Question: Need help with items 2 and 3, please. On January 1, 2023, Entity L had 60,000 shares of $1 par value common stock issued and

Need help with items 2 and 3, please.

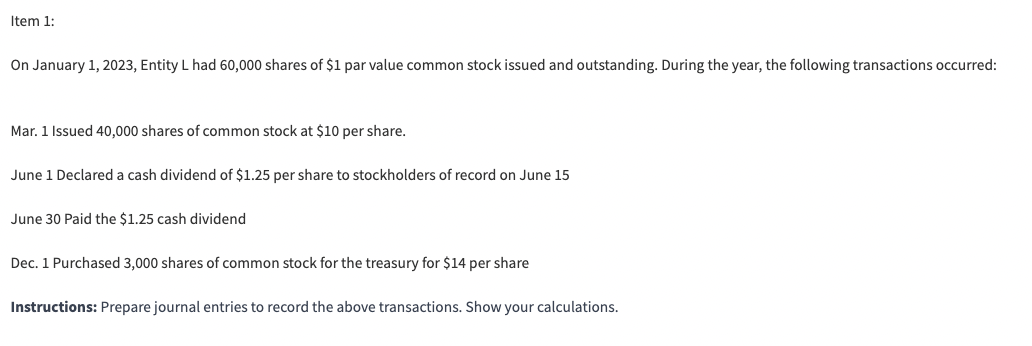

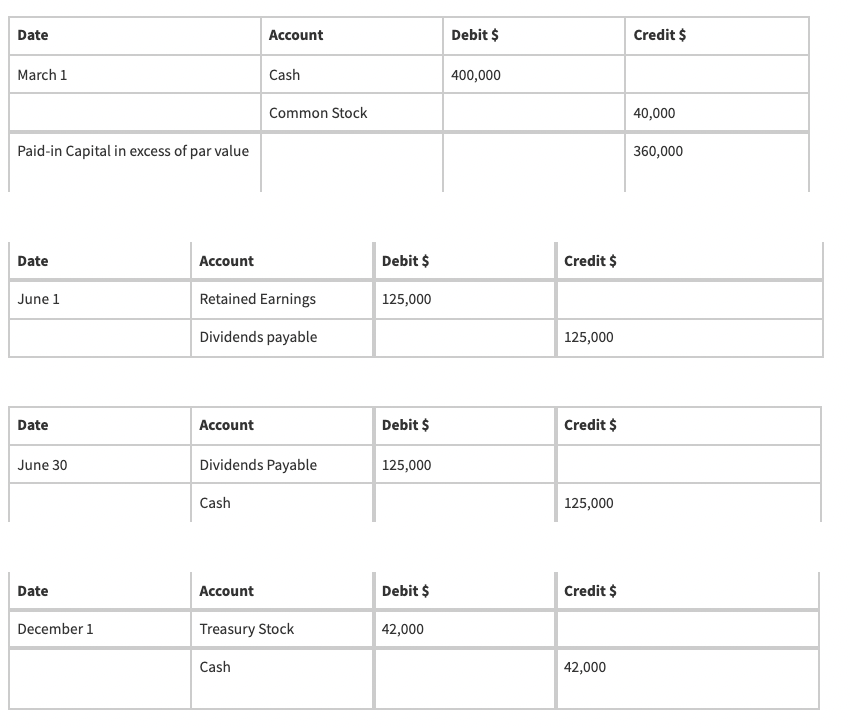

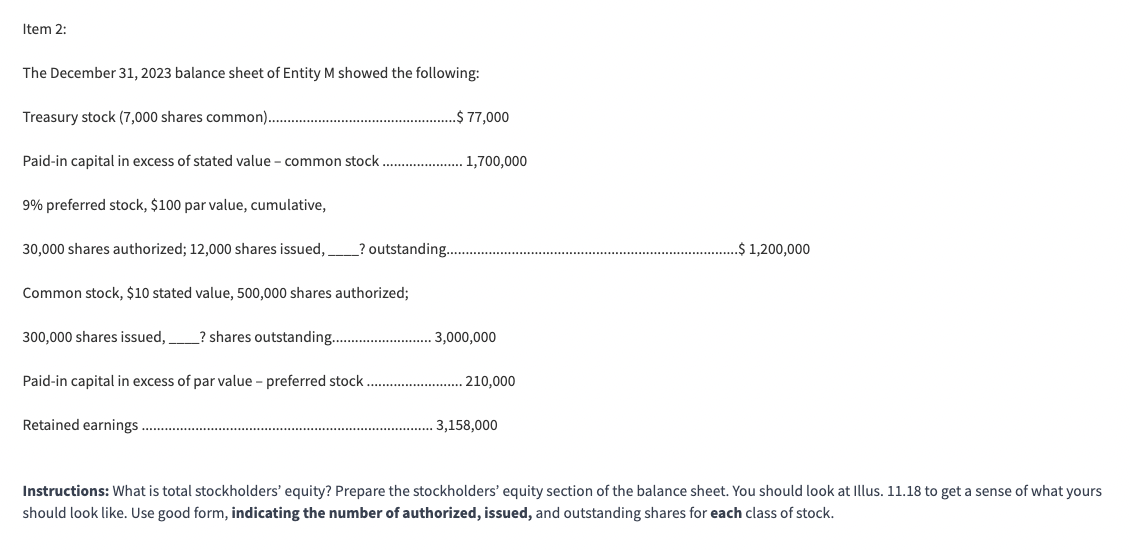

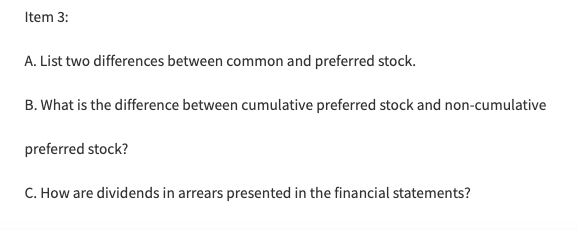

On January 1, 2023, Entity L had 60,000 shares of $1 par value common stock issued and outstanding. During the year, the following transactions occurred: Mar. 1 Issued 40,000 shares of common stock at $10 per share. June 1 Declared a cash dividend of $1.25 per share to stockholders of record on June 15 June 30 Paid the $1.25 cash dividend Dec. 1 Purchased 3,000 shares of common stock for the treasury for $14 per share Instructions: Prepare journal entries to record the above transactions. Show your calculations. \begin{tabular}{|l|l|l|l|} \hline Date & Account & Debit \$ & Credit \$ \\ \hline March 1 & Cash & 400,000 & 40,000 \\ \hline & Common Stock & & 360,000 \\ \hline Paid-in Capital in excess of par value & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Date & Account & Debit \$ & Credit \$ \\ \hline June 30 & Dividends Payable & 125,000 & \\ \hline & Cash & & 125,000 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Date & Account & Debit $ & Credit $ \\ \hline December 1 & Treasury Stock & 42,000 & \\ \hline & Cash & & 42,000 \\ \hline \end{tabular} The December 31, 2023 balance sheet of Entity M showed the following: Treasury stock (7,000 shares common) .$77,000 Paid-in capital in excess of stated value - common stock 1,700,000 9% preferred stock, $100 par value, cumulative, 30,000 shares authorized; 12,000 shares issued, ? outstanding. .$1,200,000 Common stock, $10 stated value, 500,000 shares authorized; 300,000 shares issued ? shares outstanding 3,000,000 Paid-in capital in excess of par value - preferred stock 210,000 Retained earnings 3,158,000 Instructions: What is total stockholders' equity? Prepare the stockholders' equity section of the balance sheet. You should look at Illus. 11.18 to get a sense of what yours should look like. Use good form, indicating the number of authorized, issued, and outstanding shares for each class of stock. Item 3: A. List two differences between common and preferred stock. B. What is the difference between cumulative preferred stock and non-cumulative preferred stock? C. How are dividends in arrears presented in the financial statements? On January 1, 2023, Entity L had 60,000 shares of $1 par value common stock issued and outstanding. During the year, the following transactions occurred: Mar. 1 Issued 40,000 shares of common stock at $10 per share. June 1 Declared a cash dividend of $1.25 per share to stockholders of record on June 15 June 30 Paid the $1.25 cash dividend Dec. 1 Purchased 3,000 shares of common stock for the treasury for $14 per share Instructions: Prepare journal entries to record the above transactions. Show your calculations. \begin{tabular}{|l|l|l|l|} \hline Date & Account & Debit \$ & Credit \$ \\ \hline March 1 & Cash & 400,000 & 40,000 \\ \hline & Common Stock & & 360,000 \\ \hline Paid-in Capital in excess of par value & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Date & Account & Debit \$ & Credit \$ \\ \hline June 30 & Dividends Payable & 125,000 & \\ \hline & Cash & & 125,000 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline Date & Account & Debit $ & Credit $ \\ \hline December 1 & Treasury Stock & 42,000 & \\ \hline & Cash & & 42,000 \\ \hline \end{tabular} The December 31, 2023 balance sheet of Entity M showed the following: Treasury stock (7,000 shares common) .$77,000 Paid-in capital in excess of stated value - common stock 1,700,000 9% preferred stock, $100 par value, cumulative, 30,000 shares authorized; 12,000 shares issued, ? outstanding. .$1,200,000 Common stock, $10 stated value, 500,000 shares authorized; 300,000 shares issued ? shares outstanding 3,000,000 Paid-in capital in excess of par value - preferred stock 210,000 Retained earnings 3,158,000 Instructions: What is total stockholders' equity? Prepare the stockholders' equity section of the balance sheet. You should look at Illus. 11.18 to get a sense of what yours should look like. Use good form, indicating the number of authorized, issued, and outstanding shares for each class of stock. Item 3: A. List two differences between common and preferred stock. B. What is the difference between cumulative preferred stock and non-cumulative preferred stock? C. How are dividends in arrears presented in the financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts