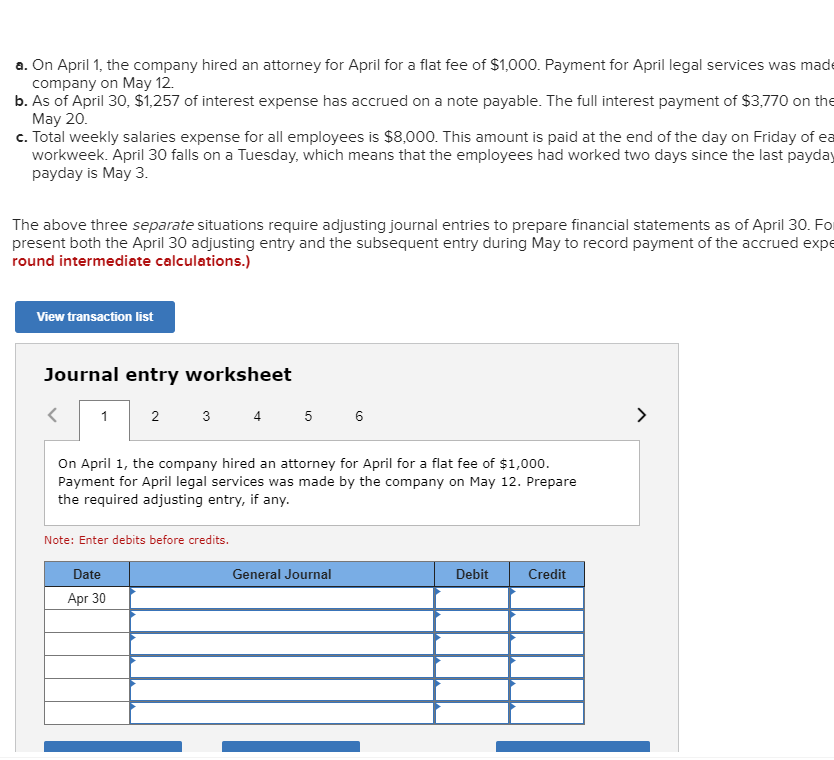

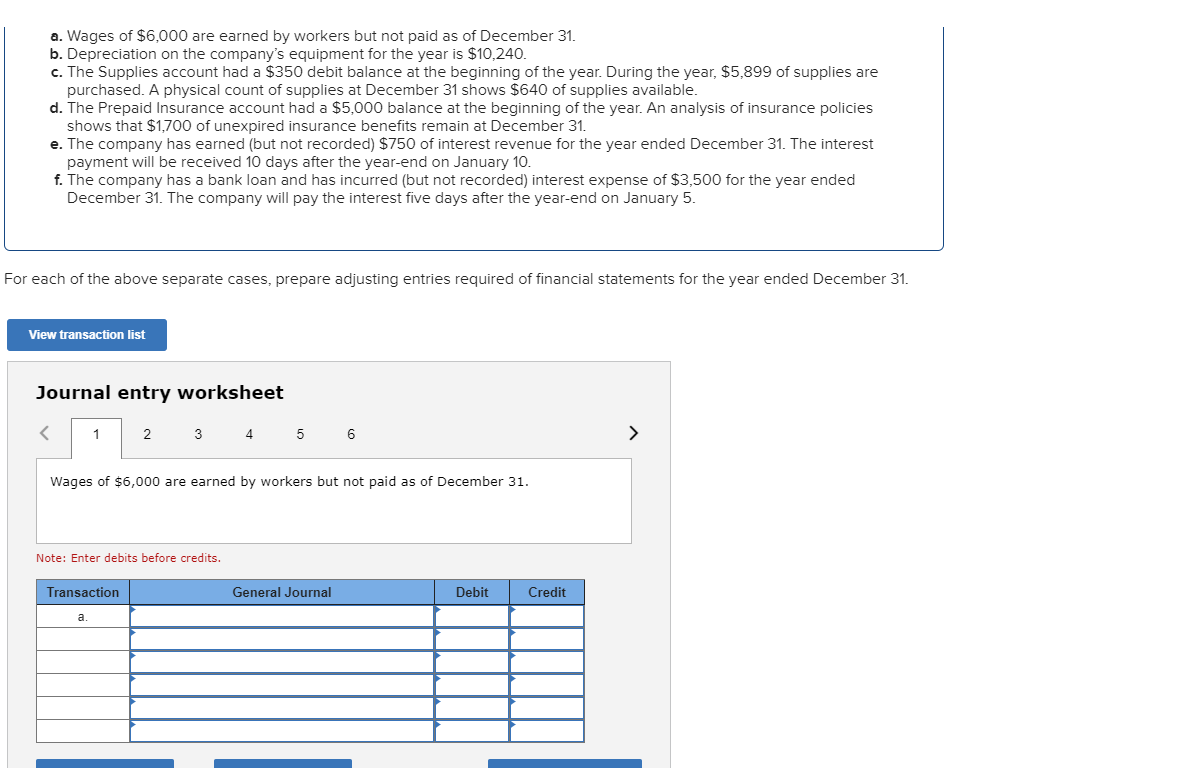

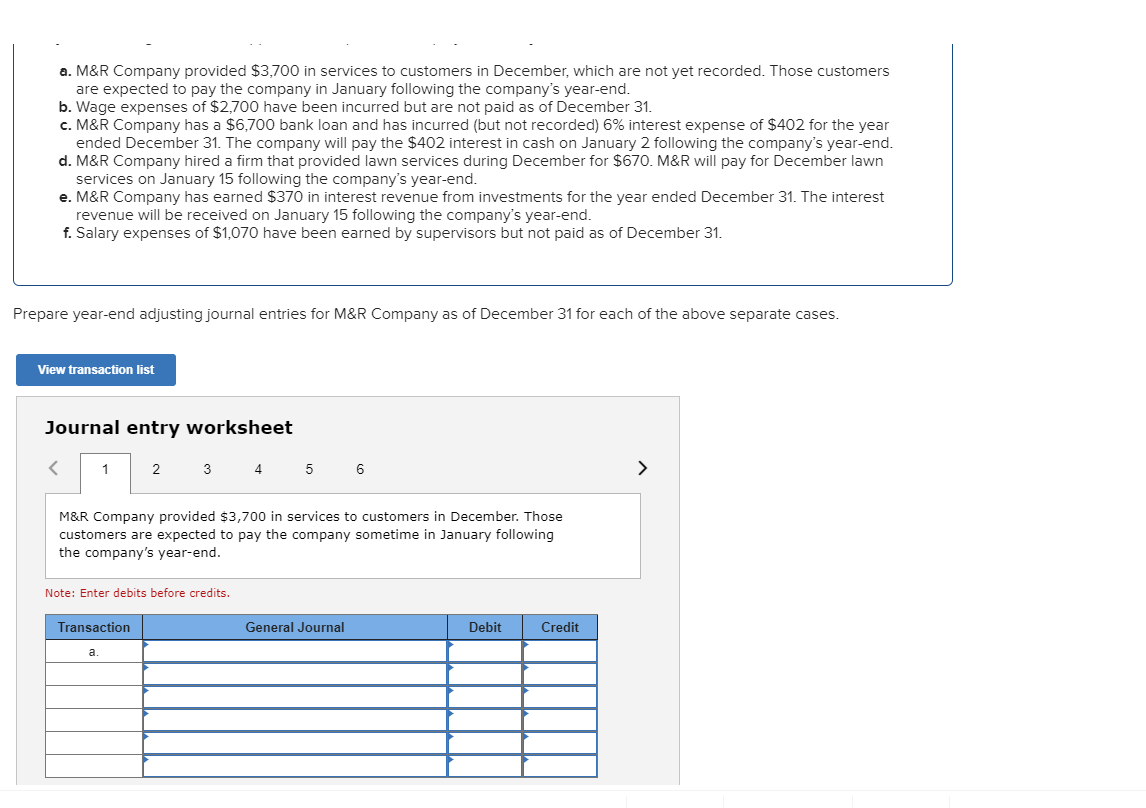

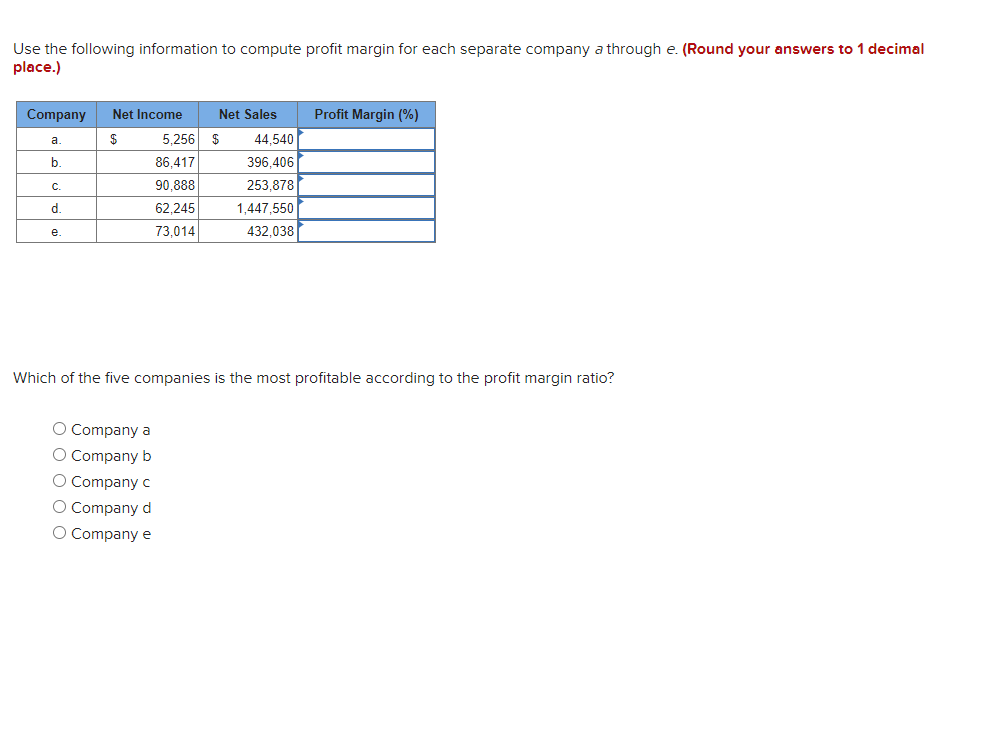

Pablo Management has eight employees, each of whom earns $125 per day. They are paid on Fridays for work completed Monday through Friday of the same week. Near year-end, the eight employees worked Monday, December 31, and Wednesday, Thursday, and Friday, January 2, 3, and 4. New Year's Day (January 1) was an unpaid holiday. Prepare the December 31 year-end adjusting entry for wages expense and record payment of the employees' wages on Friday, January 4. View transaction list Journal entry worksheet 2 Record the December 31 year-end adjusting entry for wages expense. Note: Enter debits before credits. Date December 31 Wages expense Record entry General Journal Clear entry Debit Credit View general journal > Pablo Management has eight employees, each of whom earns $125 per day. They are paid on Fridays for work completed Monday through Friday of the same week. Near year-end, the eight employees worked Monday, December 31, and Wednesday, Thursday, and Friday, January 2, 3, and 4. New Year's Day (January 1) was an unpaid holiday. Prepare the December 31 year-end adjusting entry for wages expense and record payment of the employees' wages on Friday, January 4. View transaction list Journal entry worksheet a. M&R Company provided $3,700 in services to customers in December, which are not yet recorded. Those customers are expected to pay the company in January following the company's year-end. b. Wage expenses of $2,700 have been incurred but are not paid as of December 31. c. M&R Company has a $6,700 bank loan and has incurred (but not recorded) 6% interest expense of $402 for the year ended December 31. The company will pay the $402 interest in cash on January 2 following the company's year-end. d. M&R Company hired a firm that provided lawn services during December for $670. M&R will pay for December lawn services on January 15 following the company's year-end. e. M&R Company has earned $370 in interest revenue from investments for the year ended December 31. The interest revenue will be received on January 15 following the company's year-end. f. Salary expenses of $1,070 have been earned by supervisors but not paid as of December 31. Prepare year-end adjusting journal entries for M&R Company as of December 31 for each of the above separate cases. View transaction list Journal entry worksheet 1 2 Transaction a 3 Note: Enter debits before credits. 4 M&R Company provided $3,700 in services to customers in December. Those customers are expected to pay the company sometime in January following the company's year-end. 5 6 General Journal Debit Credit > Use the following information to compute profit margin for each separate company a through e. (Round your answers to 1 decimal place.) Company Net Income $ a b. d. e 86,417 90,888 62,245 73,014 Net Sales 5,256 $ O Company a O Company b O Company c O Company d O Company e 44.540 396,406 253,878 1,447,550 432,038 Profit Margin (%) Which of the five companies is the most profitable according to the profit margin ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts