Question: Need help with LCNRV. (Intermediate.) CODE & Wrap BIU A Merge LD Copy Format Painter Clipboard Font Alignment 3 B D E F H G

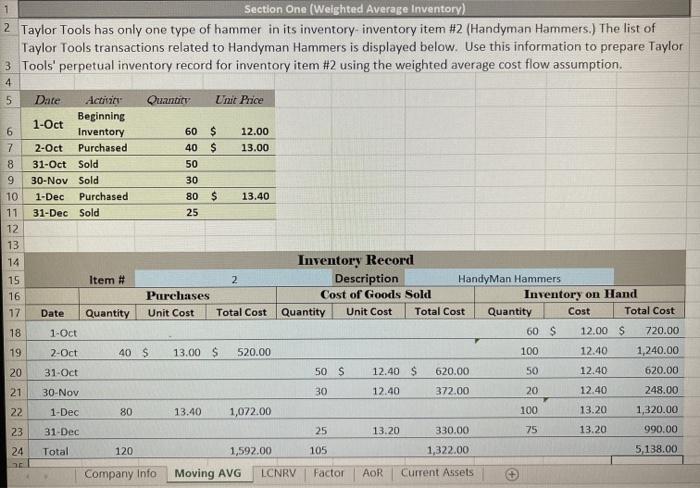

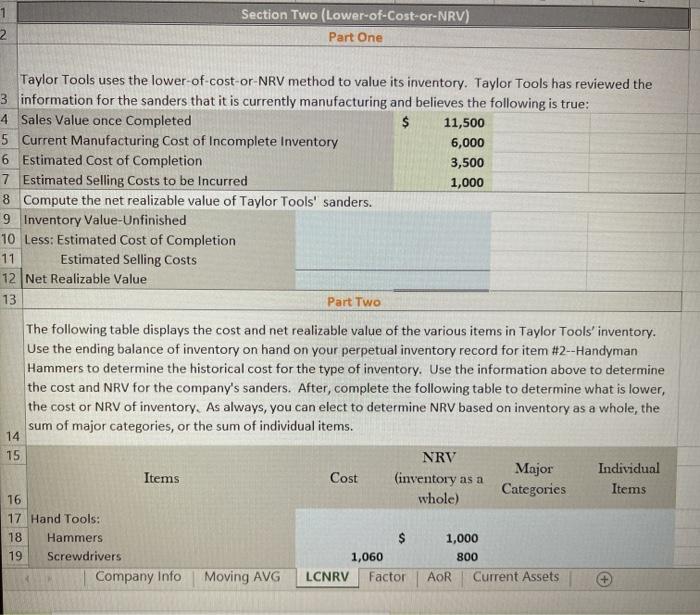

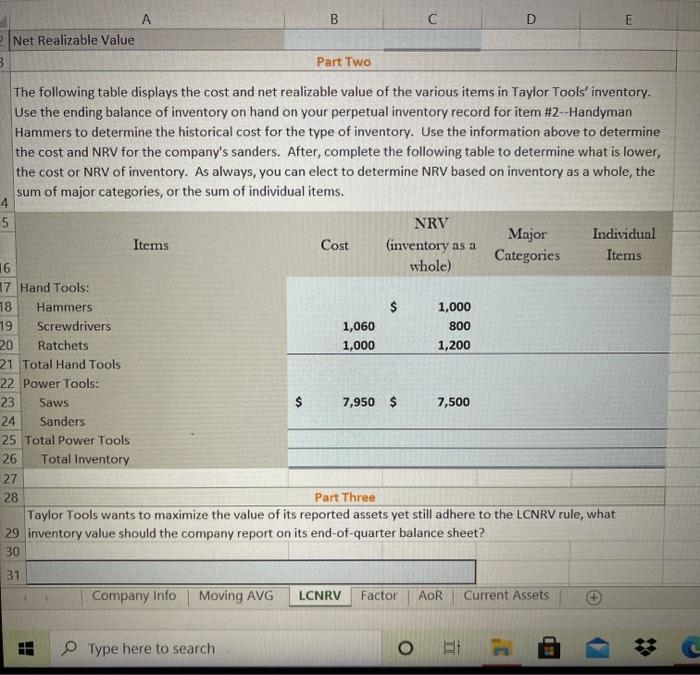

CODE & Wrap BIU A Merge LD Copy Format Painter Clipboard Font Alignment 3 B D E F H G Taylor Tools is a privately held company that has been in operations for over a decade. The company sells two types of tools to local hardware stores, hand tools and power tools. Taylor manufactures the power tools internally at their headquarters but outsources production of their hand tools to other smaller companies due to production constraints. The following information is pertinent to Taylor's accounting system: Taylor uses the weighted average (or moving average) inventory method for determining the value of its inventory on hand and the amount of cost of goods sold the company records on sales. Because Taylor Tools has elected to use weighted average cost flow assumption, it uses the lower-of cost-or-net-realizable-value method to determine if it needs to write down the value of the company's inventory. Taylor has a long standing business relationship with Wentworth Factors and frequently sells this factor a portion of their outstanding receivables. Due to this positive relationship, Wentworth gives Taylor very favorable finance rates when they do business. Taylor Tools uses the aging-of-receivables method for determing the company's 1 2 3 4 5 6 7 CO 09 Factor LCNRV AOR Company Info Moving AVG Current Assets 1 Section One (Weighted Average Inventory) 2 Taylor Tools has only one type of hammer in its inventory-inventory item #2 (Handyman Hammers.) The list of Taylor Tools transactions related to Handyman Hammers is displayed below. Use this information to prepare Taylor 3 Tools' perpetual inventory record for inventory item #2 using the weighted average cost flow assumption. 4 5 Quantity Unit Price 6 12.00 13.00 7 8 9 10 11 12 13 Date Actriz Beginning 1-Oct Inventory 2-Oct Purchased 31-Oct Sold 30-Nov Sold 1-Dec Purchased 31-Dec Sold 60 $ 40 $ 50 30 80 $ 25 13.40 14 15 16 17 18 19 20 Inventory Record Item # 2 Description HandyMan Hammers Purchases Cost of Goods Sold Inventory on Hand Date Quantity Unit Cost Total Cost Quantity Unit Cost Total Cost Quantity Cost Total Cost 1-Oct 60 S 12.00 $ 720.00 2-Oct 40 $ 13.00 $ 520.00 100 12.40 1,240.00 31-Oct 50 S 12.40 $ 620.00 50 12.40 620.00 30-Nov 30 12.40 372.00 20 12.40 248.00 1-Dec 80 13.40 1,072.00 100 13.20 1,320.00 31-Dec 25 13.20 330.00 75 13.20 990.00 Total 120 1,592.00 105 1,322.00 5,138.00 Company Info Moving AVG LCNRV Factor AOR Current Assets 21 22 23 24 1 2 Section Two (Lower-of-Cost-or-NRV) Part One Taylor Tools uses the lower-of-cost-or-NRV method to value its inventory. Taylor Tools has reviewed the 3 information for the sanders that it is currently manufacturing and believes the following is true: 4 Sales Value once Completed $ 11,500 5 Current Manufacturing Cost of Incomplete Inventory 6,000 6 Estimated Cost of Completion 3,500 7 Estimated Selling Costs to be incurred 1,000 8 Compute the net realizable value of Taylor Tools' sanders. 9 Inventory Value-Unfinished 10 Less: Estimated Cost of Completion 11 Estimated Selling Costs 12 Net Realizable Value 13 Part Two The following table displays the cost and net realizable value of the various items in Taylor Tools'inventory. Use the ending balance of inventory on hand on your perpetual inventory record for item #2--Handyman Hammers to determine the historical cost for the type of inventory. Use the information above to determine the cost and NRV for the company's sanders. After complete the following table to determine what is lower, the cost or NRV of inventory. As always, you can elect to determine NRV based on inventory as a whole, the sum of major categories, or the sum of individual items. 14 15 NRV Individual Items Major Cost (inventory as a Categories Items 16 whole) 17 Hand Tools: 18 Hammers 1,000 19 Screwdrivers 1,060 800 Company Info Moving AVG LCNRV Factor AOR Current Assets B D A Net Realizable Value 3 Part Two The following table displays the cost and net realizable value of the various items in Taylor Tools'inventory. Use the ending balance of inventory on hand on your perpetual inventory record for item #2--Handyman Hammers to determine the historical cost for the type of inventory. Use the information above to determine the cost and NRV for the company's sanders. After, complete the following table to determine what is lower, the cost or NRV of inventory. As always, you can elect to determine NRV based on inventory as a whole, the sum of major categories, or the sum of individual items. 4 5 NRV Major Individual Items Cost (inventory as a Categories Items 16 whole) 17 Hand Tools: 18 Hammers $ 1,000 19 Screwdrivers 1,060 800 20 Ratchets 1,000 1,200 21 Total Hand Tools 22 Power Tools: 23 Saws $ 7,950 $ 7,500 24 Sanders 25 Total Power Tools 26 Total Inventory 27 28 Part Three Taylor Tools wants to maximize the value of its reported assets yet still adhere to the LCNRV rule, what 29 inventory value should the company report on its end-of-quarter balance sheet? 30 31 Company Info Moving AVG LCNRV Factor AOR Current Assets Type here to search O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts