Question: need help with fair life and equity method! thanks! Shamrock Matthew Inc, acquired 20% of the outstanding common stock of Theresa Crane inc on December

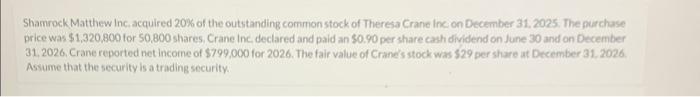

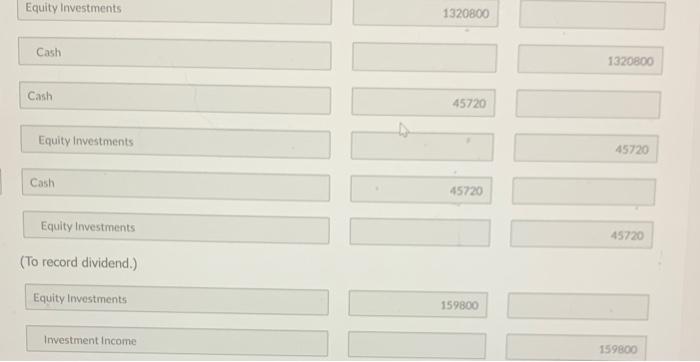

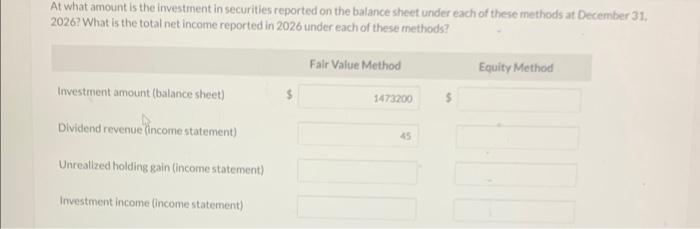

Shamrock Matthew Inc, acquired 20% of the outstanding common stock of Theresa Crane inc on December 31. 2025. The purchase price was $1,320.800 tor $0,800 shares, Crane inc declared and paid an $0.90 per share cash dividend on June 30 and on December 31.2026. Crane reported net income of $799,000 for 2026. The fair value of Crane's stock was $29 per share at December 31. 2026. Assume that the security is a trading security. Equity Investments Cash Cash Dividend Revenue Cashr Dividend Revenue (To record dividend.) Fair Value Adjustment Unrealied Holding Gain or Loss - Income 152400 Equity Investments Cash Cash Equity Investments Cash Equity Investments (To record dividend.) Equity lnvestments Investment Income At what amount is the investment in securities reported on the balance sheet under each of these methods at December 31. 2026? What is the total net income reported in 2026 under each of these methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts