Question: Need help with explanations and/or step by step for Questions 1, 2, 3, 4, and 5 1. How much money has Tennyson Investments borrowed for

Need help with explanations and/or step by step for Questions 1, 2, 3, 4, and 5

Need help with explanations and/or step by step for Questions 1, 2, 3, 4, and 5

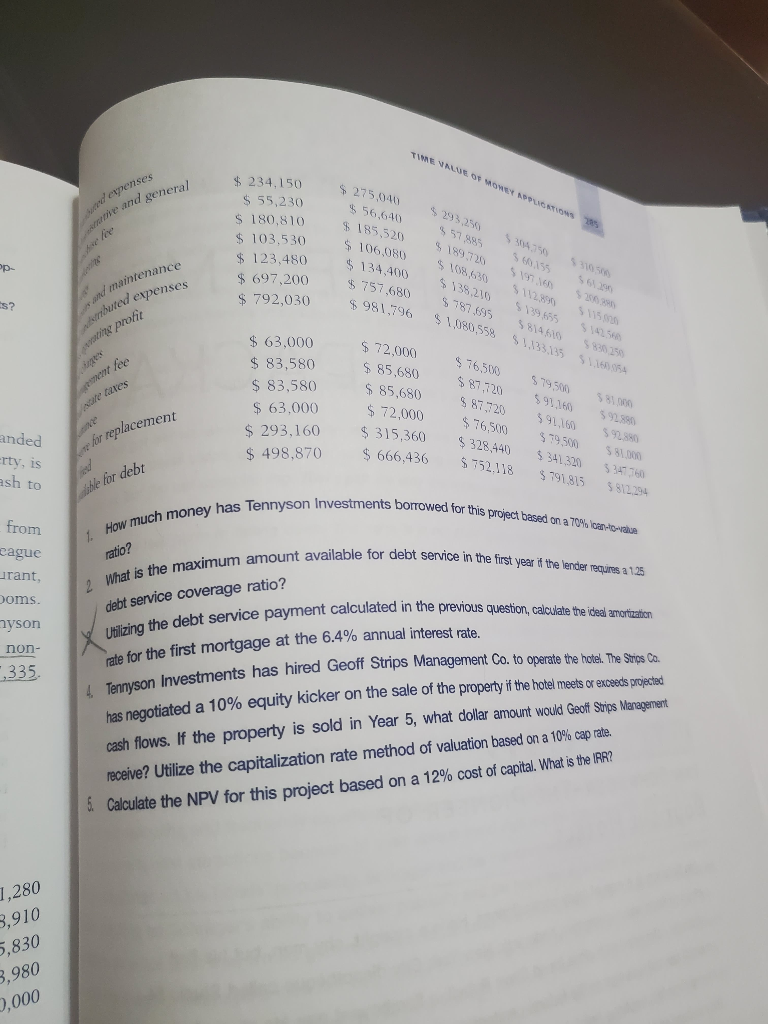

1. How much money has Tennyson Investments borrowed for this project based on a 70% loan-to-value ratio?

2, What is the maximum amount available for debt service in the first year if the lender requires a 1.25 debt service coverage ratio?

3, Utilizing the debt service payment calculated in the previous question, calculate the ideal amoritization rate for the first mortgage at the 6.4% annual interest rate.

4. Tennyson Investments has hired Geoff Strips Management Co. to operate the hotel. The Strips Co. has negotiated a 10% equity kicker on the sale of the property if the hotel meets or exceeds projected cash flows. If the property is sold in Year 5, what dollar amount would Geoff Strips Management receive? Utilize the capitalization rate method of valuation based on a 10% cap rate.

5. Calculate the NPV for this project based on a 12% cost of capital. What is the IRR?

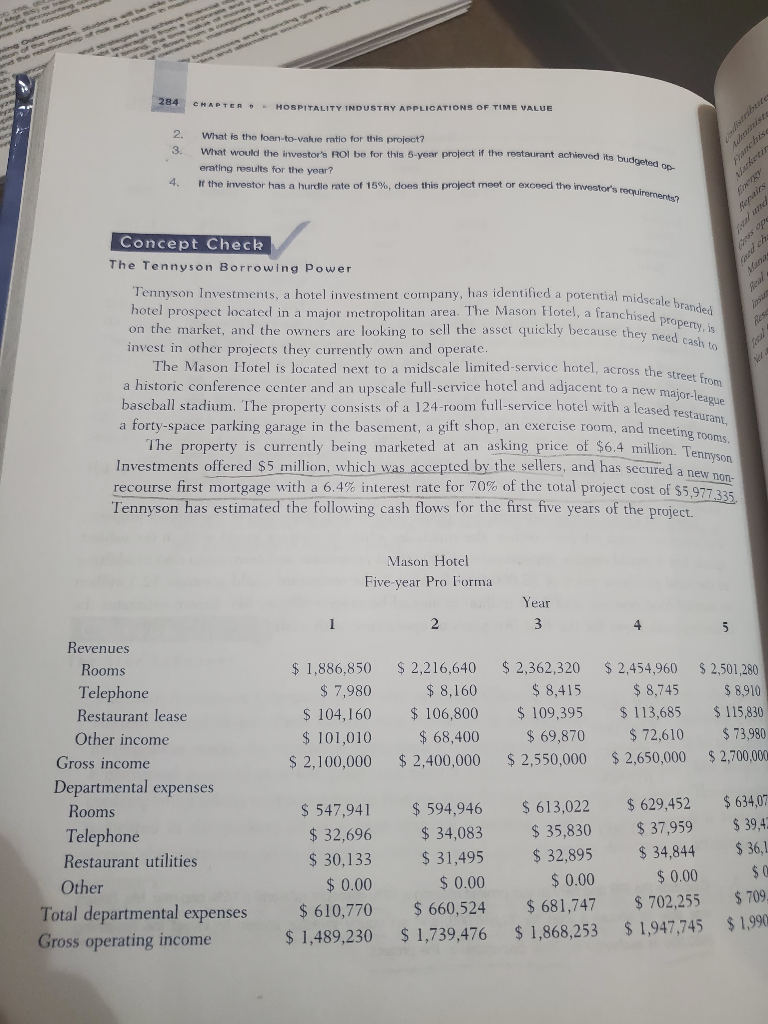

ON d Tennyson Investments, a hotel investment company, has identified a potential midscale branded 284 CHAPTER - HOSPITALITY INDUSTRY APPLICATIONS OF TIME VALUE 2. What is the loan-to-value ratio for this project? 3. What would the westor's Rol be for this 5-year project if the restaurant achieved its budgeted on erating results for the year? 4. If the inwestor has a hurdle rate of 15%, does this project meet or exceed the inventor's requirementar Concept Check The Tennyson Borrowing Power manchas on the market, and the owners are looking to sell the asset quickly because they need cash to hotel prospect located in a major metropolitan area. The Masons Hotel, a franchised propery in invest in other projects they currently own and operate. The Mason Hotel is located next to a midscale limited-service hotel, across the street from a historic conference center and an upscale full-service hotel and adjacent to a new major-league baseball stadium. The property consists of a 124-room full-service hotel with a leased restaurant a forty-space parking garage in the basement, a gift shop, an exercise room, and meeting rooms, The property is currently being marketed at an asking price of $6.4 million. Tennyson Investments offered $5 million, which was accepted by the sellers, and has secured a new non- recourse first mortgage with a 6.4% interest rate for 70% of the total project cost of $5,977,335 Tennyson has estimated the following cash flows for the first five years of the project. Mason Hotel Five-year Pro Forma Year 1 2 3 5 $ 1,886,850 $ 7,980 $ 104,160 $ 101,010 $ 2,100,000 $ 2,216,640 $ 8,160 $ 106,800 $ 68,400 $ 2,400,000 $ 2,362,320 $ 8,415 $ 109,395 $ 69,870 $ 2,550,000 $ 2,454,960 $ 8,745 $ 113,685 $ 72,610 $ 2,650,000 $ 2,501,280 $ 8,910 $ 115,830 $73,980 $ 2,700.000 Revenues Rooms Telephone Restaurant lease Other income Gross income Departmental expenses Rooms Telephone Restaurant utilities Other Total departmental expenses Gross operating income $ 634,07 $ 39,4 $36,1 $ 547,941 $ 32,696 $ 30,133 $ 0.00 $ 610,770 $ 1,489,230 $ 594,946 $ 34,083 $ 31,495 $ 0.00 $ 660,524 $ 1,739,476 $ 613,022 $ 35,830 $ 32,895 $ 0.00 $ 681,747 $ 1,868,253 $ 629,452 $ 37,959 $ 34,844 $ 0.00 $ 702,255 $ 1,947,745 $ 709. $ 1,990 How much money has Tennyson Investments borrowed for this project based on a 70%-o-the 2 What is the maximum amount available for debt service in the first year is the lender requires a 1.25 Utilizing the debt service payment calculated in the previous question, calculate the idea amortization TIME VUOMOWE DOUTONS 139 and expenses tive and general $ 234.150 $ 55,230 $ 180,810 $ 103,530 $ 123,480 $ 697,200 $ 792,030 $275,040 $ 56,640 $ 185,520 $ 106,080 $ 134.400 $ 757.680 $ 981.796 Pp- $ 108630 $ 138,210 d maintenance S? istributed expenses $ 1,080,558 81,133,135 $ 1.160.054 ating profit lee $ 63.000 $ 83,580 $ 83,580 $ 63,000 $ 293,160 $ 498,870 leares $ 72,000 $ 85,680 $ 85,680 $ 72,000 $ 315,360 $ 666,436 $76500 $ 87,720 $ 87,720 591.66 5928 se for replacement anded erty, is ash to $ 76,500 $ 328,440 $752.118 $7950 $ 341.320 SS12294 able for debt from cague 1 ratio? debt service coverage ratio? urant, Doms. myson non 1,335 ate for the first mortgage at the 6.4% annual interest rate Tennyson Investments has hired Geoff Strips Management Co. to operate the hotel. The Sties co. has negotiated a 10% equity kicker on the sale of the property if the hotel meets or exceeds projected cash flows. If the property is sold in Year 5, what dollar amount would Geoff Strips Management receive? Utilize the capitalization rate method of valuation based on a 10% cap rate. & Calculate the NPV for this project based on a 12% cost of capital. What is the IRR? 1,280 3,910 5,830 3,980 0,000 ON d Tennyson Investments, a hotel investment company, has identified a potential midscale branded 284 CHAPTER - HOSPITALITY INDUSTRY APPLICATIONS OF TIME VALUE 2. What is the loan-to-value ratio for this project? 3. What would the westor's Rol be for this 5-year project if the restaurant achieved its budgeted on erating results for the year? 4. If the inwestor has a hurdle rate of 15%, does this project meet or exceed the inventor's requirementar Concept Check The Tennyson Borrowing Power manchas on the market, and the owners are looking to sell the asset quickly because they need cash to hotel prospect located in a major metropolitan area. The Masons Hotel, a franchised propery in invest in other projects they currently own and operate. The Mason Hotel is located next to a midscale limited-service hotel, across the street from a historic conference center and an upscale full-service hotel and adjacent to a new major-league baseball stadium. The property consists of a 124-room full-service hotel with a leased restaurant a forty-space parking garage in the basement, a gift shop, an exercise room, and meeting rooms, The property is currently being marketed at an asking price of $6.4 million. Tennyson Investments offered $5 million, which was accepted by the sellers, and has secured a new non- recourse first mortgage with a 6.4% interest rate for 70% of the total project cost of $5,977,335 Tennyson has estimated the following cash flows for the first five years of the project. Mason Hotel Five-year Pro Forma Year 1 2 3 5 $ 1,886,850 $ 7,980 $ 104,160 $ 101,010 $ 2,100,000 $ 2,216,640 $ 8,160 $ 106,800 $ 68,400 $ 2,400,000 $ 2,362,320 $ 8,415 $ 109,395 $ 69,870 $ 2,550,000 $ 2,454,960 $ 8,745 $ 113,685 $ 72,610 $ 2,650,000 $ 2,501,280 $ 8,910 $ 115,830 $73,980 $ 2,700.000 Revenues Rooms Telephone Restaurant lease Other income Gross income Departmental expenses Rooms Telephone Restaurant utilities Other Total departmental expenses Gross operating income $ 634,07 $ 39,4 $36,1 $ 547,941 $ 32,696 $ 30,133 $ 0.00 $ 610,770 $ 1,489,230 $ 594,946 $ 34,083 $ 31,495 $ 0.00 $ 660,524 $ 1,739,476 $ 613,022 $ 35,830 $ 32,895 $ 0.00 $ 681,747 $ 1,868,253 $ 629,452 $ 37,959 $ 34,844 $ 0.00 $ 702,255 $ 1,947,745 $ 709. $ 1,990 How much money has Tennyson Investments borrowed for this project based on a 70%-o-the 2 What is the maximum amount available for debt service in the first year is the lender requires a 1.25 Utilizing the debt service payment calculated in the previous question, calculate the idea amortization TIME VUOMOWE DOUTONS 139 and expenses tive and general $ 234.150 $ 55,230 $ 180,810 $ 103,530 $ 123,480 $ 697,200 $ 792,030 $275,040 $ 56,640 $ 185,520 $ 106,080 $ 134.400 $ 757.680 $ 981.796 Pp- $ 108630 $ 138,210 d maintenance S? istributed expenses $ 1,080,558 81,133,135 $ 1.160.054 ating profit lee $ 63.000 $ 83,580 $ 83,580 $ 63,000 $ 293,160 $ 498,870 leares $ 72,000 $ 85,680 $ 85,680 $ 72,000 $ 315,360 $ 666,436 $76500 $ 87,720 $ 87,720 591.66 5928 se for replacement anded erty, is ash to $ 76,500 $ 328,440 $752.118 $7950 $ 341.320 SS12294 able for debt from cague 1 ratio? debt service coverage ratio? urant, Doms. myson non 1,335 ate for the first mortgage at the 6.4% annual interest rate Tennyson Investments has hired Geoff Strips Management Co. to operate the hotel. The Sties co. has negotiated a 10% equity kicker on the sale of the property if the hotel meets or exceeds projected cash flows. If the property is sold in Year 5, what dollar amount would Geoff Strips Management receive? Utilize the capitalization rate method of valuation based on a 10% cap rate. & Calculate the NPV for this project based on a 12% cost of capital. What is the IRR? 1,280 3,910 5,830 3,980 0,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts