Question: Need help with Dept Ratio, Average collection period, fixed asset turnover, return on equity (Calculating financial ratios) The balance sheet and income statement for the

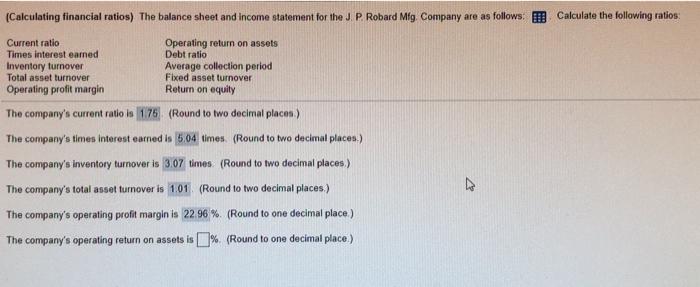

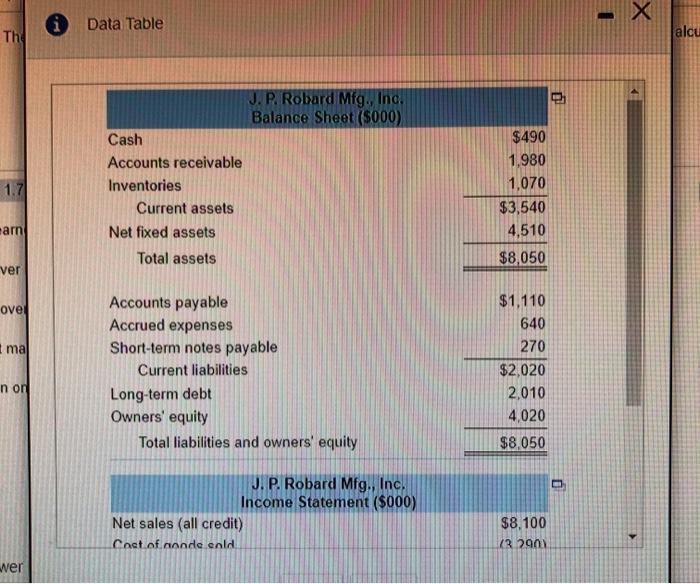

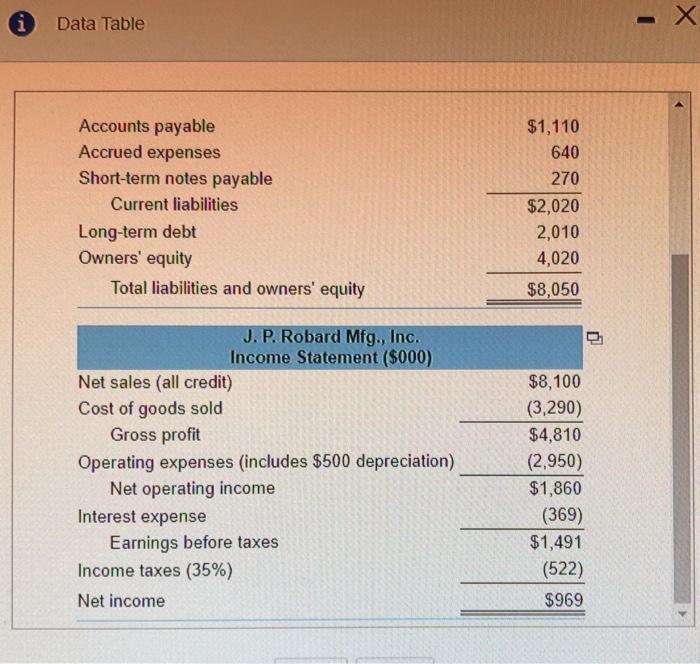

(Calculating financial ratios) The balance sheet and income statement for the JP Robard Mfg Company are as follows: Calculate the following ratios Current ratio Operating return on assets Times interest earned Debt ratio Inventory turnover Average collection period Total asset turnover Fixed asset turnover Operating profit margin Return on equity The company's current ratio is 176 (Round to two decimal places) The company's times interest eamed is 5.04 times. (Round to two decimal places.) The company's Inventory turnover is 3.07 times (Round to two decimal places.) The company's total asset turnover is 101 (Round to two decimal places) The company's operating profit margin is 22 96% (Round to one decimal place) The company's operating return on assets is % (Round to one decimal place.) V Data Table The alcu J. P. Robard Mfg., Inc. Balance Sheet (5000) Cash Accounts receivable Inventories Current assets Net fixed assets Total assets 1.71 $490 1.980 1,070 $3,540 4,510 $8,050 -am ver ove Ima Accounts payable Accrued expenses Short-term notes payable Current liabilities Long-term debt Owners' equity Total liabilities and owners' equity $1,110 640 270 $2,020 2,010 4,020 $8,050 non J.P. Robard Mfg., Inc. Income Statement (5000) Net sales (all credit) Cact of monde enld $8,100 (3 290) wer i Data Table Accounts payable Accrued expenses Short-term notes payable Current liabilities Long-term debt Owners' equity Total liabilities and owners' equity $1,110 640 270 $2,020 2,010 4,020 $8,050 J. P. Robard Mfg., Inc. Income Statement ($000) Net sales (all credit) Cost of goods sold Gross profit Operating expenses (includes $500 depreciation) Net operating income Interest expense Earnings before taxes Income taxes (35%) Net income $8,100 (3,290) $4,810 (2,950) $1,860 (369) $1,491 (522) $969

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts