Question: Need help with homework! Thanks! A one-year long forward contract on crude oil is entered into when the spot price is $20/bbl. and the risk-free

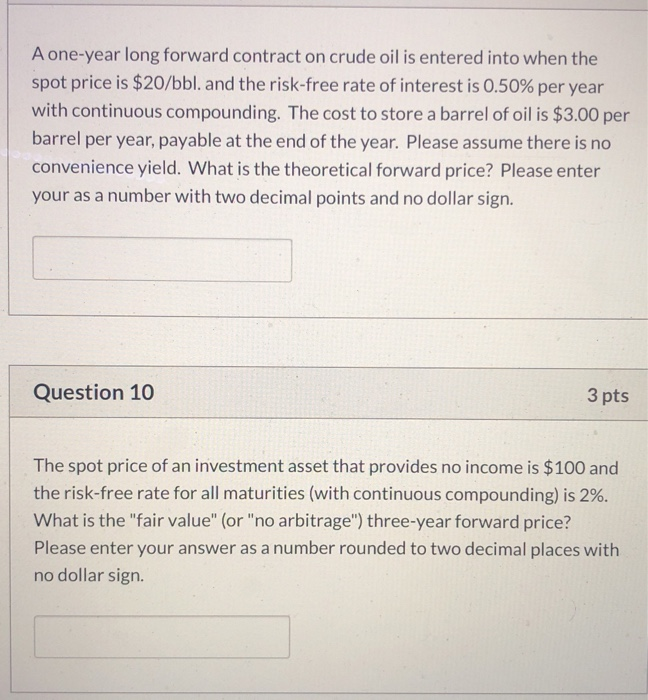

A one-year long forward contract on crude oil is entered into when the spot price is $20/bbl. and the risk-free rate of interest is 0.50% per year with continuous compounding. The cost to store a barrel of oil is $3.00 per barrel per year, payable at the end of the year. Please assume there is no convenience yield. What is the theoretical forward price? Please enter your as a number with two decimal points and no dollar sign. Question 10 3 pts The spot price of an investment asset that provides no income is $100 and the risk-free rate for all maturities (with continuous compounding) is 2%. What is the "fair value" (or "no arbitrage") three-year forward price? Please enter your answer as a number rounded to two decimal places with no dollar sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts