Question: Need help with iii. (I know the answer is a. 15.66 percent, need help solving it though) Use the following information for the next 3

Need help with iii. (I know the answer is a. 15.66 percent, need help solving it though)

Need help with iii. (I know the answer is a. 15.66 percent, need help solving it though)

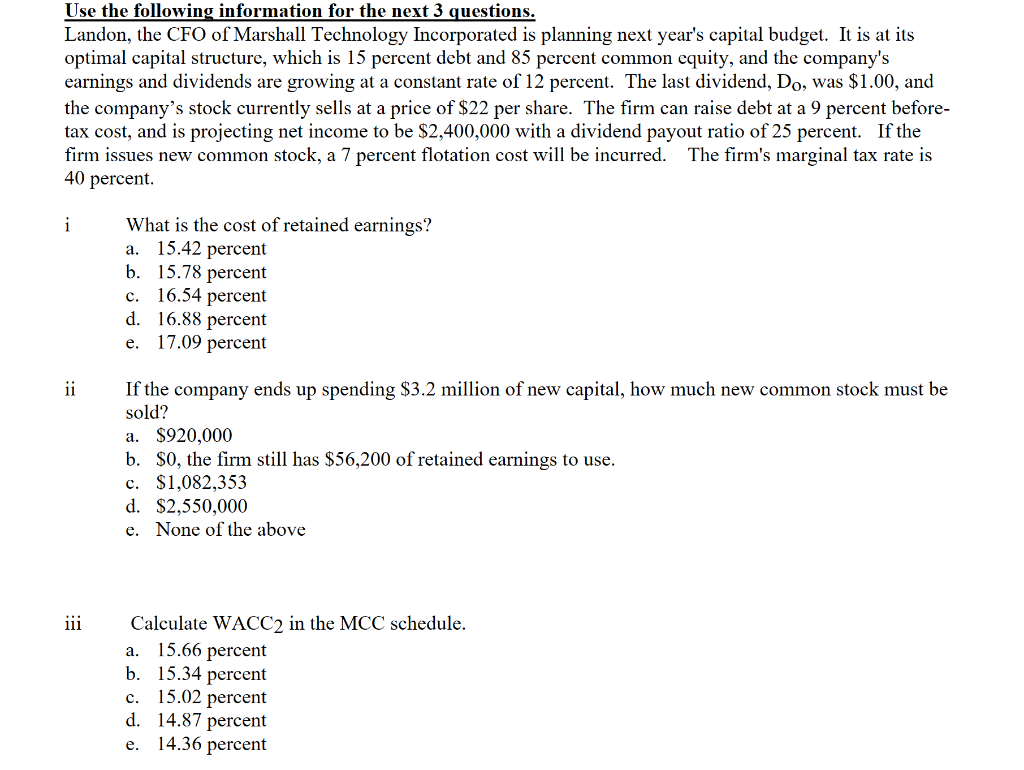

Use the following information for the next 3 questions. Landon, the CFO of Marshall Technology Incorporated is planning next year's capital budget. It is at its optimal capital structure, which is 15 percent debt and 85 percent common equity, and the company's earnings and dividends are growing at a constant rate of 12 percent. The last dividend, DO, was $1.00, and the company's stock currently sells at a price of $22 per share. The firm can raise debt at a 9 percent beforetax cost, and is projecting net income to be $2,400,000 with a dividend payout ratio of 25 percent. If the firm issues new common stock, a 7 percent flotation cost will be incurred. The firm's marginal tax rate is 40 percent. i What is the cost of retained earnings? a. 15.42 percent b. 15.78 percent c. 16.54 percent d. 16.88 percent e. 17.09 percent ii If the company ends up spending $3.2 million of new capital, how much new common stock must be sold? a. $920,000 b. $0, the firm still has $56,200 of retained earnings to use. c. $1,082,353 d. $2,550,000 e. None of the above iii Calculate WACC2 in the MCC schedule. a. 15.66 percent b. 15.34 percent c. 15.02 percent d. 14.87 percent e. 14.36 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts