Question: NEED HELP WITH D & E, Already answered ABC Refer to Table 6.3 and consider these three-year strategies: Three-In (fully invested in the risky portfolio

NEED HELP WITH D & E, Already answered ABC

Refer to Table 6.3 and consider these three-year strategies: Three-In (fully invested in the risky portfolio in each of the three years); One-In (fully invested in the risky portfolio in one year, and in the risk-free asset in the other two); and Third-In-Three (one-third of the portfolio invested in the risky portfolio and the remainder in T-bills in each of the three years).

a. Create a table like Table 6.3 for these three strategies.

| Strategy | Three-In | One-In | Third-In-Three |

| Risk premium | R + R + R = 3R | 0 + 0 + R = R | 3 1/3 R = R |

| Variance | 2+2+2=322+2+2=32 | 0+0+2=20+0+2=2 | 2/3 |

| Sharpe ratio | 3R3=S133R3=S13 | R/=S1R/=S1 | R2/3=S13R2/3=S13 |

| Price of risk | R/2=P1R/2=P1 | R/2=P1R/2=P1 | R2/3=3P1R2/3=3P1 |

|

| |||

b. Which strategy has the lowest Sharpe ratio?

| Three-In | |

| One-In | |

| Third-In-Three |

c. Which strategy provides the highest price of risk?

| Three-In | |

| One-In | |

| Third-In-Three |

d. Suppose your risk aversion coefficient is A = 3, the expected return on the risky portfolio is 20%, the standard deviation of the risky portfolio is 25%, and the T-bill rate is 5%. If you were allocating your complete portfolio in any year between Three-In and T-bills, what fraction would you devote to Three-In? (Round your answer to 2 decimal places.)

yThree-In

e. If you were allocating your complete portfolio in any year between Third-In-Three and T-bills, what fraction would you devote to Third-In-Three? (Round your answer to 2 decimal places.)

yThird-In-Three

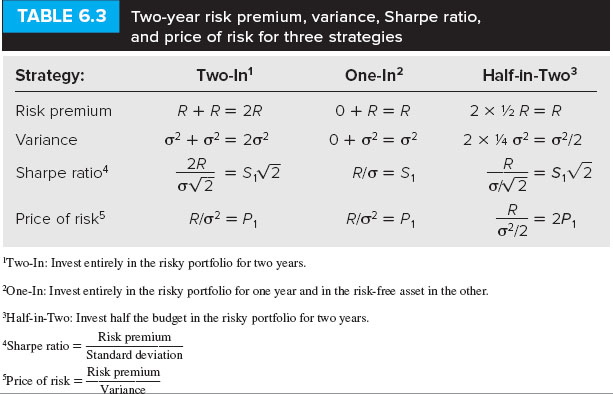

TABLE 6.3 Two-year risk premium, variance, Sharpe ratio and price of risk for three strategies Two-In One-In2 Half-in-Two3 Strategy: Risk premium Variance Sharpe ratio4 Price of risk5 RR 2R 2 x 12 RR 28 = sN2 V2 -= 2P1 o2/2 Two-In: Invest entirely in the risky portfolio for two years. 2One-In: Invest entirely in the risky portfolio for one year and in the risk-free asset in the other. Half-in-Two: Invest half the budget in the risky portfolio for two years. Risk premium Standard deviation Risk premium ratio- Price of risk TABLE 6.3 Two-year risk premium, variance, Sharpe ratio and price of risk for three strategies Two-In One-In2 Half-in-Two3 Strategy: Risk premium Variance Sharpe ratio4 Price of risk5 RR 2R 2 x 12 RR 28 = sN2 V2 -= 2P1 o2/2 Two-In: Invest entirely in the risky portfolio for two years. 2One-In: Invest entirely in the risky portfolio for one year and in the risk-free asset in the other. Half-in-Two: Invest half the budget in the risky portfolio for two years. Risk premium Standard deviation Risk premium ratio- Price of risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts