Question: JW's Lock & Key had the following transactions in December. Dec. 1 Paid December's rent, check & 6267, $2.000. 2 Paid annual premiums on

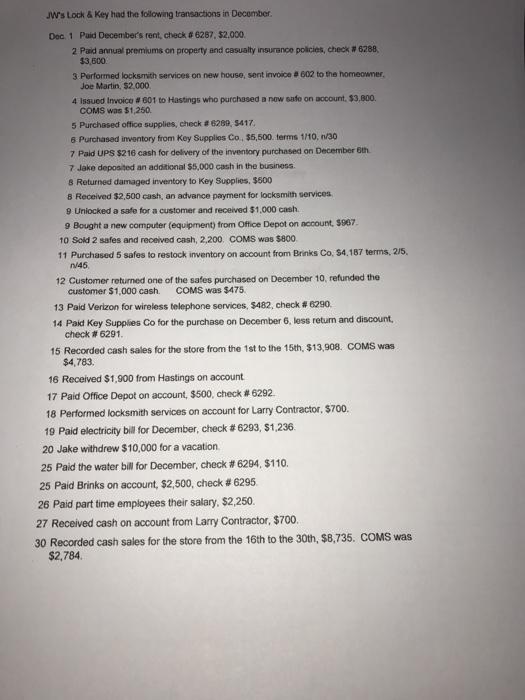

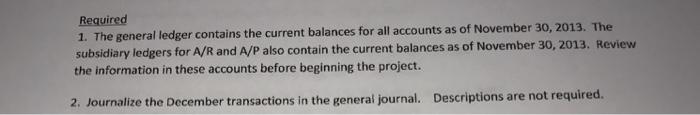

JW's Lock & Key had the following transactions in December. Dec. 1 Paid December's rent, check & 6267, $2.000. 2 Paid annual premiums on property and casualty insurance policies, check 6288, $3,600 3 Performed locksmith services on new house, sent invoice a 602 to the homeowner, Joe Martin, $2.000. 4 Issued Invoice # 601 to Hastings who purchased a now safe on account, $3,800. COMS was $1,250. 5 Purchased office supplies, check 6289, 5417. 6 Purchased imventory from Key Supplies Co, $5,500. terms 1/10, n/30 7 Paid UPS $216 cash for delivery of the inventory purchased on December Bth 7 Jake deposited an additional $5,000 cash in the business. 8 Returned damaged inventory to Key Supplies, $500 8 Received $2,500 cash, an advance payment for locksmith services 9 Uniocked a safe for a customer and received $1,000 cash. 9 Bought a new computer (equipment) from Office Depot on nccount, $907. 10 Sold 2 safes and received cash, 2,200. COMS was $800. 11 Purchased 5 safes to restock inventory on account from Brinks Co, $4,187 terms, 2/5, n45. 12 Customer returned one of the safes purchased on December 10, refunded the customer $1,000 cash. COMS was $475. 13 Paid Verizon for wireless telephone services, s482, check # 6290. 14 Paid Key Supplies Co for the purchase on December 6, less retum and discount, check # 6291. 15 Recorded cash sales for the store from the 1st to the 15th, $13,908. COMS was $4,783. 16 Received $1,900 from Hastings on account 17 Paid Office Depot on account, $500, check #6292. 18 Performed locksmith services on account for Larry Contractor, $700. 19 Paid electricity bil for December, check # 6293, $1,236. 20 Jake withdrew $10,000 for a vacation. 25 Paid the water bil for December, check # 6294, $110. 25 Paid Brinks on account, $2,500, check # 6295. 26 Paid part time empioyees their salary, $2,250. 27 Received cash on account from Larry Contractor, $700. 30 Recorded cash sales for the store from the 16th to the 30th, $8,735. COMS was $2,784. Required 1. The general ledger contains the current balances for all accounts as of November 30, 2013. The subsidiary ledgers for A/R and A/P also contain the current balances as of November 30, 2013. Revieww the information in these accounts before beginning the project. 2. Journalize the December transactions in the general journal. Descriptions are not required.

Step by Step Solution

3.50 Rating (157 Votes )

There are 3 Steps involved in it

1 1Account receivable DrCr Dec3 2000 Dec10b 3000 Dec4 5050 Dec16 1900 Dec10a3000 Dec18 700 Account r... View full answer

Get step-by-step solutions from verified subject matter experts