Question: Need help with he following accounting problem. Required information Problem 25-3A Computation of cash flows and net present values with alternative depreciation methods LO P3

Need help with he following accounting problem.

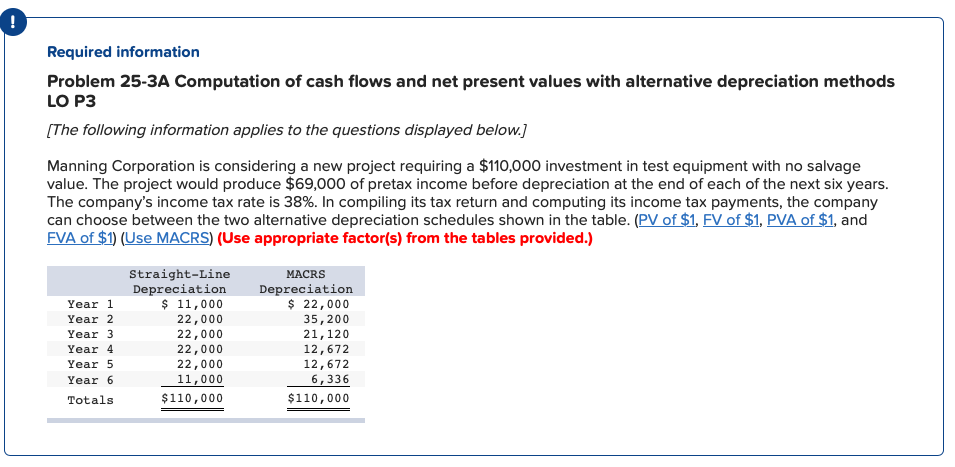

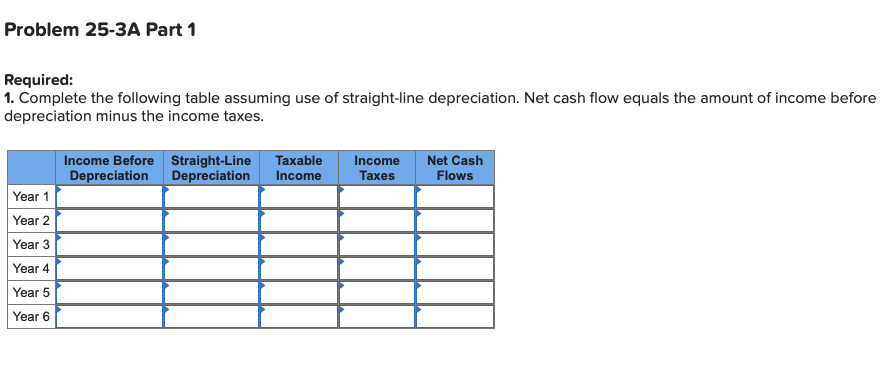

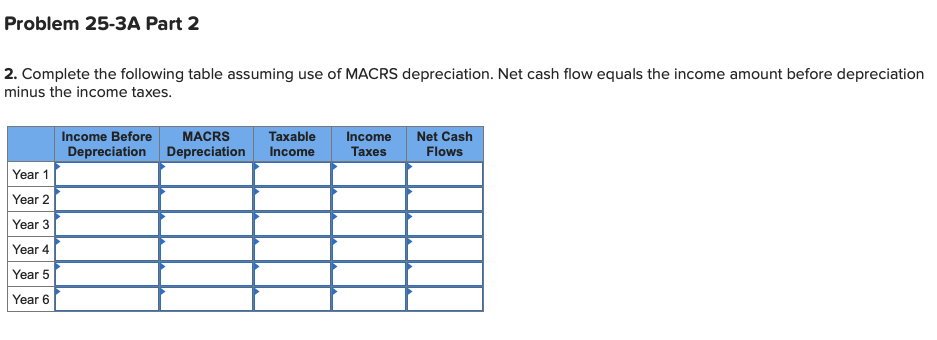

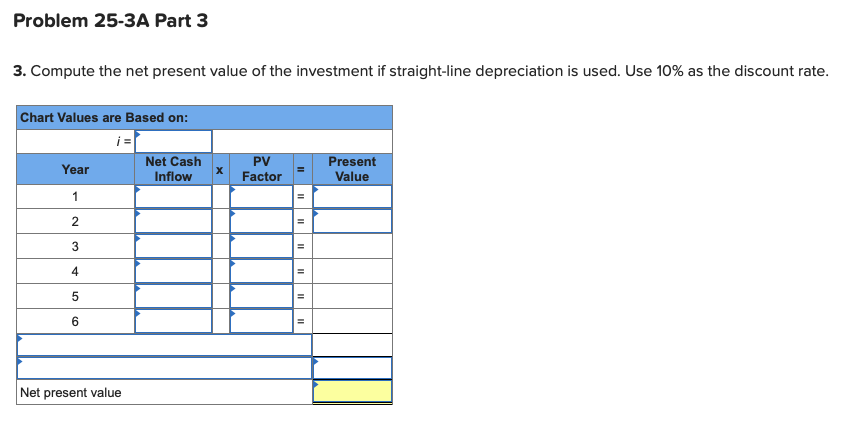

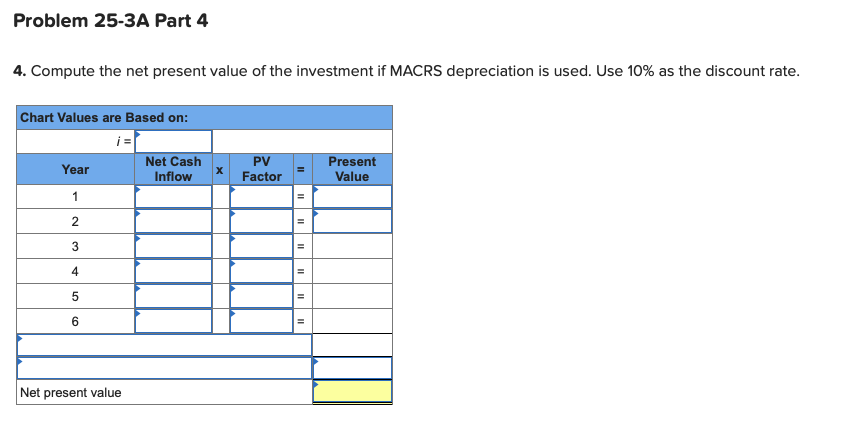

Required information Problem 25-3A Computation of cash flows and net present values with alternative depreciation methods LO P3 [The following information applies to the questions displayed below.) Manning Corporation is considering a new project requiring a $110,000 investment in test equipment with no salvage value. The project would produce $69,000 of pretax income before depreciation at the end of each of the next six years. The company's income tax rate is 38%. In compiling its tax return and computing its income tax payments, the company can choose between the two alternative depreciation schedules shown in the table. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use MACRS) (Use appropriate factor(s) from the tables provided.) Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Totals Straight-Line Depreciation $ 11,000 22,000 22,000 22,000 22,000 11,000 $110,000 MACRS Depreciation $ 22,000 35,200 21, 120 12,672 12,672 6,336 $110,000 Problem 25-3A Part 1 Required: 1. Complete the following table assuming use of straight-line depreciation. Net cash flow equals the amount of income before depreciation minus the income taxes. Income Before Depreciation Straight-Line Depreciation Taxable Income Income Taxes Net Cash Flows Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Problem 25-3A Part 2 2. Complete the following table assuming use of MACRS depreciation. Net cash flow equals the income amount before depreciation minus the income taxes. Income Before Depreciation MACRS Depreciation Taxable Income Income Taxes Net Cash Flows Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Problem 25-3A Part 3 3. Compute the net present value of the investment if straight-line depreciation is used. Use 10% as the discount rate. Chart Values are Based on: Year Net Cash Inflow PV Factor Present Value Net present value Problem 25-3A Part 4 4. Compute the net present value of the investment if MACRS depreciation is used. Use 10% as the discount rate. Chart Values are Based on: Year Net Cash Inflow PV Factor Present Value Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts