Question: Need help with multiple choice questions 8,9 and 10. thank you. the question does not tell us if it is continuously compounded or not, maybe

Need help with multiple choice questions 8,9 and 10. thank you.

the question does not tell us if it is continuously compounded or not, maybe we should assume it is.

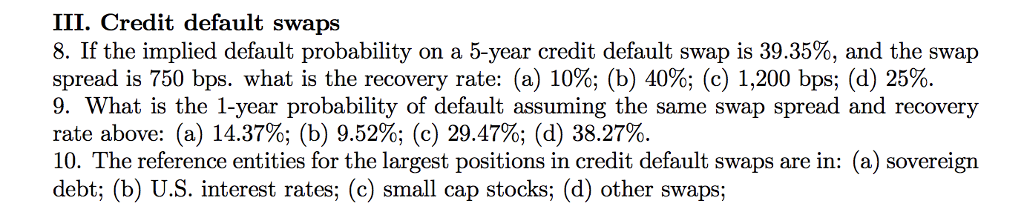

III. Credit default swaps 8. If the implied default probability on a 5-year credit default swap is 39.35%, and the swap spread is 750 bps, what is the recovery rate: (a) 10%; (b) 40%; (c) 1,200 bps, (d) 25%. 9. What is the 1-year probability of default assuming the same swap spread and recovery rate above: (a) 14.37%; (b) 9.52%; (c) 29.47%; (d) 38.27%. 10. The reference entities for the largest positions in credit default swaps are in: (a) sovereign debt; (b) U.S. interest rates; (c) small cap stocks; (d) other swaps

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts