Question: need help with e) finished goods inventory Bramble, Inc. manufactures ergonomically designed computer furniture. Bramble uses a job order costing system. On November 30 ,

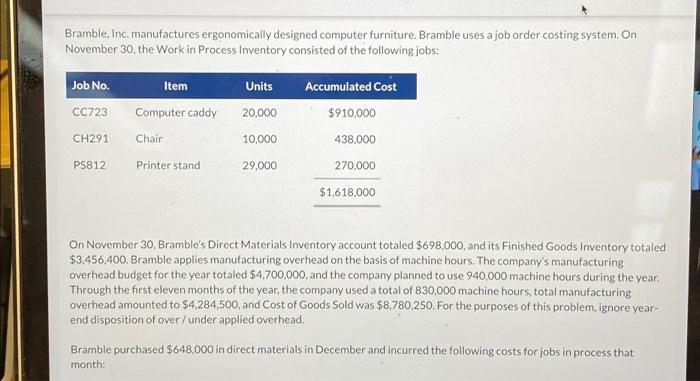

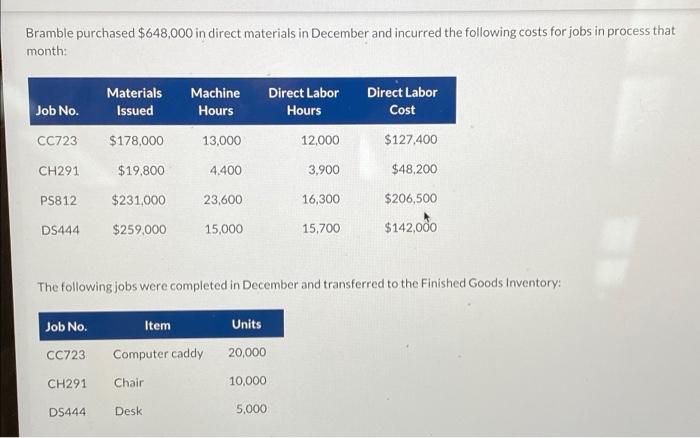

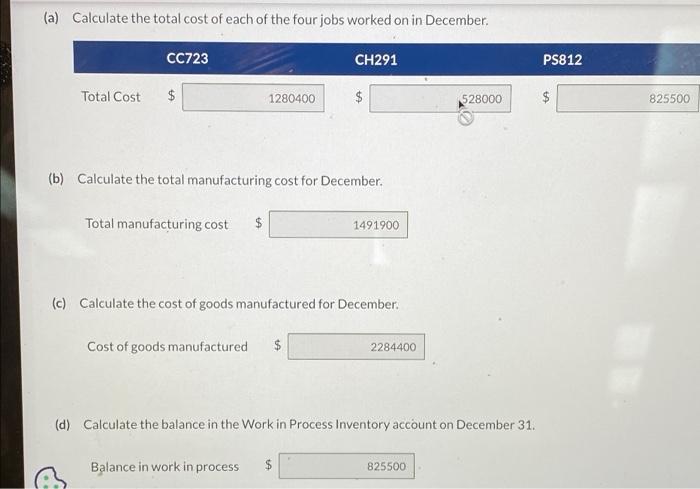

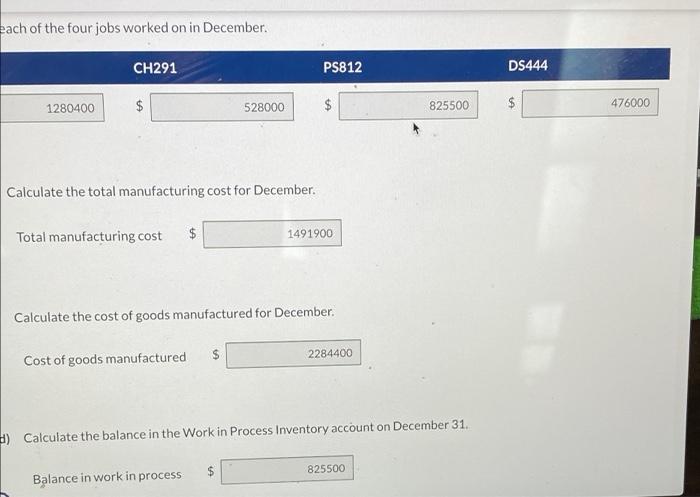

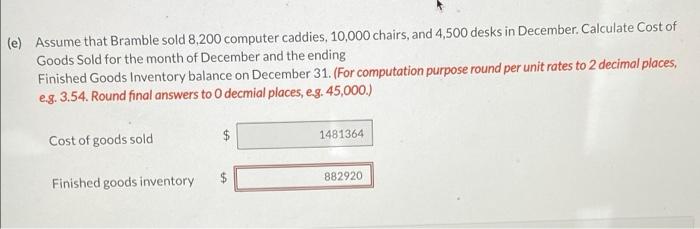

Bramble, Inc. manufactures ergonomically designed computer furniture. Bramble uses a job order costing system. On November 30 , the Work in Process Inventory consisted of the following jobs: On November 30, Bramble's Direct Materials Inventory account totaled $698,000, and its Finished Goods Inventory totaled $3,456,400. Bramble applies manufacturing overhead on the basis of machine hours. The company's manufacturing overhead budget for the year totaled $4,700,000, and the company planned to use 940,000 machine hours during the year. Through the first eleven months of the year, the company used a total of 830,000 machine hours, total manufacturing overhead amounted to $4,284,500, and Cost of Goods Sold was $8,780,250. For the purposes of this problem, ignore yearend disposition of over/under applied overhead. Bramble purchased $648,000 in direct materials in December and incurred the following costs for jobs in process that month: Bramble purchased $648,000 in direct materials in December and incurred the following costs for jobs in process that month: The following jobs were completed in December and transferred to the Finished Goods Inventory: (a) Calculate the total cost of each of the four jobs worked on in December. (b) Calculate the total manufacturing cost for December. Total manufacturing cost $ (c) Calculate the cost of goods manufactured for December. Cost of goods manufactured $ (d) Calculate the balance in the Work in Process Inventory account on December 31 . Balance in work in process $ each of the four jobs worked on in December. Calculate the total manufacturing cost for December. Total manufacturing cost $ Calculate the cost of goods manufactured for December. Cost of goods manufactured $ 4) Calculate the balance in the Work in Process Inventory account on December 31. Balance in work in process $ Assume that Bramble sold 8,200 computer caddies, 10,000 chairs, and 4,500 desks in December. Calculate Cost of Goods Sold for the month of December and the ending Finished Goods Inventory balance on December 31. (For computation purpose round per unit rates to 2 decimal places, e.g. 3.54. Round final answers to 0 decmial places, e.g. 45,000.) Cost of goods sold $ Finished goods inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts