Question: Need help with decision tree problem figuring. Thank You Use the information below to answer the questions that follow concerning the use of decision trees

Need help with decision tree problem figuring. Thank You

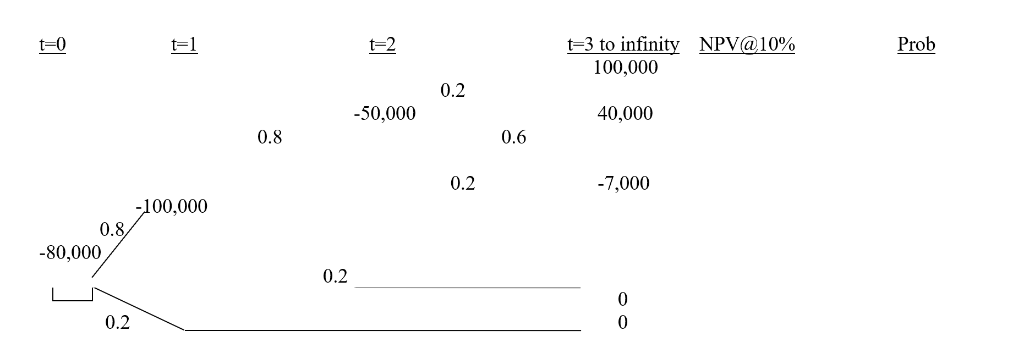

Use the information below to answer the questions that follow concerning the use of decision trees to value a project and real options. Hi Tech Inc. is considering producing a new line of printers designed to produce professional quality digital photographs. It decision process consists of three separate stages.

Stage 1: At time 0 conduct an $80,000 study of the market potential for the new printer.

Stage 2: If it appears that a sizable market exist for the machine it will spend $100,000 developing prototypes of the printer.

Stage 3: Depending on the tests of the prototype the firm will either build a high volume machine for a cost of $50,000 or not produce any machine. If it does produce a machine there are three possible sets of cash flows generated for each machine. Each set of cash flows is expected to continue in perpetuity. The project is represented in the decision tree below.

- Calculate the expected NPV for the project assuming the correct weighted average cost of capital is 10%. Include the probabilities you use (show how you set up the problem) (10 points)

- How much would the firm be willing to pay for an option to abandon the project if the firm realizes that the outcome with negative 7,000 cash flow each year after time t = 3 is correct? Assume that it must take the first -7,000 then can abandon the project and eliminate any future losses. The firm will also be able to sell the machine for $40,000 tax free (the 40,000 would also be received at time t=3) (10 points)

to t=1 t=2 t=3 to infinity 100,000 NPV@10% Prob 0.2 -50,000 40,000 0.8 0.6 0.2 -7,000 -100,000 0.8 -80,000 0.2 to t=1 t=2 t=3 to infinity 100,000 NPV@10% Prob 0.2 -50,000 40,000 0.8 0.6 0.2 -7,000 -100,000 0.8 -80,000 0.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts