Question: Need help with comprehensive project. Cannot upload the whole file. more info A ABC Corporation Statement of Shareholders' Equity For the Year Ended December 31,

Need help with comprehensive project.

Need help with comprehensive project.

Cannot upload the whole file.

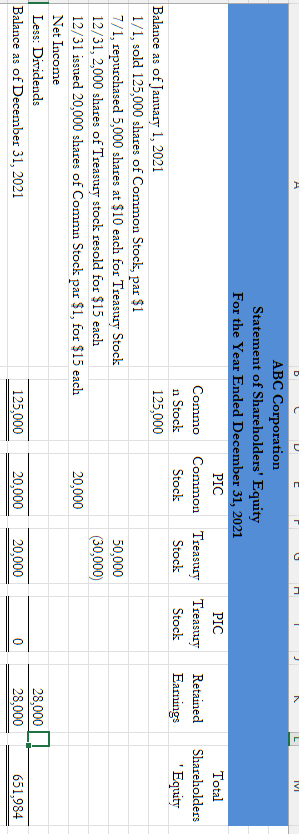

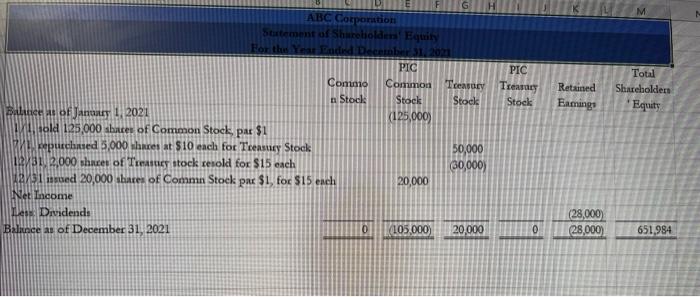

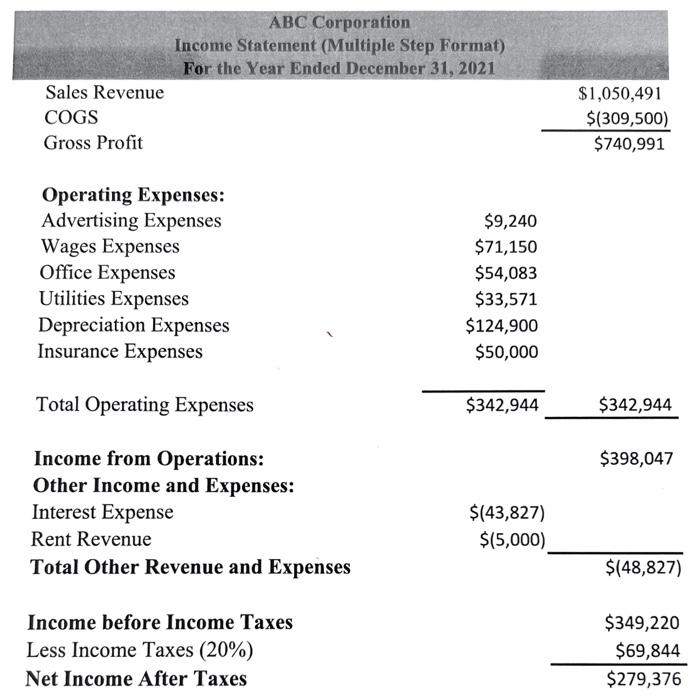

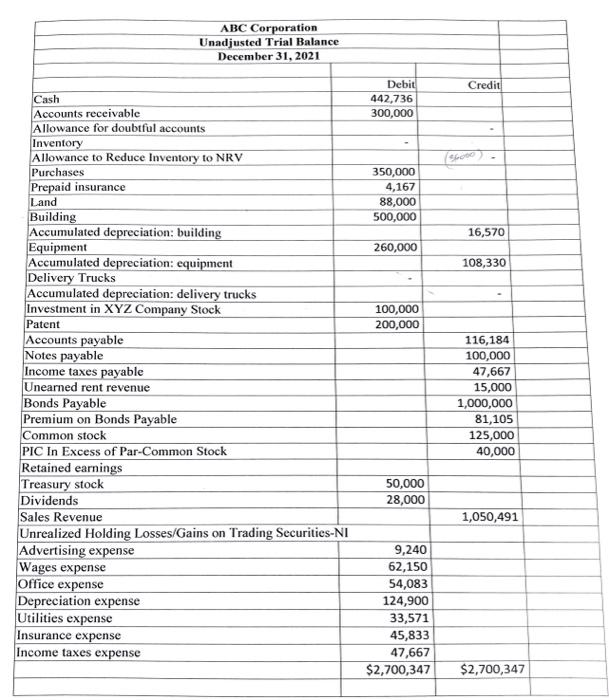

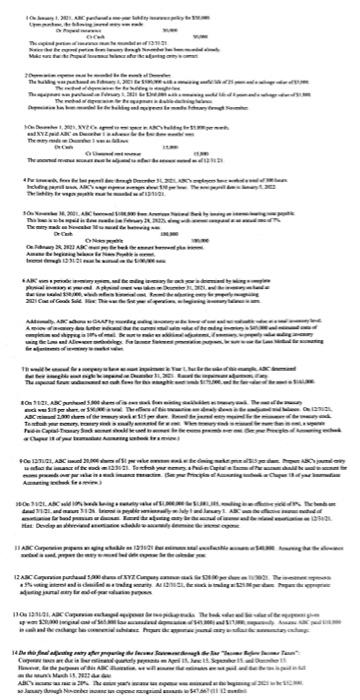

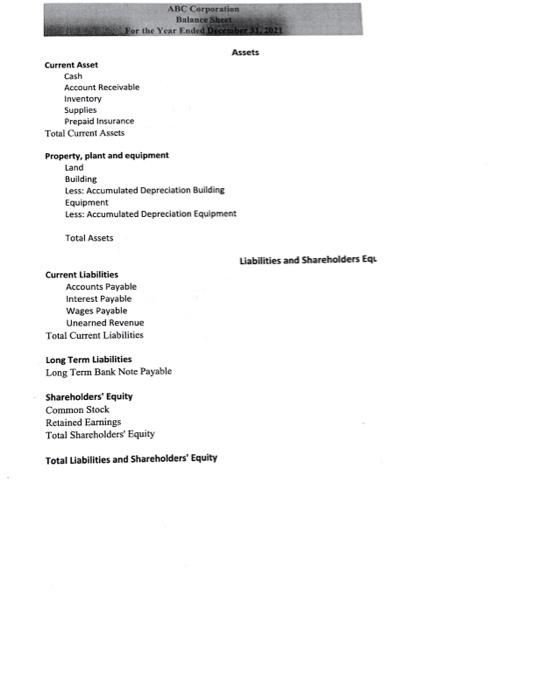

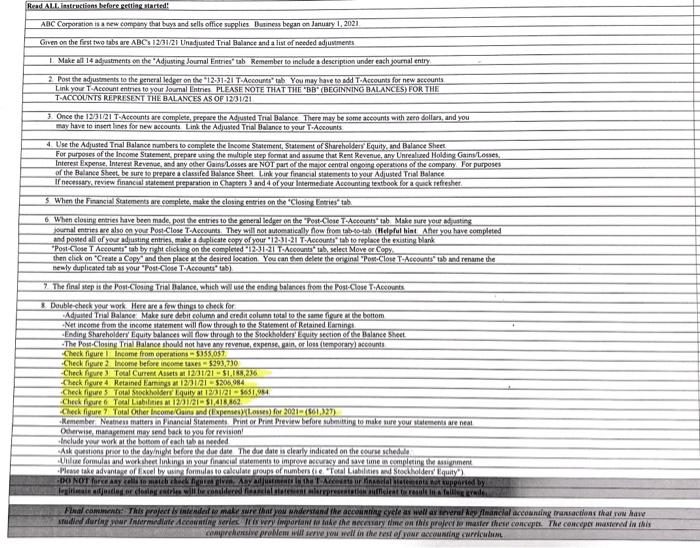

A ABC Corporation Statement of Shareholders' Equity For the Year Ended December 31, 2021 PIC PIC Total Commo Common Treasury Treasury Retained Shareholders 'Equity n Stock Stock Stock Stock Earnings 125,000 Balance as of January 1, 2021 1/1, sold 125,000 shares of Common Stock, par $1 7/1, repurchased 5,000 shares at $10 each for Treasury Stock 12/31, 2,000 shares of Treasury stock resold for $15 each 12/31 issued 20,000 shares of Commn Stock par $1, for $15 each Net Income Less: Dividends Balance as of December 31, 2021 125,000 20,000 50,000 (30,000) 20,000 20,000 0 IVI 28,000 28,000 651,984 ABC Corporation Statement of Shareholders' Equity For the Year Ended December 31, 2021 PIC PIC Commo Common Treasury Treasury Retained Stock Stock Famings n Stock Balance as of January 1, 2021 11 sold 125,000 shares of Common Stock, par $1 cepurchased 5,000 shares at $10 each for Treasury Stock 12/31, 2,000 shares of Treasury stock resold for $15 each 12/31 issued 20,000 shares of Commn Stock par $1, for $15 each Net Income Less Dividends Balance as of December 31, 2021 Stock (125,000) 20,000 50,000 (30,000) (105,000) 20,000 0 (28,000) (28,000) Total Shareholders Equity 651,984 Sales Revenue COGS Gross Profit ABC Corporation Income Statement (Multiple Step Format) For the Year Ended December 31, 2021 Operating Expenses: Advertising Expenses Wages Expenses Office Expenses Utilities Expenses Depreciation Expenses Insurance Expenses Total Operating Expenses Income from Operations: Other Income and Expenses: Interest Expense Rent Revenue Total Other Revenue and Expenses Income before Income Taxes Less Income Taxes (20%) Net Income After Taxes $9,240 $71,150 $54,083 $33,571 $124,900 $50,000 $342,944 $(43,827) $(5,000) $1,050,491 $(309,500) $740,991 $342,944 $398,047 $(48,827) $349,220 $69,844 $279,376 Cash Accounts receivable Allowance for doubtful accounts Inventory Allowance to Reduce Inventory to NRV Purchases Prepaid insurance Land Building Accumulated depreciation: building Equipment Accumulated depreciation: equipment ABC Corporation Unadjusted Trial Balance December 31, 2021 Delivery Trucks Accumulated depreciation: delivery trucks Investment in XYZ Company Stock Patent Accounts payable Notes payable Income taxes payable Unearned rent revenue Bonds Payable Premium on Bonds Payable Common stock PIC In Excess of Par-Common Stock Retained earnings Treasury stock Dividends Sales Revenue Unrealized Holding Losses/Gains on Trading Securities-NI Advertising expense Wages expense Office expense Depreciation expense Utilities expense Insurance expense Income taxes expense Debit 442,736 300,000 350,000 4,167 88,000 500,000 260,000 100,000 200,000 50,000 28,000 9,240 62,150 54,083 124,900 Credit - 16,570 108,330 116,184 100,000 47,667 15,000 1,000,000 81,105 125,000 40,000 1,050,491 33,571 45,833 47,667 $2,700,347 $2,700,347 11.2 p The hung Jinh20KYE=+ and XYZ ABC a Therty and th The ra The 11121 10, 2001ABC Toxmayak 500 Ab soos ruets aroey 18. Amate te hgining 2222 ABC back the emer be Npa AK to dr: pala 2001 CioutufGel Seed BhareTha AMAC GAAP y monding m sodhya+u Topy ber 1 Ang t ead 01121,ABC purthen 5000 for id: hlru.amacry_ i por12363 ABC timel 2,00 thes fe Terry yly Viny Feen Cpal Traayhote ype bopog uri ofypertxcedestr POo127U71 ASC sund 29.004 sflame of$l gyer vnbe omate coi:nke50a te end 123121frnt ahvdma - dourmaat rugilolof Acni and Che 38Oe392LARC HaF%5febonbout: dunnud3121aundrrort3126andanury Acted rban Luthratung anymand tin: Dovydia a 12:A3C Capuronin purchaunl 50f3 aquam1082 .55%egaoteoland ace: injuntal anxtryfr r 130: 12:3621, A3C Coqurvin atopsierase bok fa 28/000 jarigal 55 inbendangheelsh Prunar 54300&17) ninterrone erecte1 11 Vamurther, father purpomnA h 129421 ABCanaeakSCM/ oJacarygharba aane la capendrim54 ABC Corporation Balance Sheet For the Year Ended Dissab Current Asset Cash Account Receivable Inventory Supplies Prepaid Insurance Total Current Assets Current Liabilities Property, plant and equipment Land Building Less: Accumulated Depreciation Building Equipment Less: Accumulated Depreciation Equipment Total Assets Accounts Payable interest Payable Wages Payable Unearned Revenue Total Current Liabilities Long Term Liabilities Long Term Bank Note Payable Shareholders' Equity Common Stock Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity 31, 2021 Assets Liabilities and Shareholders Equ Read ALL instructions before getting started! ABC Corporation is a new company that buys and sells office supplies Business began on January 1, 2021. Given on the first two tabs are ABCs 12/31/21 Unadjusted Trial Balance and a list of needed adjustments 1. Make all 14 adjustments on the "Adjusting Journal Entries" tab Remember to include a description under each journal entry 2 Post the adjustments to the general ledger on the "12-31-21 T-Accounts" tab You may have to add T-Accounts for new accounts Link your T-Account entries to your Journal Entries PLEASE NOTE THAT THE "BB" (BEGINNING BALANCES) FOR THE T-ACCOUNTS REPRESENT THE BALANCES AS OF 12/31/21 3. Once the 12/31/21 T-Accounts are complete, prepare the Adjusted Trial Balance There may be some accounts with zero dollars, and you may have to insert lines for new accounts Link the Adjusted Trial Balance to your T-Accounts 4 Use the Adjusted Trial Balance numbers to complete the Income Statement, Statement of Shareholders' Equity, and Balance Sheet For purposes of the Income Statement, prepare using the multiple step format and assume that Rent Revenue, any Unrealized Holding Gains/Losses, Interest Expense, Interest Revenue, and any other Gains/Losses are NOT part of the major central ongoing operations of the company. For purposes of the Balance Sheet, be sure to prepare a classifed Balance Sheet Link your financial statements to your Adjusted Trial Balance If necessary, review financial statement preparation in Chapters 3 and 4 of your Intermediate Accounting textbook for a quick refresher. 5 When the Financial Statements are complete, make the closing entries on the "Closing Entries" tab 6. When closing entries have been made, post the entries to the general ledger on the "Post-Close T-Accounts" tab. Make sure your adjusting journal entries are also on your Post-Close T-Accounts. They will not automatically flow from tab-to-tab (Helpful hint After you have completed and posted all of your adjusting entries, make a duplicate copy of your "12-31-21 T-Accounts" tab to replace the existing blank "Post-Close T Accounts" tab by right clicking on the completed 12-31-21 T-Accounts tab, select Move or Copy then click on "Create a Copy" and then place at the desired location. You can then delete the original Post-Close T-Accounts" tab and rename the newly duplicated tab as your "Post-Close T-Accounts tab) 7. The final step is the Post-Closing Trial Balance, which will use the ending balances from the Post-Close T-Accounts 8. Double-check your work Here are a few things to check for Adjusted Trial Balance Make sure debit column and credit column total to the same figure at the bottom -Net income from the income statement will flow through to the Statement of Retained Earnings Ending Shareholders' Equity balances will flow through to the Stockholders' Equity section of the Balance Sheet -The Post-Closing Trial Balance should not have any revenue, expense, gain, or loss (temporary) accounts Check figure Income from operations-$355,057 Check figure 2 Income before income taxes-$293,730 Check figure 3 Total Current Assets at 12/31/21-$1,188,236 Check figure 4 Check figure 5 Check figure 6 Total Liabilities at 12/31/21-$1,418,862 Retained Earnings at 12/31/21 - $206,984 Total Stockholders' Equity at 12/31/21-$651,984 Check figure 7 Total Other Income/Gains and (Expenses)(Losses) for 2021-($61,327) Remember Neatness matters in Financial Statements Print or Print Preview before submitting to make sure your statements are neat Otherwise, management may send back to you for revision! Include your work at the bottom of each tab as needed Ask questions prior to the dayight before the due date. The due date is clearly indicated on the course schedule Utilize formulas and worksheet linkings in your financial statements to improve accuracy and save time in completing the assignment Please take advantage of Excel by using formulas to calculate groups of numbers (ie. "Total Liabilities and Stockholders' Equity") DO NOT force Any calls to match check figures given. Any adjustments in the T-Accents ur financial statements not supported by Final comments: This project is intended to make sure that you understand the accounting cycle as well as several key financial accounting transactions that you have studied during your Intermediate Accounting series. It is very important to take the necessary time on this project to master these concepts. The concepts mastered in this comprehensive problem will serve you well in the rest of your accounting curriculum A ABC Corporation Statement of Shareholders' Equity For the Year Ended December 31, 2021 PIC PIC Total Commo Common Treasury Treasury Retained Shareholders 'Equity n Stock Stock Stock Stock Earnings 125,000 Balance as of January 1, 2021 1/1, sold 125,000 shares of Common Stock, par $1 7/1, repurchased 5,000 shares at $10 each for Treasury Stock 12/31, 2,000 shares of Treasury stock resold for $15 each 12/31 issued 20,000 shares of Commn Stock par $1, for $15 each Net Income Less: Dividends Balance as of December 31, 2021 125,000 20,000 50,000 (30,000) 20,000 20,000 0 IVI 28,000 28,000 651,984 ABC Corporation Statement of Shareholders' Equity For the Year Ended December 31, 2021 PIC PIC Commo Common Treasury Treasury Retained Stock Stock Famings n Stock Balance as of January 1, 2021 11 sold 125,000 shares of Common Stock, par $1 cepurchased 5,000 shares at $10 each for Treasury Stock 12/31, 2,000 shares of Treasury stock resold for $15 each 12/31 issued 20,000 shares of Commn Stock par $1, for $15 each Net Income Less Dividends Balance as of December 31, 2021 Stock (125,000) 20,000 50,000 (30,000) (105,000) 20,000 0 (28,000) (28,000) Total Shareholders Equity 651,984 Sales Revenue COGS Gross Profit ABC Corporation Income Statement (Multiple Step Format) For the Year Ended December 31, 2021 Operating Expenses: Advertising Expenses Wages Expenses Office Expenses Utilities Expenses Depreciation Expenses Insurance Expenses Total Operating Expenses Income from Operations: Other Income and Expenses: Interest Expense Rent Revenue Total Other Revenue and Expenses Income before Income Taxes Less Income Taxes (20%) Net Income After Taxes $9,240 $71,150 $54,083 $33,571 $124,900 $50,000 $342,944 $(43,827) $(5,000) $1,050,491 $(309,500) $740,991 $342,944 $398,047 $(48,827) $349,220 $69,844 $279,376 Cash Accounts receivable Allowance for doubtful accounts Inventory Allowance to Reduce Inventory to NRV Purchases Prepaid insurance Land Building Accumulated depreciation: building Equipment Accumulated depreciation: equipment ABC Corporation Unadjusted Trial Balance December 31, 2021 Delivery Trucks Accumulated depreciation: delivery trucks Investment in XYZ Company Stock Patent Accounts payable Notes payable Income taxes payable Unearned rent revenue Bonds Payable Premium on Bonds Payable Common stock PIC In Excess of Par-Common Stock Retained earnings Treasury stock Dividends Sales Revenue Unrealized Holding Losses/Gains on Trading Securities-NI Advertising expense Wages expense Office expense Depreciation expense Utilities expense Insurance expense Income taxes expense Debit 442,736 300,000 350,000 4,167 88,000 500,000 260,000 100,000 200,000 50,000 28,000 9,240 62,150 54,083 124,900 Credit - 16,570 108,330 116,184 100,000 47,667 15,000 1,000,000 81,105 125,000 40,000 1,050,491 33,571 45,833 47,667 $2,700,347 $2,700,347 11.2 p The hung Jinh20KYE=+ and XYZ ABC a Therty and th The ra The 11121 10, 2001ABC Toxmayak 500 Ab soos ruets aroey 18. Amate te hgining 2222 ABC back the emer be Npa AK to dr: pala 2001 CioutufGel Seed BhareTha AMAC GAAP y monding m sodhya+u Topy ber 1 Ang t ead 01121,ABC purthen 5000 for id: hlru.amacry_ i por12363 ABC timel 2,00 thes fe Terry yly Viny Feen Cpal Traayhote ype bopog uri ofypertxcedestr POo127U71 ASC sund 29.004 sflame of$l gyer vnbe omate coi:nke50a te end 123121frnt ahvdma - dourmaat rugilolof Acni and Che 38Oe392LARC HaF%5febonbout: dunnud3121aundrrort3126andanury Acted rban Luthratung anymand tin: Dovydia a 12:A3C Capuronin purchaunl 50f3 aquam1082 .55%egaoteoland ace: injuntal anxtryfr r 130: 12:3621, A3C Coqurvin atopsierase bok fa 28/000 jarigal 55 inbendangheelsh Prunar 54300&17) ninterrone erecte1 11 Vamurther, father purpomnA h 129421 ABCanaeakSCM/ oJacarygharba aane la capendrim54 ABC Corporation Balance Sheet For the Year Ended Dissab Current Asset Cash Account Receivable Inventory Supplies Prepaid Insurance Total Current Assets Current Liabilities Property, plant and equipment Land Building Less: Accumulated Depreciation Building Equipment Less: Accumulated Depreciation Equipment Total Assets Accounts Payable interest Payable Wages Payable Unearned Revenue Total Current Liabilities Long Term Liabilities Long Term Bank Note Payable Shareholders' Equity Common Stock Retained Earnings Total Shareholders' Equity Total Liabilities and Shareholders' Equity 31, 2021 Assets Liabilities and Shareholders Equ Read ALL instructions before getting started! ABC Corporation is a new company that buys and sells office supplies Business began on January 1, 2021. Given on the first two tabs are ABCs 12/31/21 Unadjusted Trial Balance and a list of needed adjustments 1. Make all 14 adjustments on the "Adjusting Journal Entries" tab Remember to include a description under each journal entry 2 Post the adjustments to the general ledger on the "12-31-21 T-Accounts" tab You may have to add T-Accounts for new accounts Link your T-Account entries to your Journal Entries PLEASE NOTE THAT THE "BB" (BEGINNING BALANCES) FOR THE T-ACCOUNTS REPRESENT THE BALANCES AS OF 12/31/21 3. Once the 12/31/21 T-Accounts are complete, prepare the Adjusted Trial Balance There may be some accounts with zero dollars, and you may have to insert lines for new accounts Link the Adjusted Trial Balance to your T-Accounts 4 Use the Adjusted Trial Balance numbers to complete the Income Statement, Statement of Shareholders' Equity, and Balance Sheet For purposes of the Income Statement, prepare using the multiple step format and assume that Rent Revenue, any Unrealized Holding Gains/Losses, Interest Expense, Interest Revenue, and any other Gains/Losses are NOT part of the major central ongoing operations of the company. For purposes of the Balance Sheet, be sure to prepare a classifed Balance Sheet Link your financial statements to your Adjusted Trial Balance If necessary, review financial statement preparation in Chapters 3 and 4 of your Intermediate Accounting textbook for a quick refresher. 5 When the Financial Statements are complete, make the closing entries on the "Closing Entries" tab 6. When closing entries have been made, post the entries to the general ledger on the "Post-Close T-Accounts" tab. Make sure your adjusting journal entries are also on your Post-Close T-Accounts. They will not automatically flow from tab-to-tab (Helpful hint After you have completed and posted all of your adjusting entries, make a duplicate copy of your "12-31-21 T-Accounts" tab to replace the existing blank "Post-Close T Accounts" tab by right clicking on the completed 12-31-21 T-Accounts tab, select Move or Copy then click on "Create a Copy" and then place at the desired location. You can then delete the original Post-Close T-Accounts" tab and rename the newly duplicated tab as your "Post-Close T-Accounts tab) 7. The final step is the Post-Closing Trial Balance, which will use the ending balances from the Post-Close T-Accounts 8. Double-check your work Here are a few things to check for Adjusted Trial Balance Make sure debit column and credit column total to the same figure at the bottom -Net income from the income statement will flow through to the Statement of Retained Earnings Ending Shareholders' Equity balances will flow through to the Stockholders' Equity section of the Balance Sheet -The Post-Closing Trial Balance should not have any revenue, expense, gain, or loss (temporary) accounts Check figure Income from operations-$355,057 Check figure 2 Income before income taxes-$293,730 Check figure 3 Total Current Assets at 12/31/21-$1,188,236 Check figure 4 Check figure 5 Check figure 6 Total Liabilities at 12/31/21-$1,418,862 Retained Earnings at 12/31/21 - $206,984 Total Stockholders' Equity at 12/31/21-$651,984 Check figure 7 Total Other Income/Gains and (Expenses)(Losses) for 2021-($61,327) Remember Neatness matters in Financial Statements Print or Print Preview before submitting to make sure your statements are neat Otherwise, management may send back to you for revision! Include your work at the bottom of each tab as needed Ask questions prior to the dayight before the due date. The due date is clearly indicated on the course schedule Utilize formulas and worksheet linkings in your financial statements to improve accuracy and save time in completing the assignment Please take advantage of Excel by using formulas to calculate groups of numbers (ie. "Total Liabilities and Stockholders' Equity") DO NOT force Any calls to match check figures given. Any adjustments in the T-Accents ur financial statements not supported by Final comments: This project is intended to make sure that you understand the accounting cycle as well as several key financial accounting transactions that you have studied during your Intermediate Accounting series. It is very important to take the necessary time on this project to master these concepts. The concepts mastered in this comprehensive problem will serve you well in the rest of your accounting curriculum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts