Question: Need help with III and IV. Answer: Initial margin to be deposited =100*$50*50% =$2500 I) Maintenance Margin = 100*$50*30% =$1500 Money to deposited if Initial

Need help with III and IV.

Answer:

Initial margin to be deposited =100*$50*50%

=$2500

I)Maintenance Margin = 100*$50*30%

=$1500

Money to deposited if Initial Margin fall below Maintenance Margin:

Maximum Fall in Initial Margin with out depositing additional Money = $ 2500-$1500

= $1000

Lets share price after increse "x"

$1000 = 100*x (-) 100*$50

X= $60

Price can go up to $60 before you get margin call

II)

If Price increases to $60 than loss =($60-$50)*100

=$1000

Balance in Margin account =$2500-$1000

=$1500

Minimum Maintanance margin is $1500

Therefore no cash required to be deposited

III)

Rate of return in above = [Gain in Cash Market (-) Loss in Short position] / Initial investment

=[100*($60-$50) (-) 100*($60-$50)] / $7500

= 0%

Rate of return without margin = Gain in Cash Market / Initial investment

=100*($60-$50) / $ 5000

=20%

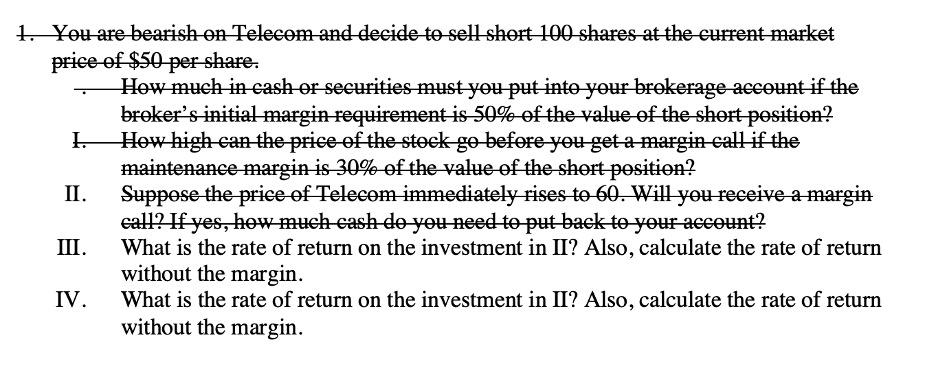

1. You are bearish on Telecom and decide to sell short 100 shares at the current market price of $50 per share. How much in cash or securities must you put into your brokerage account if the broker's initial margin requirement is 50% of the value of the short position? How high can the price of the stock go before you get a margin call if the maintenance margin is 30% of the value of the short position? I. II. Suppose the price of Telecom immediately rises to 60. Will you receive a margin call? If yes, how much cash do you need to put back to your account? III. What is the rate of return on the investment in II? Also, calculate the rate of return without the margin. IV. What is the rate of return on the investment in II? Also, calculate the rate of return without the margin. 1. You are bearish on Telecom and decide to sell short 100 shares at the current market price of $50 per share. How much in cash or securities must you put into your brokerage account if the broker's initial margin requirement is 50% of the value of the short position? How high can the price of the stock go before you get a margin call if the maintenance margin is 30% of the value of the short position? I. II. Suppose the price of Telecom immediately rises to 60. Will you receive a margin call? If yes, how much cash do you need to put back to your account? III. What is the rate of return on the investment in II? Also, calculate the rate of return without the margin. IV. What is the rate of return on the investment in II? Also, calculate the rate of return without the margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts