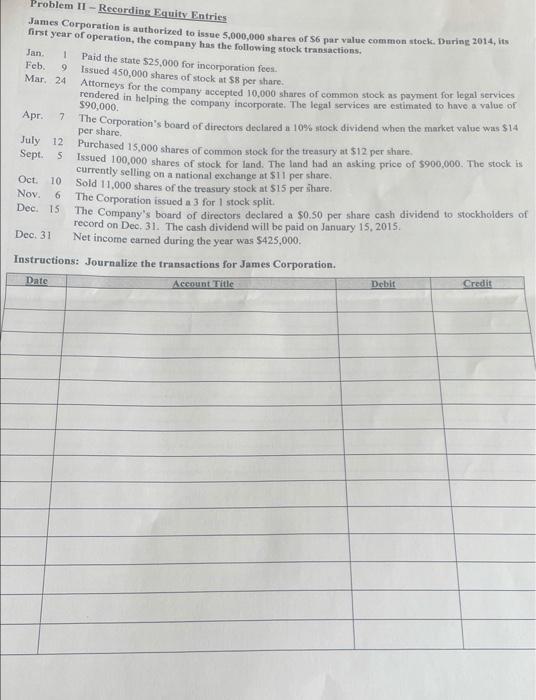

Question: Need help with equity journal entries. Jan 1 9 Problem II-Recording Equity Entries James Corporation is authorized to issue 5,000,000 shares of S6 par vulue

Jan 1 9 Problem II-Recording Equity Entries James Corporation is authorized to issue 5,000,000 shares of S6 par vulue common stock. During 2014, its first year of operation, the company has the following stock transactions, Paid the state $25,000 for incorporation fees Feb. Issued 450,000 shares of stock at $8 per share Mar 24 Attorneys for the company accepted 10,000 shares of common stock as payment for legal services rendered in helping the company incorporate. The legal services are estimated to have a value of 590,000 Apr. 7 The Corporation's board of directors declared a 10% Hock dividend when the market value was $14 per share July 12 Purchased 15,000 shares of common stock for the treasury at $12 per share. Sept. Issued 100,000 shares of stock for land. The land had an asking price of $900,000. The stock is currently selling on a national exchange at $11 per share. 10 Sold 11,000 shares of the treasury stock at $15 per share. Nov. The Corporation issued a 3 for 1 stock split. Dec. 15 The Company's board of directors declared a $0.50 per share cash dividend to stockholders of record on Dec. 31. The cash dividend will be paid on January 15, 2015, Dec. 31 Net income earned during the year was $425,000 Instructions: Journalize the transactions for James Corporation. Credit Debit Date 5 Oct 6 Account Title

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts