Question: need help with journalizing transactions pertaining to debt inverstments! Current Attempt in Progress Sarasota Corp. had these transactions pertaining to debt investments Jan. 1 Purchased

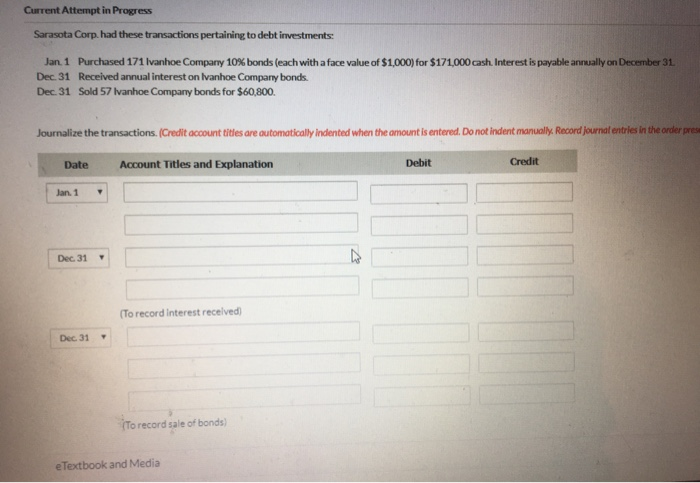

Current Attempt in Progress Sarasota Corp. had these transactions pertaining to debt investments Jan. 1 Purchased 171 Ivanhoe Company 10% bonds (each with a face value of $1,000) for $171,000 cash. Interest is payable annually on December 31 Dec. 31 Received annual interest on Ivanhoe Company bonds. Dec. 31 Sold 57 Ivanhoe Company bonds for $60,800. Journalize the transactions. (Credit account titles are outomatically indented when the amount is entered. Do not indent manually. Record journal entries in the order pre Date Account Titles and Explanation Debit Credit Jan. 1 Dec 31 To record interest recelved) Dec. 31 To record sale of bonds e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts