Question: Need help with d, e, and f Homework: Valuing Bonds Assignment 0 Saved Consider three bonds with 5.30% coupon rates, all making annual coupon payments

Need help with d, e, and f

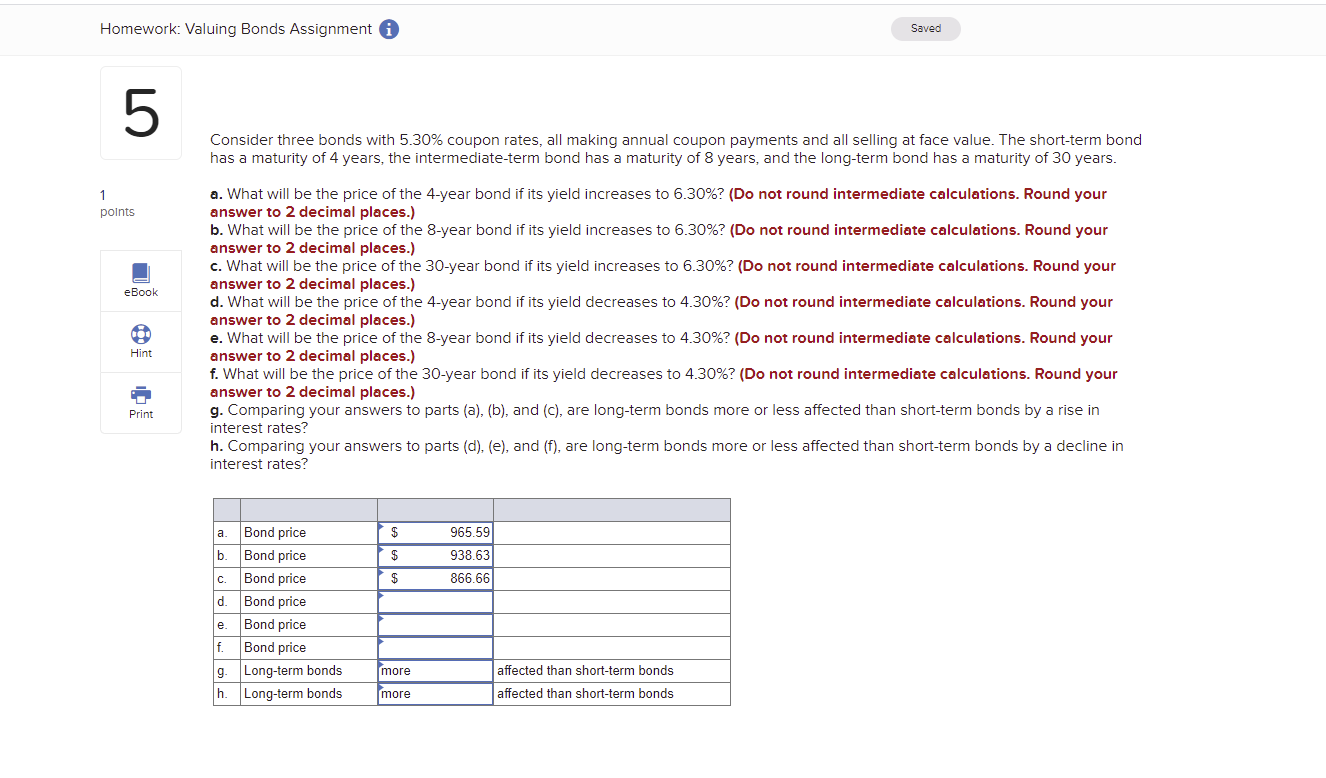

Homework: Valuing Bonds Assignment 0 Saved Consider three bonds with 5.30% coupon rates, all making annual coupon payments and all selling at face value. The shortterm bond has a maturity of 4 years, the intermediate-term bond has a maturity of 8 years, and the long-term bond has a maturity of 30 years. a. What will be the price of the 4-year bond if its yield increases to 6.30%? {Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What will be the price of the 8-year bond if its yield increases to 6.30%? [Do not round intermediate calculations. Round your answer to 2 decimal places.) c. What will be the price of the 307year bond if its yield increases to 6.30%? [Do not round intermediate calculations. Round your answer to 2 decimal places.) cl. What will be the price of the year bond if its yield decreases to 430%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) e. What will be the price of the 8year bond if its yield decreases to 430%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) f. What will be the price of the 30year bond it its yield decreases to 4.30%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) 9. Comparing your answers to parts [a], (b), and [c], are long-term bonds more or less affected than short-term bonds by a rise in interest rates? h. Comparing your answers to parts {d}, (e), and (f), are longterm bonds more or less affected than shortterm bonds by a decline in interest rates? Bond pn'ce Bond pn'ce Bond price Bond price Bond price \"runner" Bond price attested than shortiterm bonds aected than short-term bonds Longtem'l bonds .7\"? Long-tam] bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts