Question: need help with E1B and E2B 6:21 P. HW 5 - Chapter 12.pdf - Read-only LO 1 EXERCISES: SET B Partnership Characteristics E1B. Indicate whether

need help with E1B and E2B

need help with E1B and E2B

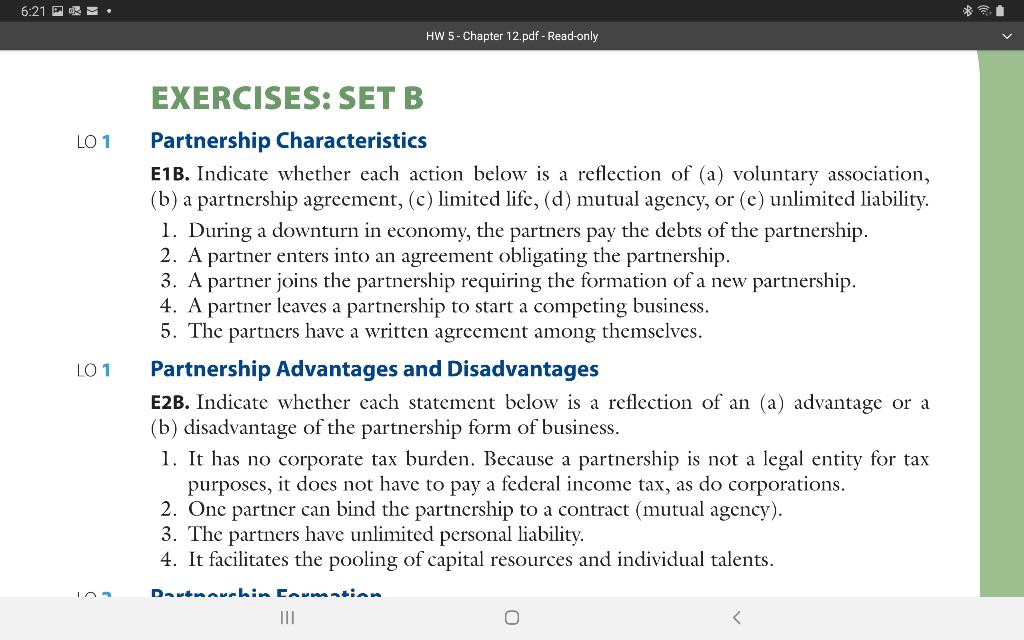

6:21 P. HW 5 - Chapter 12.pdf - Read-only LO 1 EXERCISES: SET B Partnership Characteristics E1B. Indicate whether each action below is a reflection of (a) voluntary association, (b) a partnership agreement, (c) limited life, (d) mutual agency, or (e) unlimited liability. 1. During a downturn in economy, the partners pay the debts of the partnership. 2. A partner enters into an agreement obligating the partnership. 3. A partner joins the partnership requiring the formation of a new partnership. 4. A partner leaves a partnership to start a competing business. 5. The partners have a written agreement among themselves. Partnership Advantages and Disadvantages E2B. Indicate whether each statement below is a reflection of an (a) advantage or a (b) disadvantage of the partnership form of business. 1. It has no corporate tax burden. Because a partnership is not a legal entity for tax purposes, it does not have to pay a federal income tax, as do corporations. 2. Onc partner can bind the partnership to a contract (mutual agency). 3. The partners have unlimited personal liability. 4. It facilitates the pooling of capital resources and individual talents. LO 1 Davinavchin Camation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts