Question: Need Help with First Entry on Part B- Equity Method exercise 45 On January 1, 2014, Plate Company purchased a 90% interest in the common

Need Help with First Entry on Part B- Equity Method

Need Help with First Entry on Part B- Equity Method

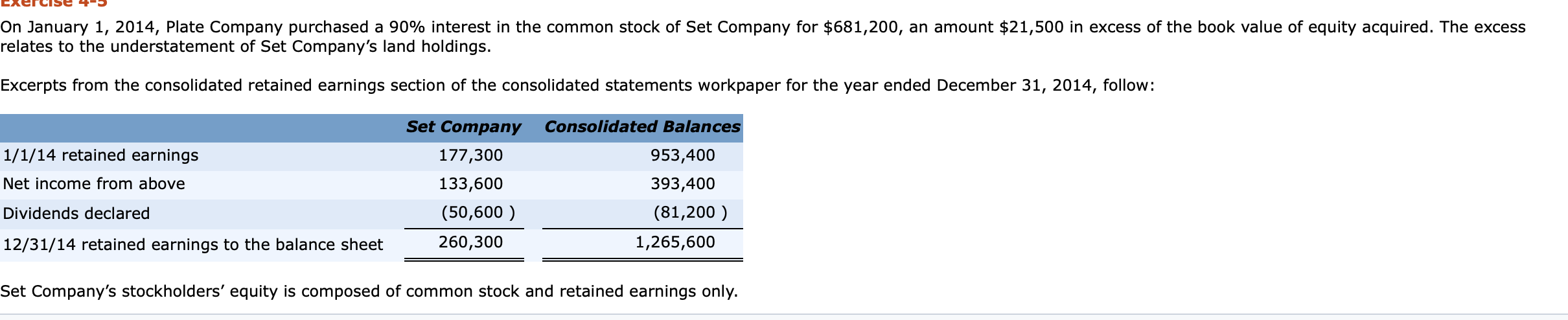

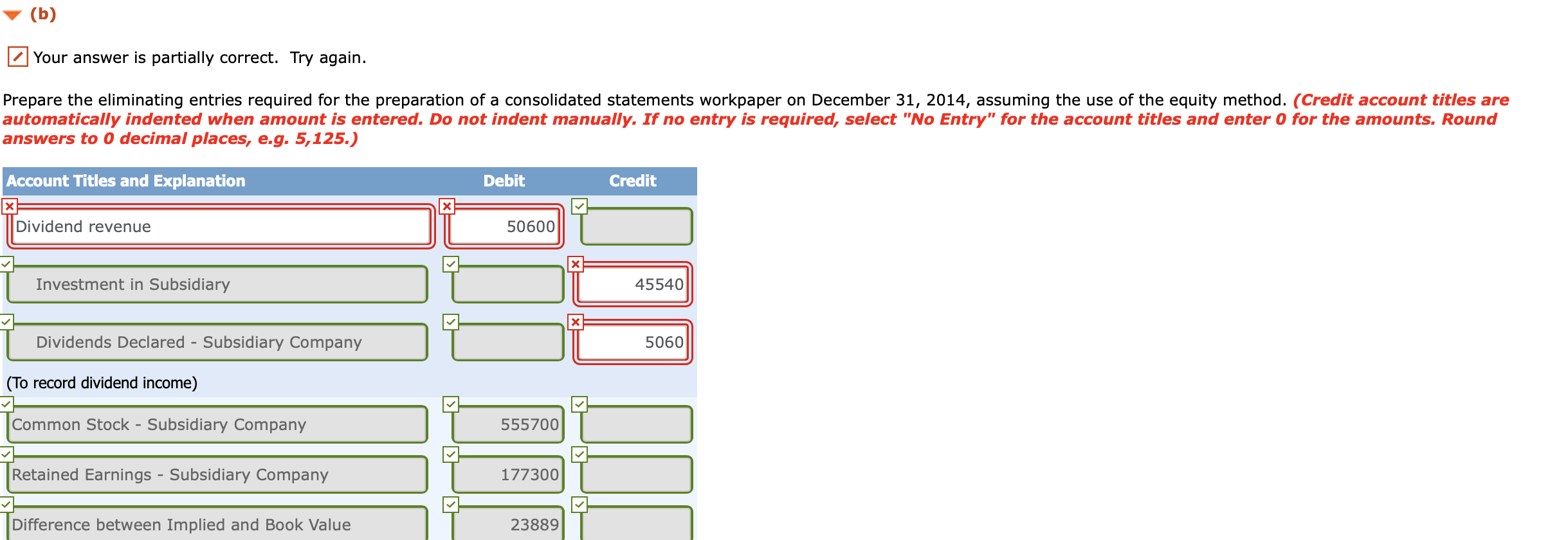

exercise 45 On January 1, 2014, Plate Company purchased a 90% interest in the common stock of Set Company for $681,200, an amount $21,500 in excess of the book value of equity acquired. The excess relates to the understatement of Set Company's land holdings. Excerpts from the consolidated retained earnings section of the consolidated statements workpaper for the year ended December 31, 2014, follow: 1/1/14 retained earnings Net income from above Set Company 177,300 133,600 (50,600 ) 260,300 Consolidated Balances 953,400 393,400 (81,200) 1,265,600 Dividends declared 12/31/14 retained earnings to the balance sheet Set Company's stockholders' equity is composed of common stock and retained earnings only. (b) Your answer is partially correct. Try again. Prepare the eliminating entries required for the preparation of a consolidated statements workpaper on December 31, 2014, assuming the use of the equity method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to 0 decimal places, e.g. 5,125.) Account Titles and Explanation Debit Credit Dividend revenue 50600 506007 Investment in Subsidiary I 45540 45540| Dividends Declared - Subsidiary Company IT 5060 (To record dividend income) Common Stock - Subsidiary Company 55700 |Retained Earnings - Subsidiary Company 300 Difference between Implied and Book Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts